With respect to yourretirement book of business, how do you differentiate yourself fromother advisors in your area and space? (Photo:Shutterstock)

With respect to yourretirement book of business, how do you differentiate yourself fromother advisors in your area and space? (Photo:Shutterstock)

How you differentiate yourself as an advisor is absolutelycritical to managing and growing your benefits customer base.

|With respect to your retirement book of business, how do you addvalue to your plan sponsor and participant clients? Howdo those services fit into your existing practice model? And –perhaps most importantly – how does what you offer differentiateyou from other advisors in your area and space?

|DC plans have become highly commoditized

In many ways defined contribution plans have become highlycommoditized, in a much-publicized “race to the bottom” on price.Even services such as investment selection and monitoring, plandesign and even vendor selection, are highly formulaic (and ideallydocumentable) processes.

|What truly sets you apart, as an advisor / consultant, to yourplan sponsor / business-owner clients?

|The relationships you build with your plan sponsor clients ispivotal and a key component of that is the services you offer tothem (and, by extension, to their employees / plan participants).Your service offering – especially relative to that of yourcompetitors – can help cement your relationships with yourplans.

|At the LIMRA Secure Retirement Institute, we regularly talk todefined contribution (DC) plan advisors about what they look for ininvestments and provider partners, and how they manage their ownpractices and service models.

|Trends for benchmarking your practice

We found some clear trends that can help you benchmark your ownpractice and strategically evaluate how vendors and providers youwork with can supplement your own practice capabilities.

|The vast majority of advisors help their clients conduct annualplan reviews. Overall, 94 percent of advisors (but just 82 percentof advisors who primarily identify as “consultants”) say that theyoffer annual plan review.

|How your partners (and the wholesalers who work directly withyou) support your own plan review efforts should be a strongconsideration for you in building a network of preferred DCproviders. It helps you to stay in front of your clients withmeaningful benchmarks and plan performance data that's packaged tohelp you deliver it.

|After plan review, the majority of advisors also support groupenrollment meetings (86 percent), provider fee analysis andbenchmarking (85 percent), investment policy development (85percent) and “retirement readiness” participant education.

|Other participant-level services, such as advice, counseling fordeparting employees, financial wellness and executive-levelretirement planning, are offered by fewer advisors, but are stillfamiliar elements of a DC service offering.

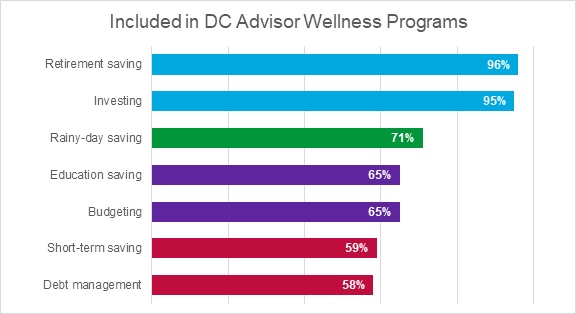

|With respect to financial wellness, advisors are most likely tooffer retirement and investing support, while managing debt andshort-term saving support are less common.

|Given that debt and more immediate financial needs arewell-known impediments to retirement savings, adding these to afinancial wellness offering could be a differentiator for anadvisor. Also including this service for plan sponsors andparticipants could be valuable.

||Fiduciary support is another area in which advisors can add realvalue to plan sponsors. When asked, broadly, 91 percent of advisorssay that that do think of themselves as fiduciaries to the plansthey sell and service.

|Considerably fewer, however, report that they offer commonspecific 3(21) and 3(38) investment selection and managementsupport.

|With respect to these fiduciary services – perhaps more than anyother service, given the nature and scrutiny of DC investmentselection and menus – advisors can both protect themselves andincrease their value propositions by forming partnerships withproviders who offer both tools and services to manage fiduciaryroles and responsibilities.

|The sheer breadth of services required to manage a DC book meansthat the successful DC advisor will carefully analyze his or herown personal preferences, strengths and capabilities, as well assupport offered at the firm level, and then strategically selectand place partners (for investments, recordkeeping and otherservices) to build solutions that work best for his or her ownpractice and clients.

|Deb Dupont is responsible for the LIMRA SecureRetirement Institute's institutional (retirement plans) retirementresearch program. She conducts and supervises research,benchmark reporting and study groups focused on the issues andtrends faced by constituents of the defined contributionindustry. She also provides guidance and thoughtleadership in helping LIMRA's member firms better understand theopportunities available for improving delivery of institutionalretirement solutions .

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.