To sell health-related insurance products other than majormedical insurance in 2016, it might help to start with calmingmusic, herbal tea, or, in states where this islegal, medical marijuana.

|Anything to get prospects down from the ceiling long enough thatthey can calm down and look at you, rather than muttering,"Full-time equivalent, full-time equivalent," over and over. Andover.

|It looks as if 2016 will be the first year that the PatientProtection and Affordable Care Act (PPACA) will have noticeableeffects on ordinary big and midsize employers. Maybe it'sa hammer that's dropping. Maybe it's the othershoe that's dropping. Whatever the right metaphor is for thestart of the PPACA commercial health insurance market changing themarket in a significant way, the changes are here.

|Small nonprofit, member-owned health insurers are closing.Executives at the big, publicly traded health insurances aretalking about their PPACA World major medical insurance operationsas if those are disappointing adolescents, not perfect, adorablenewborns.

|Many of the employers that might be open to considering newvoluntary benefits options or improving their wellness andcondition management programs are busy figuring out how to preparetheir first PPACA World 1095-C employee coverage offer forms, whichare supposed to go out by March 31.

|Any of the individual medical customers you continue to servemay have to jump from one disappearing health plan to another.

|Meanwhile, it's an election year. Much of potential customers'mental energy that could go into considering dental, vision,disability or critical illness insurance options, or even long-termcare insurance options, may go into panicking over who will sit inthe Oval Office in January 2017.

|So, what could go right for you this year, in spite all of themajor medical panic?

|For five ideas about reasons for you to look forward to the newyear, read on.

||

|

1. The Medicare Advantage and Medicare supplement insurancemarkets could be reasonably stable.

Given all of the commotion about the PPACA World major medicalmarket, it doesn't seem as if, for example, the U.S. Department ofHealth and Human Services (HHS) and the Centers for Medicare &Medicaid Services (CMS) will have much capacity to do more thanbleat like a sheep about Medicare product concerns.

||

2. The insurance community might be able to turn thepresidential candidates and congressional candidates intodisability insurance marketers.

In spite of Democrats' and Republicans' efforts to portraythemselves as being in total disagreement about everything, theyseem to be converging on the idea that people who can afford tofend for themselves generally should fend for themselves. Maybeinsurers could find ways to lead candidates from both parties totalk a little about the importance of private paycheck protectionarrangements.

|||

3. The insurance community might get some serious conversationsgoing about long-term care planning.

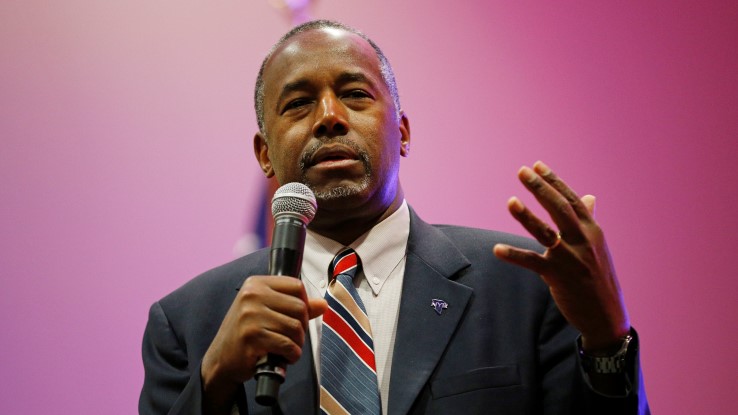

Ben Carson, for example, got his campaign off to a late start inthe spring, because he went home to see his mother, who hadAlzheimer's disease and was near death.

|Hillary Clinton has offered a packageof caregiver support proposals.

|This might be the year when caregiving becomes at least as muchof a campaign news topic as those who design the candidates'spouses’ party clothes.

|(AP Photo/John Locher)

|||

4. Insurers and producers may end up dealing with new, updatedregulations for non-medical health products.

But, this time around, the insurance community may be in a goodposition to mobilize consumers to defend consumers' right to buyproducts like travel medical health insurance and critical illnessinsurance free from excessive new red tape.

|Read: 6 reasons voluntary sales will flourish in2016

|Consumer groups always used to argue that the gap fillerproducts were unnecessary, because consumers should and could buycomprehensive, smoothly functioning major medical coverage withoutbig coverage gaps. Good luck with that strategy this year.

|||

5. Interest rates will rise and make the managers of thesurviving LTCI issuers look brilliant.

Of course, we've been making that prediction for several yearsrunning, but, eventually it will come true. Maybe 2016 will be theyear.

|Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.