Shorter tenure equals more turnover and morejobs during workers' careers, and more turnover results in anincreased incidence of cashout leakage of 401(k) plans. (Photo:Shutterstock)

Shorter tenure equals more turnover and morejobs during workers' careers, and more turnover results in anincreased incidence of cashout leakage of 401(k) plans. (Photo:Shutterstock)

On April 10th, the Employee Benefit Research Institute (EBRI)featured the webinar EBriefing: Trends in Employee Tenure,showcasing the latest EBRI research examining broad employee tenuretrends over time, and the impact that shorter tenure can have onretirement savings.

|The webinar's presenters included CraigCopeland, Senior Research Associate, EBRI and Spencer Williams, President & CEO, RetirementClearinghouse (RCH), and was moderated by Stacy Schaus, Founder& CEO, Schaus Group LLC.

|Craig Copeland on tenure trends

Leading off, EBRI's Copeland detailed the latest trends inemployee tenure using data from the U.S. Census Bureau's Current Population Survey, which covers 1983 topresent.

|Copeland's presentation immediately dispelled two commonly-heldmyths regarding employee tenure: 1) that a large percentage ofindividuals hold a “career job” and 2) that tenure tends to beshorter when the labor market is weakest.

|Copeland's data also revealed two important findings linkingtenure to retirement savings:

- Account balance size is strongly correlated totenure. The EBRI/ICI 401(k) Plan Database reveals that28% of active participants with a balance less than $5,000 in 2012were not in the same plan in 2013, whereas that figure dropped to21% for participants with a balance between $5,000-$9,999 and to17% for those with balances $20,000 or more.

- The average and median balances of “consistent 401(k) planparticipants” – which includes participation across retirementplans – were significantly higher than the values for allparticipants.

Copeland summarized the impact of shorter tenure on retirementas follows:

- Shorter tenure equals more turnover and more jobs duringworkers' careers

- More turnover results in an increased incidence of cashoutleakage

- If retirement savings are stranded in a prior plan,coordination with new plan savings may not occur

- Continuous participation in a plan has a large impact on theresulting savings amounts

Spencer Williams introduces “synthetic tenure”

RCH's Spencer Williams then introduced a new concept – “synthetic tenure” – whereby enhancingsystem-wide portability, particularly for small accounts, enablesparticipants to preserve their savings through job changes,mirroring the success of EBRI's longer-tenured, consistentparticipation population.

|Making the case for synthetic tenure, Williams presentedcomposite cashout leakage statistics, indicating that thepreponderance of today's cashout leakage occurs for job-changingparticipants with plan account balances less than $5,000.

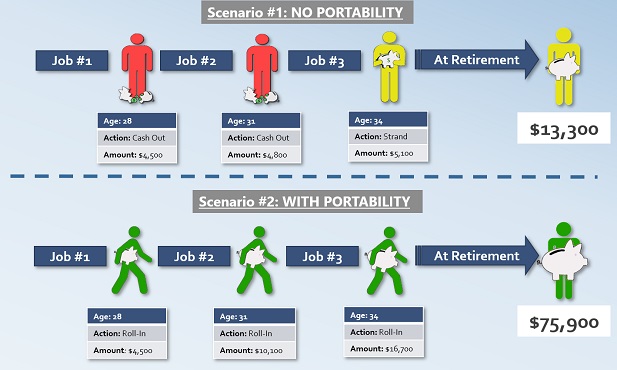

|Next, applying EBRI tenure data, Williams illustrated twoscenarios for a 25-34 year-old participant, whose average tenure isless than 3 years, and will likely have 3 jobs during that periodin their life.

- Without portability: Thehypothetical participant will likely cash out two of their threesmall-balance retirement accounts and leave the third stranded withtheir prior employer, resulting in $13,300 in retirement savings atage 65.

- With portability: The average participantwould likely preserve those three balances, rolling them forwardinto their new employer's plan. By contrast, they wouldhave a $75,900 balance at retirement, an amount which wouldsimulate the outcomes of the higher-tenured, consistentparticipation population.

Figure 1: Synthetic Tenure (Image: RetirementClearinghouse)

Figure 1: Synthetic Tenure (Image: RetirementClearinghouse)

Once again referencing EBRI research, Williams noted that in2017, EBRI estimated that system-wide auto-portability woulddramatically reduce leakage for small accounts, preserving morethan $1.5 trillion in the retirement savings, in today'sdollars.

|In closing, Williams also noted that auto-portability, onceadopted, could lead to a dramatic reduction in the incidence ofmissing participants by 1) consolidating accounts as participantschange jobs and 2) providing a source of more-reliable currentaddress information, when a participant's current-employer's plancan be located and accessed for address information.

|Tom Hawkins is Senior Vice President, Marketing& Research at Retirement Clearinghouse.

|READ MORE:

|What is auto-portability? It depends onwho's asking

|DOL cracks down on efforts to find missingparticipants

|401(k) truth bomb: Missing participants are bad,but cashouts are worse

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.