While premiums continue to rise sharply for plans on the Affordable Care Act exchanges, premiums rose modestly for employer-sponsored plans, according to the 2017 Employer Health Benefits Survey by the Kaiser Family Foundation and the Health Research & Educational Trust.

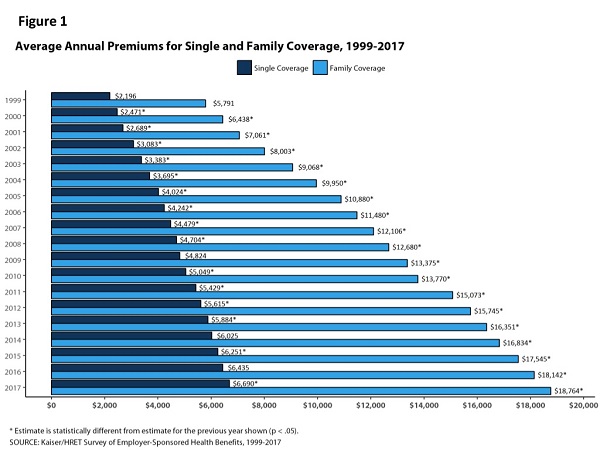

The average premium for family coverage in the workplace in 2017 increased by 3 percent from a year ago, to an annual total cost of $18,764, according to the survey, which included more than 2,100 interviews with non-federal public and private firms. The amount of yearly increases appears to be leveling off, as this is the sixth consecutive year of small increases. Overall, average premiums for family coverage in the workplace have risen 55 percent since 2007, but at a slower 19 percent pace since 2012.

The average premium for single coverage increased by 4 percent to an annual total cost of $6,690.

The modest increases are in stark contrast to the 20 percent on average spike in premiums on the ACA exchanges. Analysts tell Kaiser Health News that they are surprised that premiums in the workplace haven’t risen higher as the economy improved, which they would have thought would have led to a jump in use of health services and health costs.

Drew Altman, chief executive of the Kaiser Family Foundation, it’s “health care’s greatest mystery” why health insurance costs have continued their slow pace even as the economy has picked up the past few years. “We can’t explain it.”

While overall premium increases remain modest, workers are picking up a greater portion of the tab — this year $5,714 for family coverage, about a third of total cost. However, average deductibles remained stable at $1,221. After doubling since 2010, the pace of increases may be leveling off.

“Increasing deductibles has been a main strategy of employers to keep premiums down and we will have to watch if this plateauing is a one time thing … or if this portends a sharper increase in premiums in future years,” Altman says. “It could be deductibles are reaching their natural limit or could be the tighter labor market” that’s causing employers to back off.

Other key findings of the survey included:

-

The average annual premium for family coverage for covered workers in small firms ($17,615) is lower than the average premium for covered workers in large firms ($19,235).

-

The average annual premiums for covered workers in high-deductible health plans with savings options are lower for single coverage ($6,024) and family coverage ($17,581) than overall average premiums. The average premiums for covered workers enrolled in PPO plans are higher for single ($6,965) and family coverage ($19,481) than the overall plan average.

-

The average premiums for covered workers are lower in the South ($6,372 for single coverage and $18,038 for family coverage) than the average premiums for covered workers in all other regions. The average premium for family coverage for covered workers in the Northeast ($20,092) is higher than the average family premium for covered workers in all other regions.

-

The average premiums for covered workers vary across industries, with those in the retail industry being particularly low ($5,716 for single coverage and $16,920 for family coverage).

-

The average premiums for covered workers in firms with a relatively large share of younger workers (where at least 35 percent of the workers are age 26 or younger) are lower than the average premiums for covered workers in firms with a smaller share of younger workers ($5,922 versus $6,762 for single coverage and $16,893 versus $18,939 for family coverage).

-

Premiums also vary by firm wage level. The average premiums for covered workers in firms with a relatively large share of lower-wage workers (where at least 35 percent of workers earn $24,000 a year or less) are less than the average premiums at firms with a smaller share of lower-wage workers ($6,035 versus $6,739 for single coverage and $16,376 versus $18,942 for family coverage).

-

The average premiums for covered workers in firms with at least some union workers are higher than the average premiums for covered workers in firms without union workers ($7,183 versus $6,434 for single coverage and $19,885 versus $18,177 for family coverage).

-

There is also variation in premiums by type of firm ownership. For both single and family coverage, covered workers at private for-profit firms have lower average annual premiums than covered workers at public firms or private not-for-profit firms.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.