As health care costs continue torise in the U.S., more and more small and mid-sized employers arepursuing a self-funded strategy for their group benefits plan.

As health care costs continue torise in the U.S., more and more small and mid-sized employers arepursuing a self-funded strategy for their group benefits plan.

Self-funding was often out of reach for groups of this size, butmarket changes and new products introduced over the last few yearshave made it a legitimate option. For example, it's now possible toavoid lasering employees, and there are specific employeedeductibles as low as $25,000.

|Often, when brokers explain these and other benefits ofself-funding to groups, the response is almost disbelief: Whydoesn't everyone self-fund their benefits plan?

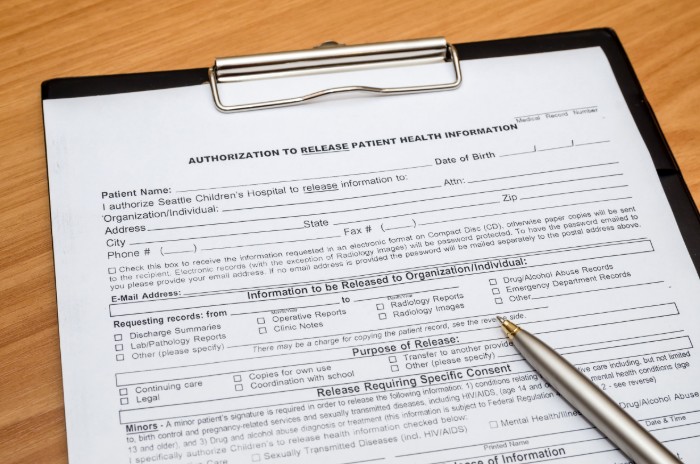

|Of course, there are a variety of reasons, but one thatshouldn't be ignored is the transactional and administrative burdenof the health questionnaire process. Self-funding requires healthforms, and this hurdle can disincentivize brokers and employersalike from really pursuing alternate funding.

|To understand why, it may help to consider the typicalreinsurance health questionnaire.

|What's in a health questionnaire?

|As most brokers know, the health questionnaire is used todetermine the health status of a group and is required to quoteself-funded or level-funded plan options.

|Among basic group and employee information, including name,birth dates, marital and employee status and more, employees areasked to provide fairly detailed health history information.

|An employee may be asked to identify whether she or any of herdependents have, within the last five years, received treatment,testing, or a diagnosis for a wide range of conditions listed onthe form.

|Employees are often also asked to provide information about anydiagnoses not listed on the form, as well as thorough details aboutany conditions they have identified. Details include the relevantemployee or dependent, the condition, treatment dates,prescriptions and more.

|The process of distributing, completing, collecting andsubmitting these forms generally causes a lot of headaches forbrokers and HR administrators alike.

|How are medical questionnaires typicallymanaged?

|Why do health forms cause so many issues? One reason is becauseof the sensitivity of the information provided in health forms, HRtypically wants as little to do with the process as possible.Often, employees are asked to place their completed forms in amanila envelope left in the HR department by a certain date, whichis handed off to the broker.

|This is, obviously, a less-than-ideal way to manage the process.How does HR or the broker know who's completed the form and whohasn't? How do you streamline the process while maintainingemployee privacy?

|Even Dwight Schrute of “The Office” faced challenges with thequestionnaire process in the episode “Health Care.” Frustrated withfake conditions listed by employees, Dwight takes matters into hisown hands, telling employees, “I'm now going to read aloud yoursubmitted medical conditions. When you hear yours read, pleaseraise your hand to indicate that it is real.”

|Telling employees that they have “forfeited” their right toprivacy, the episode lampoons the situation, but it's actually apretty accurate representation of how difficult it is to manage thehealth form process.

|Mistakes, complexity and endlessback-and-forth

|Most employees aren't going to make up fake conditions, but amajority of forms are missing information or have other errors.

|Maybe an employee indicates he is receiving treatment for acondition, but hasn't correctly listed his prescriptions. Maybeanother employee didn't know enough relevant details to fill outthe form on behalf of her spouse. In many cases, the carrier willwant more information, and there is a lot of follow up and back andforth between carriers, the broker, HR and employees.

|Ultimately, HR teams and small businesses have a hard timegetting this done. It's also a lot of work for the broker, whodoesn't know whether the group is even going to wind up deciding ona self-funded strategy at the end of the process.

|All this uncertainty and administrative burden creates adisincentive for brokers to pursue self-funding, even when it mightbe in the best interest of their groups.

|Modernized benefits solutions

|All of these inefficiencies illustrate the need for more modernhealth form solutions. Fortunately, from benefits administration toquoting, there are more tech solutions available than ever beforeto streamline every step of the group benefits process, includinghealth questionnaires.

|By bringing the health form process online, brokers can makethis process less painful and more accessible for a greater numberof clients and prospects.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.