Out-of-pocket costs can be a pain in the budget for manyemployees.

|Health savings accounts have traditionally offered employeessome relief, but many employees don’t have the means to adequatelypre-fund their HSA. That’s why employers are increasingly turningto supplemental medical insurance to fill gaps and provide asolution that works for all employees.

|Managing rising deductibles

The percentage of Americans in high-deductible health plans hasskyrocketed in recent years, with more than 50 million Americans currentlyenrolled in these plans. As more employers migrate tohigh-deductible options, employee participation in those plans isgrowing exponentially.

|Not surprisingly, employees’ out-of-pockets costs are rising aswell. Over the past five years, employee responsibility fordeductibles, co-pays and co-insurance has increased. Deductibles alone have increased a whopping 86%in this time frame.

|Employees are feeling the pain in their pocketbooks, and manystruggle to make high-deductible plans work for them and theirfamilies. Some have been forced to declare bankruptcy over unpaid medical bills,while others are depleting their savings or forgoing care.

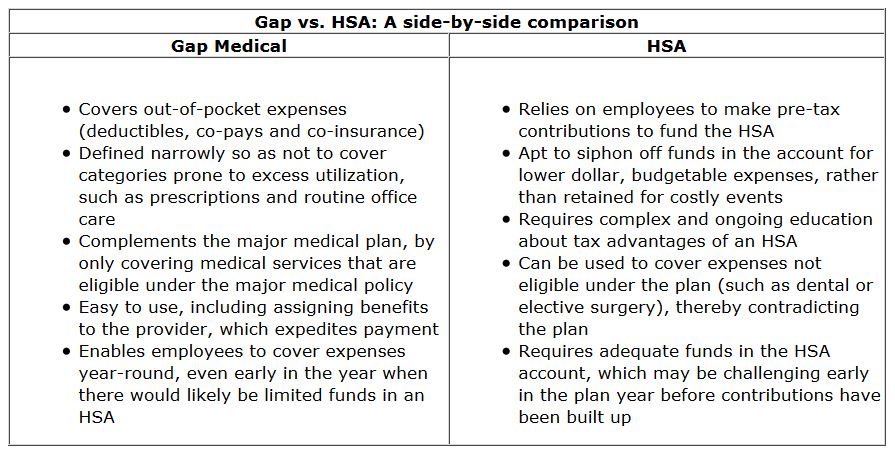

|Most employers seeking solutions that help soften employees’high out-of-pocket expenses have turned to Health Savings Accounts(HSAs).

|These tax-advantaged accounts enable employees enrolled inhigh-deductible health plans to fund their HSA with pre-taxcontributions and use those funds to cover their out-of-pockethealth expenses.

|But, HSAs have their limitations, especially for average wageearners who may not have the means to adequately pre-fund an HSAand may find themselves with medical bills they can’t afford.

|Even more financially stable employees may be unlikely to knowhow much they’d need to save to adequately prepare for anunforeseen medical event, such as a hospitalization or surgery dueto an accident or illness. Studies show that three in five Americans don’t have enough moneysaved to cover the costs of an unexpected medical emergency,typically averaging $1,000.

|There are other options. Two out of three employers are now offeringsupplemental insurance coverages – such as supplementalmedical, hospital indemnity and critical illness insurance – tohelp employees fill gaps.

|In particular, true gap medical coverage like supplementalmedical insurance can help employees cover eligibleout-of-pocket expenses like deductibles, co-pays and co-insurance,when it is provided alongside a high-deductible health plan.

||Filling gaps for all employees

Supplemental medical insurance provides a solution for groupsseeking plans that will be effective for all of their employees –not just those that can afford to fund an HSA – while alsopotentially reducing their costs.

|This insured supplemental medical option helps employees coverhigher cost, non-selectable medical expenses, such as inpatienthospitalization, ER visits, outpatient surgery, diagnostic testingand, in some cases, chemotherapy and radiation.

|These plans complement existing medical plans and only coverservices that are eligible under the major medical policy. Inaddition, they typically do not cover costs prone toexcess utilization, such as prescriptions or routine officevisits.

|Not only does supplemental medical insurance provide coveragethat works for all employees equally, it also provides them withprotection from day one of the plan year.

|Many employees who participate in HSAs are often ill-prepared tocover out-of-pocket expenses early in the plan year, because therehasn’t been enough time to build up funds. Conversely, late in theplan year, employees in HSAs may have already used up funds onlower-cost, budgetable items (such as prescriptions), leaving themexposed should they encounter an unexpected and costly healthcrisis.

||Saving time and money for the company

A supplemental medical plan can do even more than save money foremployees. When carefully designed in conjunction with thehigh-deductible plan, these gap plans can also generate plansavings for the company as well.

|Here’s how it works: First, employers can increase thedeductible to reduce major medical premiums.

|From there, they can apply some of that savings toward funding asupplemental medical plan that helps soften the blow for employeesby covering eligble out-of-pocket costs like deductibles, co-paysand co-insurance.

|A combined major medical and supplemental medical plan not onlyreduces employees’ financial explosure, it also can help employersachieve significant plan savings (see sample cost savingsillustration):

Current PPO Plan | Total per month | Total premium |

2016 PPO Plan | $65,839.75 | $790,077.00 |

NEW MM + Gap Plan | Total per month | Total premium |

New Major Medical Plan | $57,763.84 | $693,166.08 |

+Supplemental Medical | $ 3,969.32 | $ 47,631.84 |

2017 MM + Supp Med Plan | $61,733.16 | $740,797.92 |

Plan savings | $ 49,279.08 |

Results: Gap results in a plan savings of 6.2% yearover year

|In addition to the cost savings, supplemental medical plans cansave time for the employer.

|HSAs typically require complex employee education ontax-advantages and usage, while gap protection coverages likesupplemental medical are relatively simple for employers toimplement and for employees to understand and use.

|No doubt, HSAs have their place for employees who can adequatelyset aside pre-tax dollars into these accounts.

|But supplemental medical insurance offers more protection for awide range of employees from day one in the plan year. Byreducing their out-of-pocket exposure, these plans fill gaps andoffer meaningful financial protection - just when it is needed themost.

|Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.