Making theswitch to so-called point-of-sale rebates for new clients is a bigand unique step for UnitedHealth, and it builds on its Januarytransition of a different subset of its business. (Photo:Shutterstock)

Making theswitch to so-called point-of-sale rebates for new clients is a bigand unique step for UnitedHealth, and it builds on its Januarytransition of a different subset of its business. (Photo:Shutterstock)

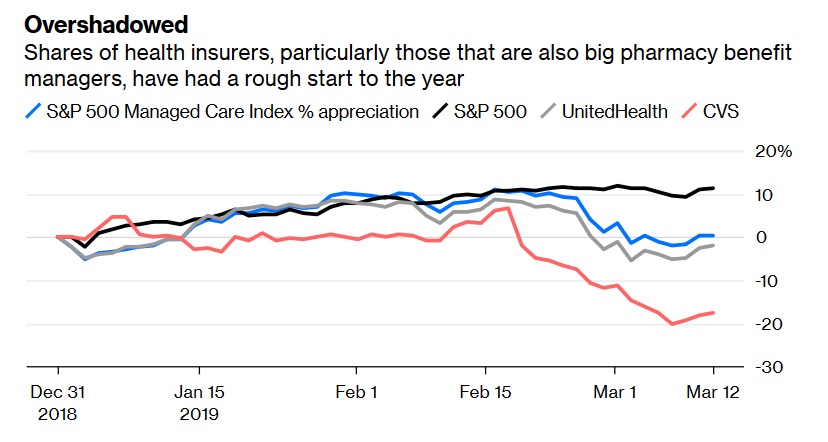

The health-care policy environment is shifting in a dangerousway for insurance giants. A seemingly small change in how drugs are paid for could be the beginning of aresponse.

|UnitedHealth Group Inc., the largest U.S. health insurer,announced Tuesday that its pharmacy-benefit management arm OptumRXwill mandate that all new employer health-plan clients pass thedrug discounts it obtains for them directly to plan participants.That's a big shift from the current system, under which OptumRX andother PBMs negotiate prices with drugmakers and hand the resultingrebate checks to clients to use as they wish. PBMs profit from thisarrangement, and have an incentive to favor heavily rebated drugs.That pushes drugmakers to hike prices, and patients are exposed toartificially inflated costs.

|UnitedHealth's new policy means lower drug costs for morepeople. But it has broader implications. It smartly preempts Trumpadministration efforts to reform rebates, and shows that theindustry can make needed changes ahead of pushes for an even biggergovernment-led overhaul of the way they do business.

| (Source: Bloomberg)

(Source: Bloomberg)

Increasing costs and unhappiness with the status quo aremotivating the administration's regulatory effort to end rebates inMedicare. It is also thinking about forcing insurers to reveal thehidden prices they negotiate with hospitals, which would wreakhavoc on their ability to negotiate. Consumer dissatisfaction alsobehind broader reform efforts championed by Democrats, such asMedicare for All. Such plans are distant threats, but they arepresent and existential enough to weigh on shares.

|Making the switch to so-called point-of-sale rebates for newclients is a big and unique step for UnitedHealth, and it builds onits January transition of a different subset of its business. Whilethe impact will be small at first as existing clients can stick tothe old system, the new model could eventually impact as many as 18million Americans, according to a research note from Royal Bank ofCanada analyst Frank Morgan.

|UnitedHealth says people already on its point-of-sale plans savean average of $130 per eligible prescription and that medicationadherence is up by as much as 16 percent. People are happier andhealthier when they can afford to take their medicine, and are morelikely to avoid larger medical costs down the line.

|If the administration's efforts on rebates succeed, UnitedHealthwill face less disruption and have more experience in making a newbusiness model work. Slower rivals such as CVS Health Inc. andCigna Inc's Express Scripts – which offer point-of-sale rebates asan option but don't mandate it – may suffer. Already in February,CVS attributed part of its weak 2019 guidance to the impact ofshifting drug-pricing trends on its PBM as drugmakers held back onprice hikes under political scrutiny.

|Plans that offer point-of-sale rebates have a chance to focusmore on reducing overall costs for both patients and payers,especially when integrated with an insurance plan. This isn't goingto make insurers and PBMs beloved overnight, or produce instantsystemic cost-savings. But UnitedHealth is taking a needed andbigger step toward a better and more patient-friendly system.

Read more:

- Winners and losers in Trump's plan to kill drugrebates

- Anthem promises transparency in newPBM

- Drug price transparency takes a stepforward

Max Nisen ([email protected])is a Bloomberg Opinion columnist covering biotech, pharma andhealth care. He previously wrote about management and corporatestrategy for Quartz and Business Insider. This column does notnecessarily reflect the opinion of the editorial board or BloombergLP and its owners. To contact the editor responsible for thisstory: Beth Williams at [email protected].

|Copyright 2019 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.