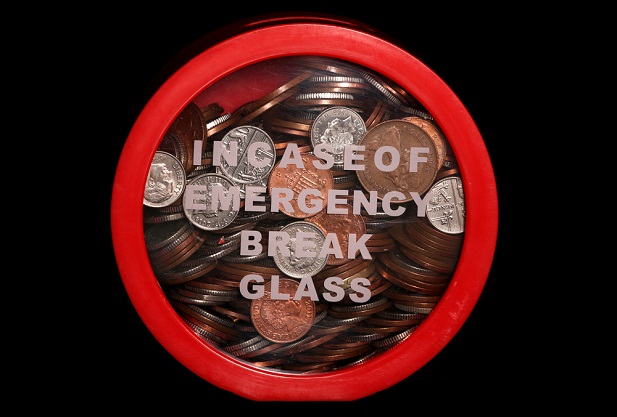

Savings are as important asincome: Low-income families with savings of $2,000 to $4,999 aremore financially resilient than middle-income families withoutsavings. (Photo: Shutterstock)

Savings are as important asincome: Low-income families with savings of $2,000 to $4,999 aremore financially resilient than middle-income families withoutsavings. (Photo: Shutterstock)

Everyone should have an emergency fund. Generating an income isnecessary to meet your day-to-day expenses, but having an emergency fund is anasset — and it's critically important. It's a form ofwealth—something that can help you navigate a financial setback, like an unexpected bill orthe loss of a job.

|Unfortunately, many people don't have one.

|Earlier this year, GOBankingRates conducted a national survey that asked whether people hadenough savings to cover three common types of financialemergencies: a car repair, a medical emergency, or six months'worth of living expenses if they lost their job. More than half ofrespondents answered no:

|● 55% couldn't cover sixmonths of living expenses

|● 54% couldn't handle amedical emergency

|● 42% would have toborrow money or sell something to pay for an unexpected carrepair.

|In fact, about half of respondents had less than $1,000saved.

|These numbers leave people financially vulnerable, so thatrelatively minor events like a parking ticket, jury duty, or timeoff from work to care for a sick family member can result in majorconsequences.

|According to the Urban Institute, financially insecurehouseholds are 14 times more likely to be evicted, 3 times morelikely to miss a housing payment, and 3 times more likely to miss autility payment.

|Even a small amount of non-retirement savings can make a hugedifference. According to the same study, families with just $250 to$749 in savings are less likely to be evicted, miss a housing orutility payment, or receive public benefits.

|In fact, their research has further shown that savings are asimportant as income: Low-income families with savings of $2,000 to$4,999 are more financially resilient than middle-income familieswithout savings.

|Now for the silver lining; it's never too late to start anemergency fund or to encourage plan participants to do so. A greatoption is to engage with EARN, a national nonprofit that exists to promote thepower of saving. Founded in 2001, this award-winning organizationcreates prosperity for low-income families by helping them save andinvest in their futures.

|EARN works at the intersection of financial technology andfinancial inclusion to develop online programs that empowerlow-income Americans to take charge of their financial lives. EARNhas partnered with other mission-driven organizations at the stateand local level, and has received major funding from companies suchas JP Morgan Chase, along with the MetLife Foundation and W.K.Kellogg Foundation.

|EARN has created the SaverLifeprogram to support working families in building the habit ofsaving. Currently open to partner organizations, SaverLife offerscash incentives combined with financial coaching, nudges, andgames. Participants build financial knowledge, confidence andself-efficacy along with the habit of saving.

|And it appears to be working. Despite an average annual incomeof $33,000, participants (Savers) save an average of $758 over sixmonths, and are more likely to stick with a budget (75%) and saveregularly (88%).

|EARN uses both small and large cash incentives in creative waysto help motivate their program participants to save. A contest suchas #WhatImSavingFor is designed to promote the inspiring storieswithin communities of savers by inviting participants to post apicture of their savings goal on social media, and in return, beingentered into a weekly cash prize drawing.

|Their successful SaverLife Tax Pledge campaign encouraged peopleto save a portion of their tax refunds by taking a pledge andconsequently being entered into a drawing for a cash prize. Theresult: 9,000 new savers pledging to save over $2.4M intax refunds.

|Behavioral research supports the idea of using pledging as a wayto strengthen motivation that can encourage futurefollow-through.

|Multiple studies have found that 'pre-commitment' actions suchas signing a public pledge make it more likely that people willactually do whatever it is that they have pledged to do.

|Incorporating behavioral insights into financial wellnessprograms like this one can improve financial security for millionsof Americans.

|Having an adequate emergency fund means that people can thenafford to save for retirement. Programs like EARN's SaverLife areinnovative, based on research, and appear to be making a differencefor participants. This holiday season, think about how you can helpparticipants make a pledge to grow an emergency fund.

||

Dr. Martha Brown Menard is the SeniorResearcher and data diva for Questis. She is a research scientist, financialwellness coach, and member of the Association for FinancialCounseling and Planning Education. She is passionate aboutdemocratizing personalized financial guidance through scalable andconfigurable technology. Contact Questis to learnmore about EARN.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.