The U.S. Bureau of Labor Statistics has released its annual report from the National Compensation Survey on Health and Retirement Plan Provisions in Private Industry in the United States, 2010 (August 2011, Bulletin 2770).

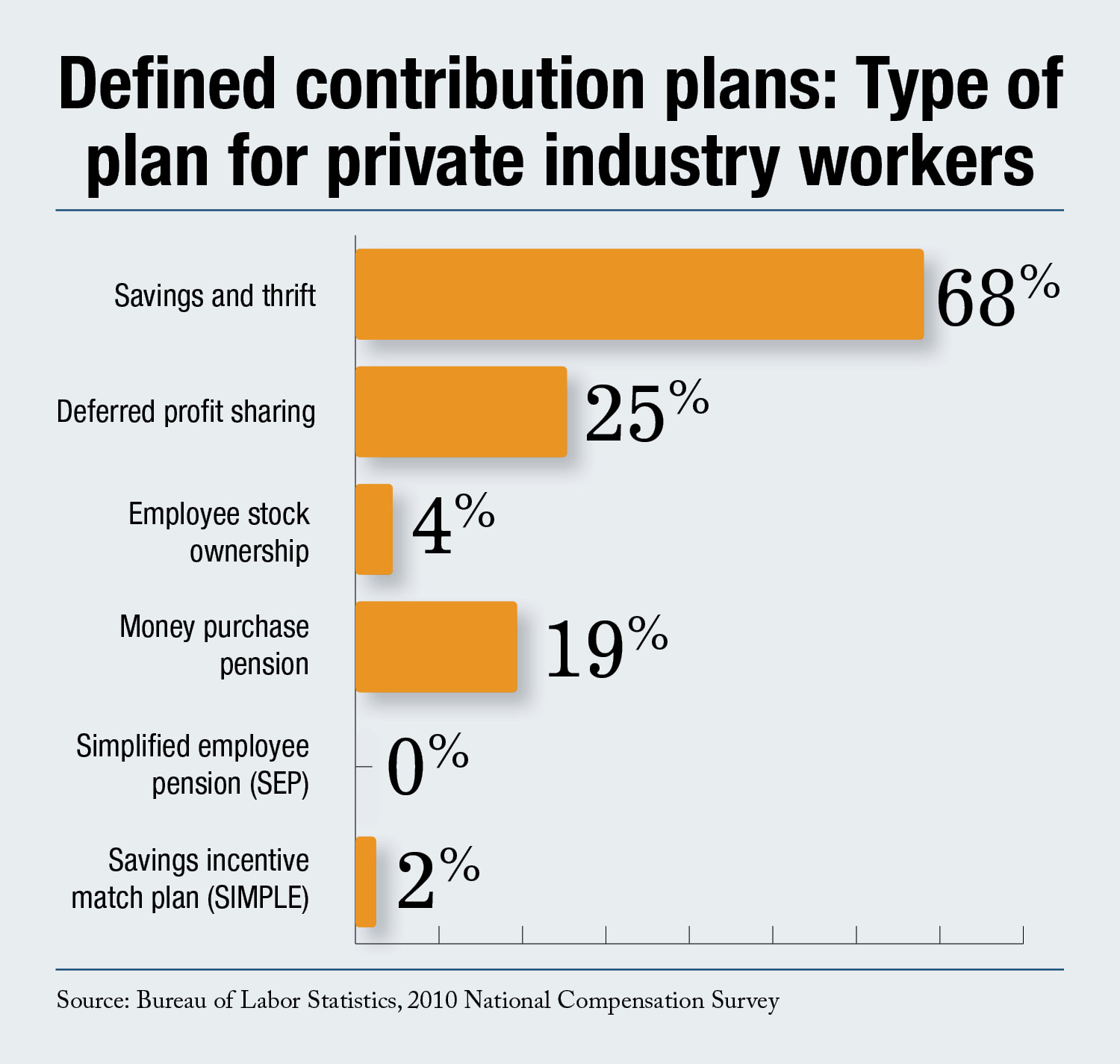

The survey was based on a sample of approximately 3,200 establishments. Among the data published for health benefits, the report finds that defined contribution plans take many forms; 68 percent of workers participating in a defined contribution plan are in a savings and thrift plan. Other types of defined contribution plans include deferred profit sharing, employee stock ownership, money purchase pension, simplified employee pension (SEP), and savings incentive match plan (SIMPLE).

Looking at all workers participating in defined contribution plans, 86 percent contribute with a 401(k) pre-tax contribution while 23 percent contribute with a Roth 401(k) contribution. (In some cases, employees contribute to both, so the total is greater than 100 percent.)

Looking at all workers participating in defined contribution plans, 86 percent contribute with a 401(k) pre-tax contribution while 23 percent contribute with a Roth 401(k) contribution. (In some cases, employees contribute to both, so the total is greater than 100 percent.)

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.