In the self-insured world, “centers of excellence” is a termthat is beginning to be used for a specific hospital that has beenselected by a large employer for bundled pricing of high-ticket,higher-volume surgeries like knee replacement.

|The label alone heightens expectations of vastly superior healthcare. Consumers want to believe they will experience care that isoff the charts in all respects; from advanced techniques, expeditedtreatment and length of stay, to pain management and overallpatient satisfaction.

|The name implies that centers of excellence (COEs) are somewhatimmune to the inherent dangers of hospitalization. This expectationpersists, despite a recent study estimating that aquarter of a million deaths are caused by medical errors eachyear.

|The assumption most employees have about COEs is that they arefirst and foremost selected based on performance; that objectivemeasures of outcomes like mortality and complications are topselection criteria. They expect that only after the performancequality is determined are prices taken into consideration to findthe best value. They assume that centers of excellence live at theintersection of amazing quality and good price.

|Rise in popularity

With the rapid increase in cost of health care over the lastdecade, self-insured employers have sought outlower cost structures by engaging directly with hospitals. This trend is a big part of what is driving thepopularity of COEs.

|These are typically hospitals with great name recognition thatcontract directly with self-insured employers to provide fantasticdeals for paying cash or expedited payment terms. The hospital ishappy because they improve their cash flow (bypassing insurancecompanies whose payments are often delayed by months), employersare happy because they are often paying less money, and theemployees are happy because they believe they are going to a placethat has been vetted as “the best of the best.” On the surface, itseems everybody wins.

|Lack of outcomes transparency

Unfortunately, trustworthy outcomes-based metrics have not beenwidely available until recently, so as a proxy for excellence,employers have had no alternative but to identify top providersbased on name recognition and reputation.

|With this in mind, our analytics team set out to investigatewhether centers of excellence truly provide exceptional care. Wetackled this problem by analyzing the outcome metrics for existingCOEs.

|While most of these centers have great national reputations, thedata show surprising areas of mediocre and even poor performance.This included high variance in hospital outcomes across the differentprocedures performed; for example, a hospital can be exceptional athip replacement, but nowhere near as good for heart bypasssurgery.

|We would not go as far as to say there is no correlation betweenreputation and outcomes, but more often than not, one does notguarantee the other.

|We also found surprisingly little evidence supporting theassumption that outcomes are the top driver of COE selection. Infact, it would appear that the top factors that drive selection areprice and reputation. In other words, centers of excellence arealways “excellent” in pricing, but not necessarily “excellent” atperformance.

|The cost of poor quality

|

So should self-insured employers care aboutquality? Why upset the apple cart if no one is complaining?

|If a quarter of a million deaths from medical errors isn'tenough of a reason to care about quality, how about the fact thatpoor health care quality costs payers hundreds of billions of dollars a year?

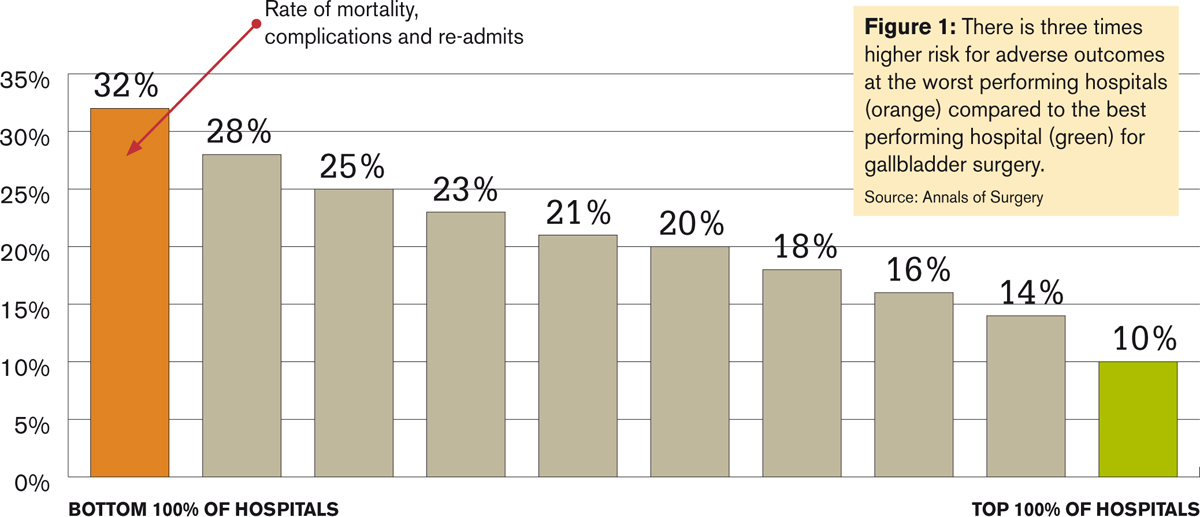

|A series of studies conducted recently by MPA HealthcareSolutions in Chicago showed that poor performing providers pose twotimes greater risk of adverse outcomes (such as severecomplications or mortality) in colon and cardiac surgery, and three times greater riskof adverse outcomes in gall bladder surgery, hip, knee, kidneyremoval, and lung resection surgery.

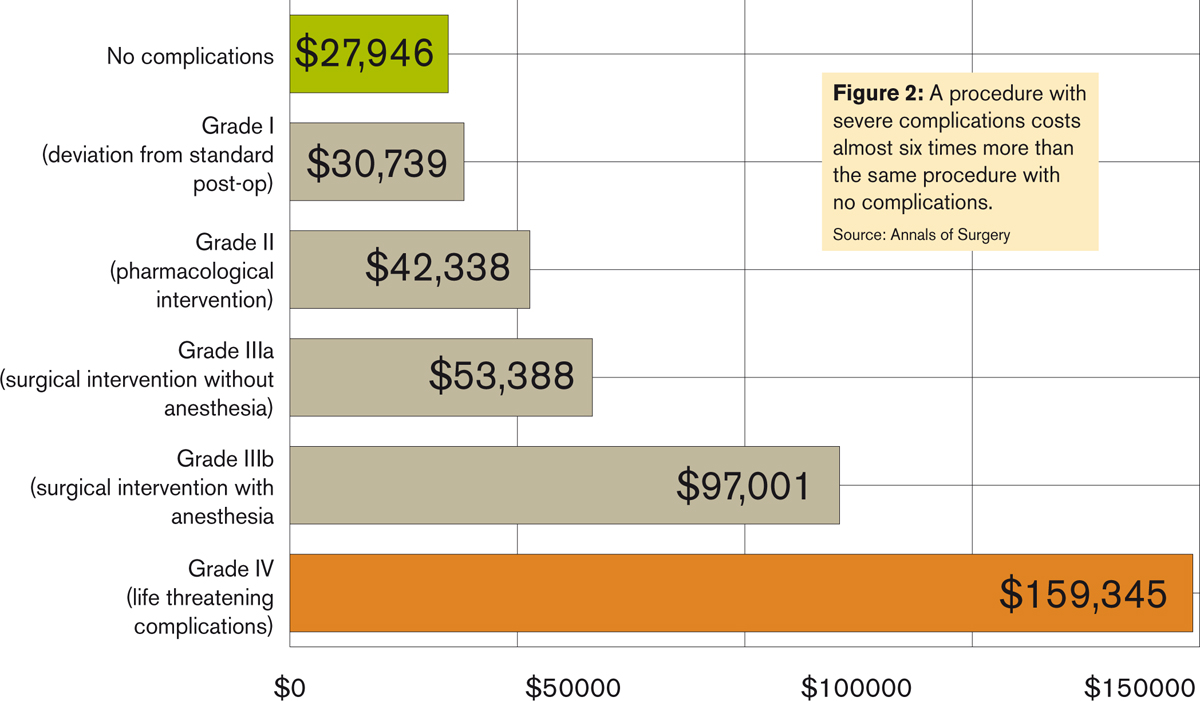

|Complications lead to extended hospital stays and readmissions,and ultimately translate to higher costs and more suffering forpatients. In a 2011 study published in the Annals of Surgery,the investigators found that a procedure resulting in severecomplications costs nearly six times more than the same procedurewith no complications.

|That well-negotiated $18,000 sticker price on knee surgery,which saved a self-insured employer $10,000 upfront, has thepotential of quickly turning into $100,000 if a major complicationoccurs, and this does not take into account the indirect costs oflost productivity, not to mention unnecessary patientsuffering.

|The search for quality

It's clear that the term “center of excellence” needs to beredefined. Here are the five critical steps to truly achieveexcellence.

|1. Ruthlessly ignore reputation

|The first step in selecting better centers of excellence is toput your preconceptions aside and become reputation agnostic. Asnoted, reputation does not always correlate to quality. Case inpoint: A Chicago hospital, touted as a “nationally recognizedleader” according to their website, was recently selected by a verylarge self-insured employer as a center of excellence for knee andhip surgery.

|The hospital's orthopedic department is considered “#1 in allparts of Chicago,” which is presumably what helped them become acenter of excellence to great fanfare.

|Unfortunately, three continuous years of outcomes data does notsupport the hospital's reputation. When examining risk-adjustedsevere complications and overall adverse outcomes, the abovereferenced hospital ranks far below the national average ofperformance for orthopedics providers in the country.

|When it comes to knee and hip replacement surgery, it performedat the absolute bottom. In terms of long-term clinical outcomes forthese procedures, on a 100 to 800 point scale, their quality scoresfor both procedures are at the poorest performance of 100.

|To further illustrate how reputation doesn't matter, one of thebest hospitals in the country for knee replacement surgery is anall but unknown facility — Valley Baptist in Harlingen, Texas. Yet,despite lacking a national brand name, Valley Baptist has performedat the absolute top on the scale with a score of 800. As theseexamples show, one should heavily discount reputation as part of acenter of excellence selection.

|2. Medical quality analytics: Don't do ityourself

|

Unless you're a surgeon with a PhD in statistical analysis and adecade or two of experience grappling with medical performancedata, you need to find a team to perform the due diligencenecessary to evaluate whether a hospital is performing well.

|With some digging, an experienced health care analytics teamwould be able to direct a self-insured employer from the abovementioned reputable-but-poorly-performing Chicago hospital, to theequally reputable but demonstrably high-performing NorthwesternMedicine Network, including hospitals in the Greater Chicago arealike Central Dupage in Winfield with a score of 710 in kneereplacement surgery and Lake Forest Hospital with a score of 610 inhip replacement surgery.

|One of the biggest pitfalls we see with self-insured employersis the outsourcing of due diligence to organizations — includingemployer coalitions — lacking health care analytics or statisticscapabilities. If you wish to pursue the center of excellence model,it's important to qualify the team and find people, organizationsor platforms that incorporate strong health care analyticsexperience.

|3. Outcomes, outcomes, outcomes

|The most important step in selecting true centers of excellenceis to focus on objective outcomes. Objective outcomes are metricsthat are measurable and not biased by perception. For example,mortality is an objective outcome. Complication rate is anobjective outcome. Readmission rate is an objective outcome.

|By contrast, patient satisfaction is not an objective outcome,because “satisfaction” is colored by things that do notmeaningfully contribute to health care results. In fact, there hasbeen evidence that shows that subjective outcomes like patientsatisfaction are inversely correlated with effective patient care.

|With the 2013 and 2014 releases of massive Medicare providerdata, there is at least one publicly available data set for lookingat outcomes, and there are now a handful of analytics effortsranking and scoring the various hospitals based on these raw datasources.

|Importantly, when you look at health care quality metrics, makesure that whatever platform or methodology you choose, there isrisk adjustment for the patient population (meaning, hospitals withsicker patients are not penalized for taking on those patients).Also, you must scrub the raw data and normalize it against facilityvariations, and you must have robust statistical weighting toensure a truly comparable rating system.

|4. Look for cost effectiveness

|

You can stop at step three if you like, because outcomes-basedquality is the minimum standard for selecting a center ofexcellence. However, for most self-insured companies, loweringhealth care cost is a major motivator. To this end, a filter basedon cost can be applied to find the best providers with the lowestcost as a final step. You can take your list of excellent providersand your table of costs for each procedure and map them to oneanother.

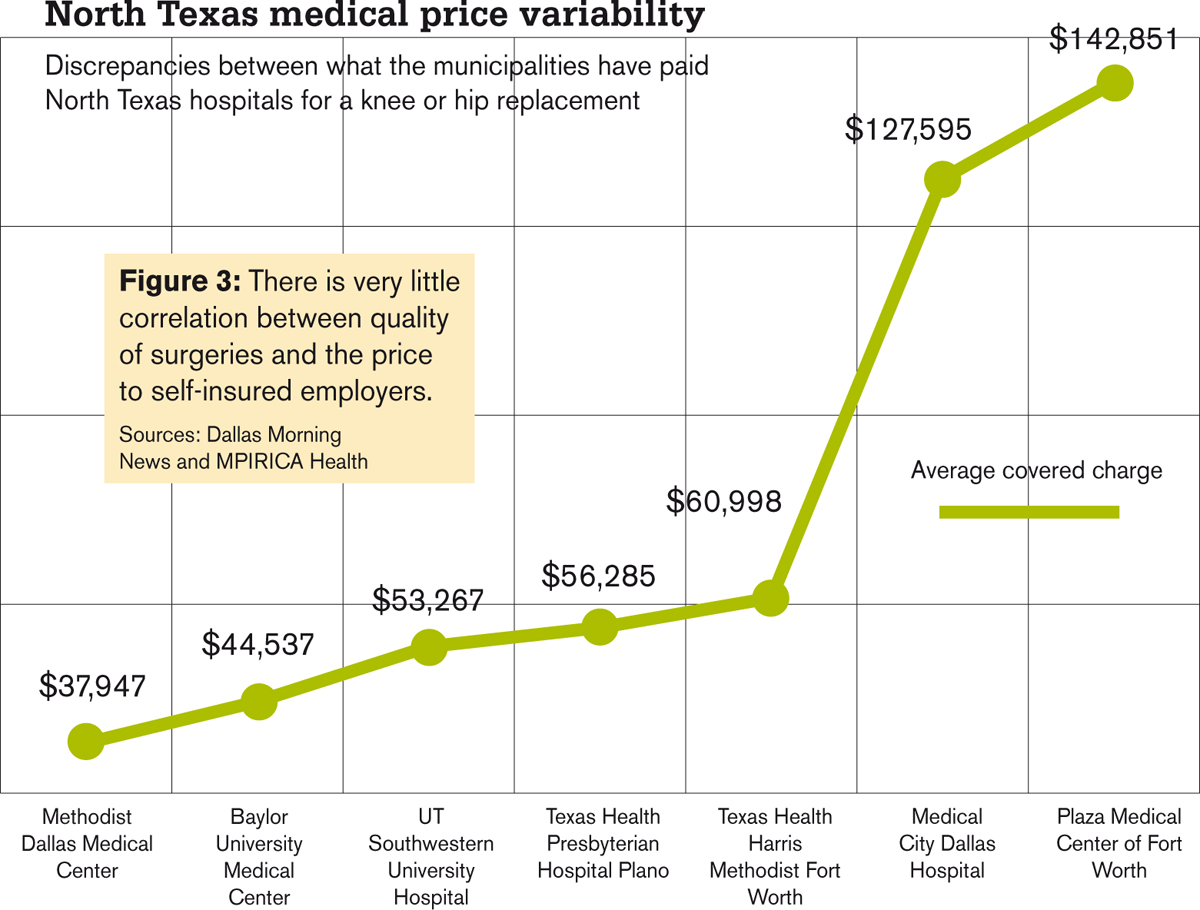

|Now, if you think low cost and high quality are mutuallyexclusive, think again. As noted earlier, lower quality actuallycosts more money because of longer hospital stays and more medicalintervention. While health care costs can be complex, just lookingat the orthopedics price data from North Texas as reported in the DallasMorning News, combined with knee replacementquality scores, you can see that the lowest cost hospitals areamongst the highest quality providers in the group.

|5. Direct procurement

|Once you establish quality and find value, the final step is toengage with the hospital organization to establish a relationshipfor direct procurement of services.

|The core tenet of a center of excellence model is negotiating arelationship that is a win-win for both the provider andself-insured employer. The key features of the relationship shouldinclude reference-based bundled price, fast cash payment andquality monitoring.

|These relationships encourage ongoing quality and efficiencyfrom the hospital, and allows the employer to steer patients to theprovider by offering incentives like zero out-of-pocket costs orcash back.

|The take-home message

Finding and contracting with a center of excellence forspecific procedures is a great way to lower costs forself-insured employers, but it takes a bit of legwork.

|However, if you follow the steps laid out above, you will beable to take advantage of the COE trend, save money, and protectyour most important asset: your employees. This is what a true winfor everyone looks like.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.