Although it may be premature to perform last rites on insurance exchanges created under theAffordable Care Act (ACA), it's fair to say that they are on lifesupport in many states.

|“We continue to see a decline in issuer participation in thehealth insurance exchanges, leaving consumers with fewer and fewerinsurance options,” Seema Verma, administrator of the federalCenters for Medicare & Medicaid Services, said in a reportissued in late July. “I am deeply concerned about the crisissituation facing the individual market in many states across thenation.”

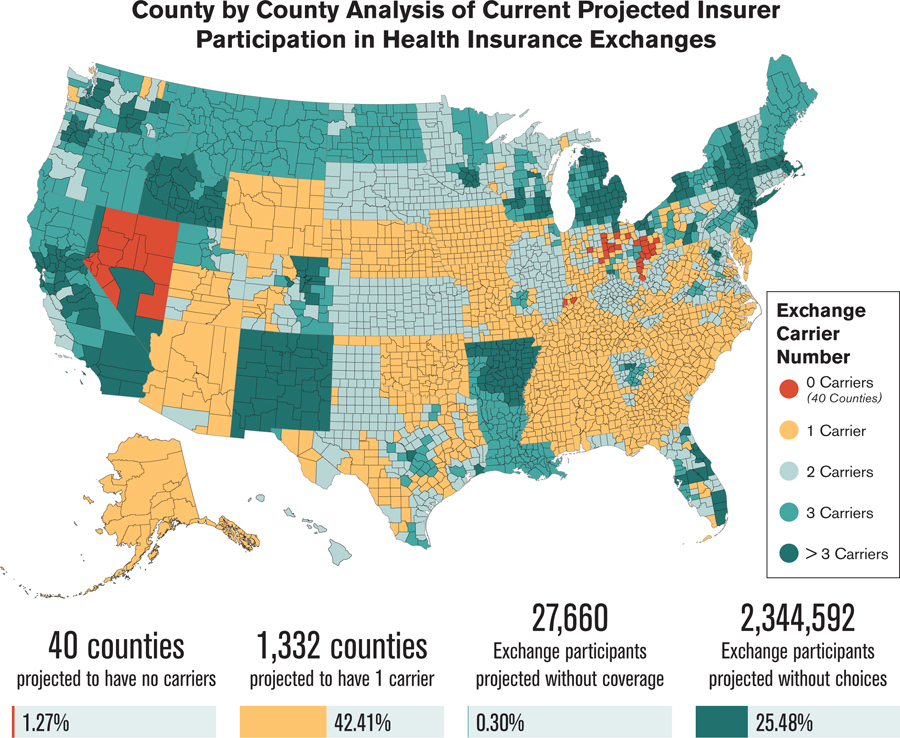

|The agency projects that residents of 49 counties will have nooptions to choose from when they try to enroll in a plan through anexchange for 2018. Another 2.4 million exchange participants in1,300 counties may have only one carrier option next year,according to the report (see chart on page 15).

|Related: Don't sabotage ACA, Americans say: Poll

|“My fear is that regardless of what Congress does, it will be tothe detriment of the carriers,” says Fred Joyner, owner of CarolinaBenefit Administrators in Winston-Salem, North Carolina. “There arevery few already, and I’m concerned that regardless of whathappens, carries will decide it's not worth it and bail out.”

|The Heritage Foundation, a conservative think-tank inWashington, D.C., says the reduction in the number of carrierscontinues a pattern that started with the inception of the ACA:

|“One of the stated aims of the ACA was to increase competition among healthinsurance companies. That goal has not been realized, and byseveral different measures, the ACA's exchanges offer lesscompetition and choice in 2017 than ever before. Now in the fourthyear of operation, the exchanges continue to be far lesscompetitive than the individual health insurance market was beforethe ACA's implementation. Moreover, insurer participation in thelaw's government-run exchanges has declined over the past two yearsand is now at the lowest level yet. This lack of insurerparticipation leaves exchange customers in 70 percent of U.S.counties with no insurer choice, or a choice between merely twoinsurers.”

|Clouded crystal ball

|Trying to project the fate of the exchanges in 2018 and beyondis like peering into a kaleidoscope. The picture can change asquickly as it comes into focus. Republicans ran in 2016 on aplatform of repealing and replacing the ACA. When all was said anddone, however, much more was said than done.

|In late July, the Senate voted against what was termed the“skinny repeal.” This bill would have permanently ended theindividual coverage mandate and its employer mandate for eightyears. It also would have given states flexibility to opt out ofsome Obamacare regulations, defunded Planned Parenthood for a year,repealed the medical device tax for three years and allowed morepre-tax money to pay for health savings accounts.

|Now what? Many states face a situation similar to the one inNorth Carolina.

|“Right now in North Carolina, we have one carrier: Blue CrossBlue Shield,” Joyner says.

|“Cigna has carved out about three or four counties aroundRaleigh, but our state has 100 counties.

|“Prices are escalating. Blue Cross Blue Shield filed for 20percent to 30 percent rate increases for 2018, citing instabilityand uncertainty. They have lost millions of dollars in the pastseveral years, mainly because they are attracting less-than-healthypeople. Young, healthy people are not buying into it and insteadare opting not to buy coverage or buy gap-type products.”

|Although short-term medical plans don't meet the ACArequirements, they are popular options. Some healthy consumers findthat the combined cost of these policies and the fine for notbuying insurance under the ACA is still less than the price ofapproved plans offered on the exchanges, Joyner says. He expectsthe Department of Health and Human Services in the next severalmonths to expand the current limit of 90 days for these plans.Overall, however, “choices for agents and consumers are verylimited in North Carolina,” he says.

|Things are not any rosier in Wisconsin.

|

“We really don't have any private exchange markets,” says TerryFrett, senior benefits consultant for R&R Insurance inWaukesha, Wisconsin. “The carriers have left them, so they havedefaulted to public exchanges. Anthem and Blue Cross and BlueShield say they are going to withdraw next year. Humana and Pulsepulled out last year, and UnitedHealthcare the year beforethat.”

|This attrition has been frustrating for brokers and consumersalike. “Most of the people whom we facilitate for individualinsurance retired early and are not yet eligible for Medicare,”Frett says. “Their choice of plans keeps shrinking. Quite a fewhave gone from United to Humana to Blue Cross.”

|Related: 5best and worst states for health care

|One bright spot in Wisconsin is the presence of regionalcarriers, as health care providers can also be insuranceorganizations. For example, one health plan offered in MilwaukeeCounty is a collaboration between a local medical school andAscension Health Alliance in St. Louis.

|“Our state is divided into 26 territories for buying healthinsurance,” Frett says. “In 2018, Milwaukee Country will only havefour carriers. Three of the four have never sold before except toMedicare beneficiaries. Now they are moving into the individualmarket and will target the most-subsidized populations.”

|Soaring costs

|The problems plaguing exchange plans are two-pronged. Along witha number of carriers pulling out, the ones that remain have filedfor significant premium increases. eHealth, an online exchange inMountain View, California, estimates that 2018 rate increases willmake health insurance unaffordable for 29 percent of individualsand 54 percent of families who purchased insurance on exchangesthis year. (The ACA considers a plan unaffordable if thelowest-cost plan available costs more than 8.13 percent of theinsured's adjusted gross income.)

|Researchers arrived at these percentages based on estimates byOliver Wyman Health, which projects rate increases ranging from 28percent to 40 percent next year.

|“What we’re seeing now in Obamacare is death-spiral pricing, andin many states, only the heavily subsidized will be able to affordcoverage in 2018,” says Scott Flanders, CEO of eHealth. “Obamacaremade real improvements in the individual health insurance market byincreasing access to health care for millions of Americans, but ithas proven to be a deeply flawed piece of legislation that needs tobe repaired or replaced in order to help people stay covered.”

|Put clients first

|This bleak outlook creates challenges not only for consumers,but also for brokers. How can insurance professionals best serveclients who look to them for answers when there may not be any goodones?

|First, plan for the status quo in 2018 instead of any majorchanges to the ACA. “The absolute earliest anything could change inthe individual market is 2019,” Frett says. “We are too far gonenow. Carriers have already had to file rates, which would makechange impossible for 2018.”

|The status quo is not good news for a broker's income stream,Joyner says.

|“I tell brokers and agents across two states that even ifObamacare remains in place for the next two or three years, thecompensation that agents are receiving for marketing Obamacareplans is very small in comparison to the effort it takes to assistconsumers through the exchanges,” he says. “What we have beensuggesting is to be proactive and take advantage of ancillaryproducts to supplement your income. Look at fixed indemnity-typeproducts, where the policy pays ‘X’ amount for a hospital stay oroffice visit.”

|Educating and servicing current clients is the top priority atR&R Insurance in Wisconsin.

|“It becomes very challenging,” Frett says. “Our focus in ontaking care of our current clients. We are not looking to writebusiness with new clients. There is still a huge disconnect amongconsumers. They will call and ask for a quote on health insurance.I have to tell them, ‘you can't just sign up anytime you want, butonly during open enrollment. It's not like buying autoinsurance.’

|“My advice is to take care of your immediate clients first. Weare being proactive by sending them educational information so theywill know what is happening this year. The three most importantreminders are that open enrollment will be during a compressed timeperiod this year; that the policy they have in 2018 will not be thesame one that they have this year; and that they can expect aminimum 20 percent rate increase.”

|2018 is an election year, so it's always possible that Congresswill act to fix the ACA and problems plaguing the exchanges.Brokers such as Joyner, however, are planning ahead as if nothingwill change.

|“Some agents are throwing up their hands and saying they aregoing back to selling things such as life insurance, investmentsand estate planning,” he said. “I can't blame them at this point.Whether it will ever come back to where it was before Obamacare ishard to say.”

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.