The holdings in America's largestpension expose a dilemma for lawmakers who are considering ways topenalize Russia for alleged election meddling. (Photo:Shutterstock)

The holdings in America's largestpension expose a dilemma for lawmakers who are considering ways topenalize Russia for alleged election meddling. (Photo:Shutterstock)

(Bloomberg) –An escalating war of words between Russia and theU.S. didn't prevent a chunk of pensions that belong to Californianfirefighters and police officers from finding its way into debtsold by President Vladimir Putin's government.

|$460 million invested

The California Public Employees' Retirement System, or CalPERS, had about $460 million invested inRussian government bonds as of the end of June, up over 8 percentsince last year, according to data provided to Bloomberg News.

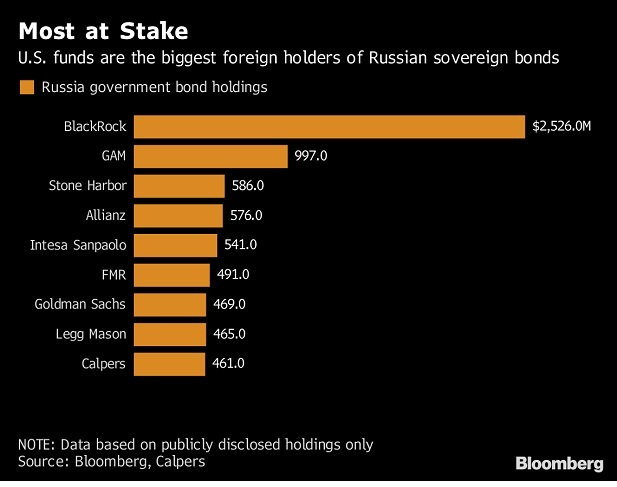

|Based on publicly disclosed figures, that makes the state ofCalifornia Russia's 10th-largest foreign creditor, behind other topU.S. investors including BlackRock and Stone Harbor InvestmentPartners.

|In the sanctions standoff between Russia and the U.S., thevulnerability goes both ways after two years of inflows from carrytraders briefly turned Russian debt into an investor darling.

|The holdings in America's largest pension expose a dilemma forlawmakers who are considering targeting Russia's sovereign debt aspart of new penalties being discussed to punish Putin's governmentfor alleged election meddling.

| Table 1: U.S. funds holding Russiansovereign bonds. (Source: Bloomberg, CalPERS)

Table 1: U.S. funds holding Russiansovereign bonds. (Source: Bloomberg, CalPERS)

“It matters that pension funds are involved in Russian debtbecause they're likely arguing against sanctions against sovereignbonds” to the Treasury's Office of Foreign Assets Control, saidKoon Chow, a senior strategist in London at Union Bancaire Privee.“It may not have much impact though, given the bipartisan U.S.support for punishing Russia further.”

|Sanctions on bonds are major sticking point

Senator Chris Van Hollen, a Maryland Democrat and co-sponsor ofone of the bipartisan bills under consideration, said last monththat concerns over sanctions on government bonds are a majorsticking point.

|At the end of summer, U.S. investors accounted for 6 percent ofRussian sovereign debt, including Eurobonds and ruble securitiesknown as OFZs, according to the domestic rating company ACRA. Seechart below:

|“With all investment management decisions, CalPERS followsfederal and state laws, while also complying with any directivefrom the CalPERS board as it relates to specific investmentactivities,” spokeswoman Megan White said by email.

|Van Hollen's bill would trigger new sanctions on energy andfinancial sectors if the director of national intelligencedetermines Russia is continuing to interfere. The sovereign debtmeasure has already been modified to apply sanctions only to newbond issues, he said.

|“The bill from hell”

A separate proposal in Senate, dubbed the “bill from hell” andsponsored by Lindsey Graham and Robert Menendez, would also targetRussia's debt and state banks, but the measures would take effectupon passage of the law.

|The legislature's leadership has suggested this plan would bewatered down if it were to come up for a vote.

|Daleep Singh, a former Treasury official who helped writesanctions measures against Russia in 2014, came out in favor ofcurbs on sovereign debt in a hearing last month, arguing that thereis “no credible reason why U.S. public pension funds and savingsvehicles should fund the Russian government.”

|Congress is unlikely to pass any new sanctions until after theNovember mid-term elections. Still the threat of the sanctionsalone has led to redemptions from Russian sovereign bonds, withnon-residents selling about $7.5 billion since April.

|Russian 10-year bond yields have recovered to near 8.8 percentafter surging to a two-year high last month due to concern overtougher U.S. curbs and a wider emerging-market sell-off.

|Policy makers in Moscow have said that there is enough localdemand to mop up bonds offloaded by foreigners if the market is hitby sanctions.

|After a string of disrupted debt sales, the government managedto drum up enough demand to reduce yields at an auction onWednesday. Still, local-currency bonds have handed investors a lossof 13.9 percent this year, the fifth-worst performance in emergingmarkets.

|CalPERS board hasn't publicly discussed

The Russia investment hasn't been a topic of public discussionsfor the board of CalPERS, which has been a leader among U.S.pensions pushing for socially responsible investing.

|A CalPERS board member, Jason Perez, has said it shouldn't focuson divesting to meet ethical investing goals.

|CalPERS has around $360 billion in assets, with about a fifth ofthe total invested in fixed income, according to a Septemberpresentation.

|READ MORE:

|Retirees' nightmare: Slashedpensions

|10 states with the best pensionfunding

|Why returns on public pensionsvary

|Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.