How are your clients feeling about the economy? Are theyoptimistic? Cautious? Both?

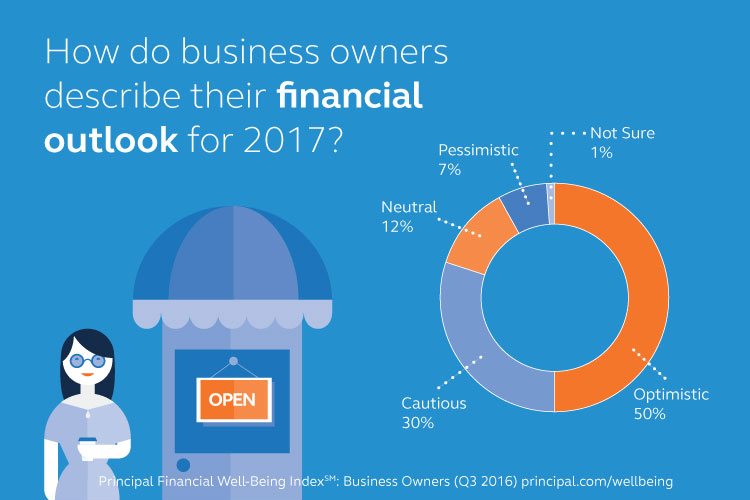

|In a recent survey from Principal Financial, half of surveyedbusiness owners (50%) said they are feeling optimistic abouttheir economic outlook. That’s up from the yearbefore. And when it comes to their business financials, 70 percentsaid they’ve improved significantly or somewhat from the previousyear.

|

Those are great numbers. When business owners are feelingconfident, they’re more likely to invest in their business andtheir people. And they’re more open to talking about enhancingtheir employee benefit package.

|But be careful. While plenty of business owners are feeling thelove, it’s important to keep sight of the fact that not everyone’sin the same place. In the same survey, 30 percent describedthemselves as cautious.

|So, what does this mean for you? Well, consider each of yourclients individually with these simple tips in mind.

|1. Find out where they stand. Are theyconfident and perhaps prepared to boost their employee benefits? Orare they more cautious and looking for cost-saving measures? Youhave solutions for either disposition; but you can’t offersolutions to meet their needs until you identify their currentpoint of view. All it takes is a conversation.

|2. Change your approach based on how they’refeeling. If they’re confident and optimistic, talkingabout expanding their benefits should be on the table. Focus on howimportant benefits are to recruiting and retaining good employees.If they’re cautious or pessimistic, bring up voluntary benefits andother options that can help them offer value to employees, whilealso managing costs. Tread lightly when discussing benefits thatare 100 percent employer-paid.

|3. Be prepared to offer several options.

|For the cautiously optimistic, find the middle ground. Thesebusiness owners are generally optimistic about the future, but theyrealize something could go wrong. So hedge, and suggest somecombination of employer-paid and voluntary solutions. This is also where fundingoptions can be important in the conversation.

|Things change, and the next time you connect with your clients,they may be feeling differently. So always start each conversationwith some questions that help you assess how they’re feeling aboutthe economy, their business, their finances and their future. Youmight make another sale. Or, you may uncover a detail that wouldsuggest they’re planning to eliminate a benefit. Either way, you’llwant to know … and know sooner than later.

|GP61983 | 4/2017

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.