Bigbusinesses most likely fear big Medicare expansion in large partbecause it would lead to a significant tax increase. But looking atany tax increase as an enemy is a mistake. (Photo:Shutterstock)

Bigbusinesses most likely fear big Medicare expansion in large partbecause it would lead to a significant tax increase. But looking atany tax increase as an enemy is a mistake. (Photo:Shutterstock)

Like a significant chunk of American voters, a majority of largeemployers want to expand Medicare. Just not too much.

|A new survey of 147 large employers from theNational Business Group on Health found that 55 percent ofthem support a Medicare expansion that’s limited to olderAmericans. Only 23 percent think eligibility should dropto age 50, however, and 45 percent don’t think it shouldexpand at all. A majority believe that a broader “Medicare for All”plan would increase health costs.

|The same survey also highlights why employers should considercoming around on health reform that reduces their role in thesystem. The growth in health costs has outpaced inflation and wagegrowth for years, and the surveyed businesses expect it to rise5 percent to $15,375 for each employee next year. About70 percent of those costs will fall on the companies,which plan to try everything from boosting virtual health servicesto investing in health concierges to rein them in, according to thesurvey.

|Related: 10 states paying the most for employer-sponsoredhealth care premiums

|History suggests that their best efforts might not amount tomuch.

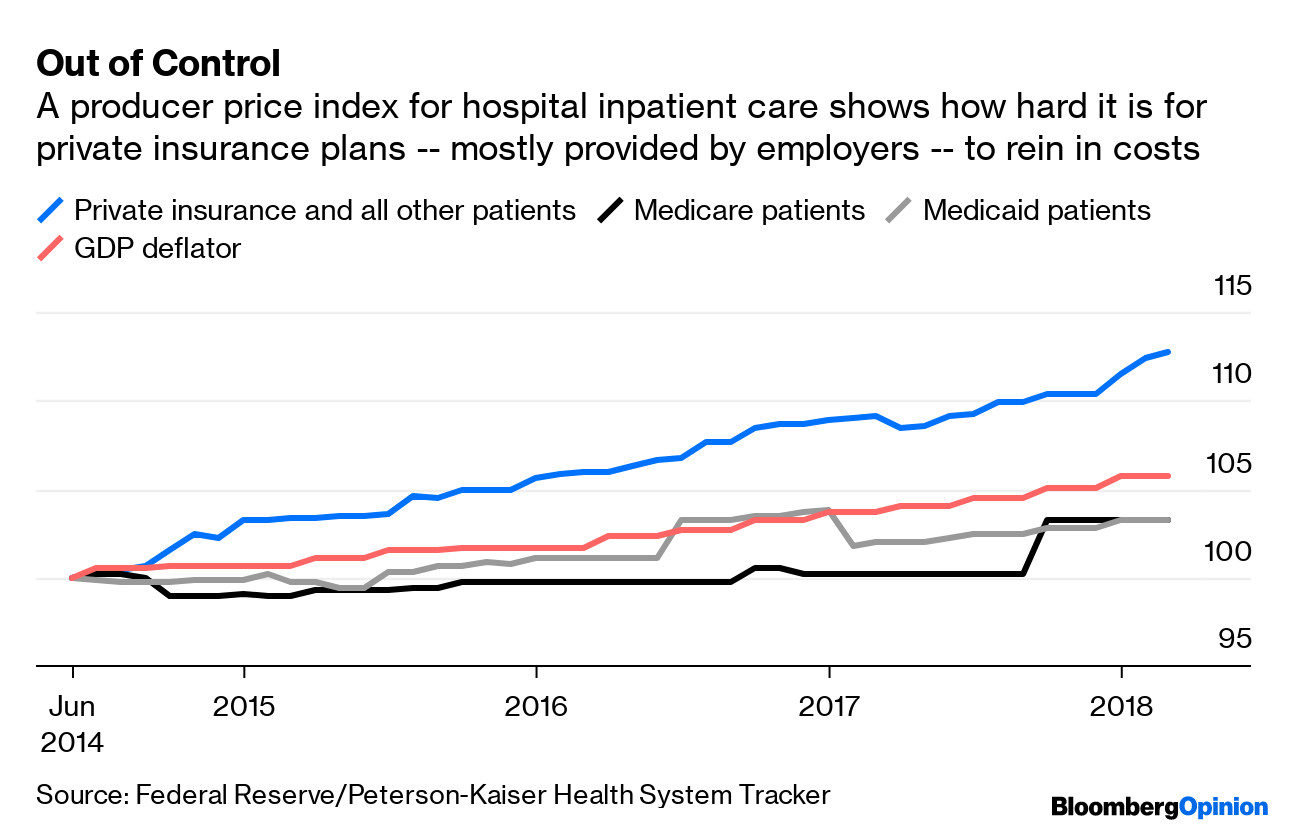

|

Employer-sponsored insurance is America’s single largest sourceof health coverage. That’s mostly true because the IRS exemptedemployer health benefits from taxes in 1943, a move that createdthe federal government’s single biggest tax expenditure. Largecompanies derive some benefit from the current system because theycan provide a significant tax-free benefit that helps them competefor talent and pay people less. But it comes with significantdrawbacks. Employers have to devote substantial resources toproviding health care and controlling costs. Many of them have noparticular expertise or advantage in doing so.

|The results are mixed. Yes, individuals with private insuranceare generally satisfied with the quality of their coverage. They’renot nearly as happy about the cost as deductibles rise. The U.S.pays more than any other developed country for health care andmedicines and receives worse results on a variety of metrics.Employers pay particularly high prices and spend heavily on plansthat have higher overhead than public alternatives. A recent RANDCorporation study found that employer-sponsored plans paidhospitals at 241% of Medicare rates in 2017. Employers are alreadyeffectively subsidizing public programs, not to mention theprofitability of insurers, health care providers anddrugmakers.

|It’s not entirely their fault. The American system inherentlyfragments negotiating power, which gives providers a significantadvantage and makes it difficult for even the largest employers toget a good deal. Turning a larger piece of health care over to thegovernment would free companies to focus more time and resources ontheir actual business instead of on navigating the world’s mostexpensive and convoluted health care market.

|Big businesses most likely fear big Medicare expansion in largepart because it would lead to a significant tax increase. Butlooking at any tax increase as an enemy is a mistake. Those taxesrepresent a trade-off; they would replace some or all of thebillions of dollars that employers are currently spending on care.Depending on what taxes are imposed and whether the public plan isable to control costs better than the current system — and it couldhardly do worse — many employers could come out ahead.

|There are a lot of unknowns when it comes to Medicare for Alland plans that move the country in that direction. Employers areright to be skeptical until they know more, but the results couldwell shake out in their favor, and they shouldn’t be so quick todiscount the approach.

|Max Nisen([email protected]) is a Bloomberg Opinion columnistcovering biotech, pharma and health care. He previously wrote aboutmanagement and corporate strategy for Quartz and BusinessInsider.

|Read more:

- Health insurers mount battle against Medicare forAll

- Nonprofits look for health care reform, but maybenot Medicare for All

- AMA narrowly divided in opposition to Medicare forAll

|

|

Copyright 2019 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.