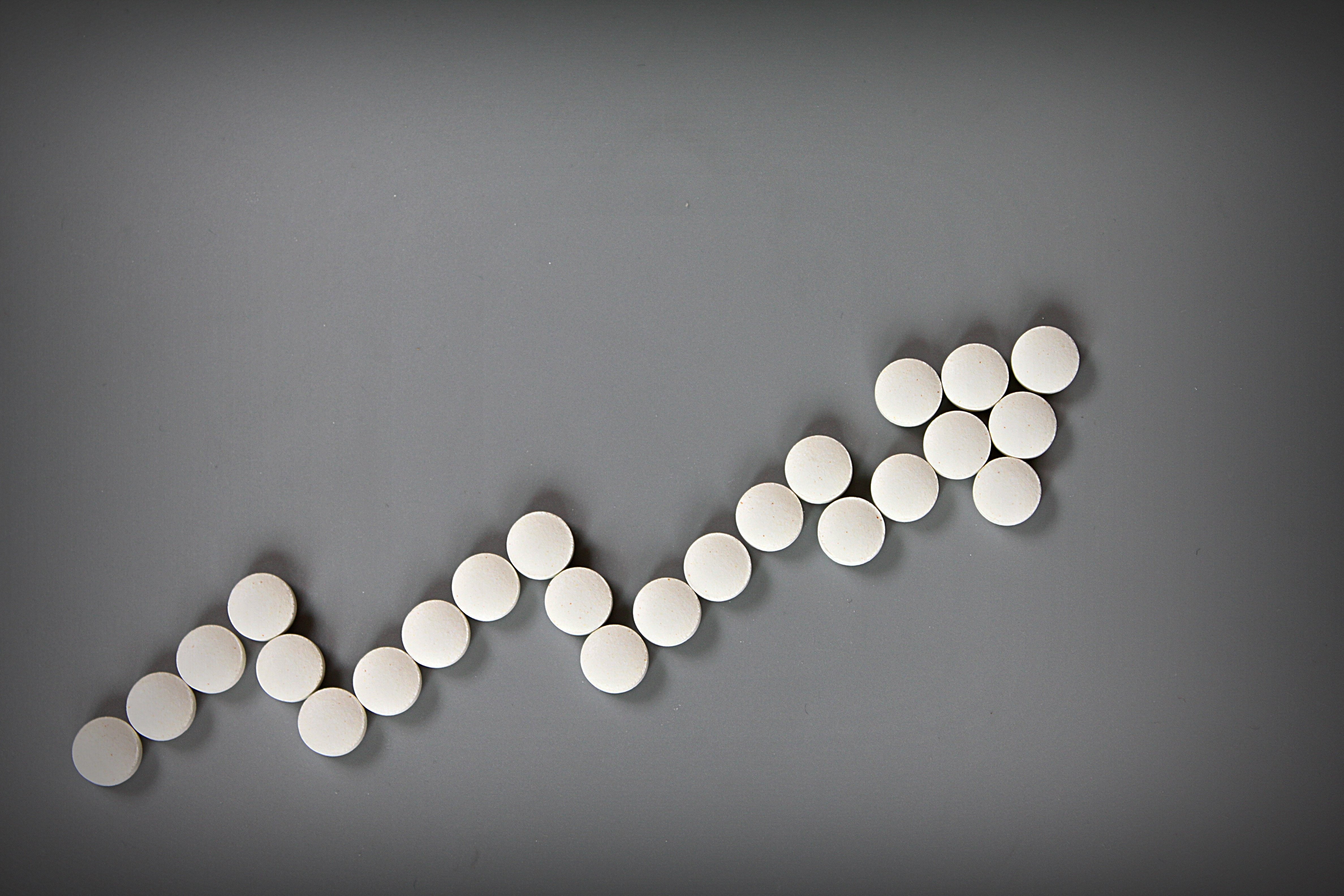

The Senate Finance Committee is proposing ways the tax system could be reformed to promote increased retirement savings and recently considered testimonies from multiple employee benefits and retirement experts.

One of the experts Judy A. Miller, director of retirement policy for the American Society of Pension Professionals & Actuaries, is concerned about the proposals because they slash the contribution limits, and turn this year's into a credit, which, she says, would discourage small-business owners from providing workplace retirement plan.

"The key to promoting retirement security is expanded workplace savings and increased incentives for small-business owners to sponsor retirement plans," Miller says. "We urge Congress not to dismantle what's working with our private employer sponsored retirement system to pay down the current debt and as a result put the retirement future of American workers in jeopardy."

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.