You know that reference-based pricing is agreat cost containment tool. When it's been done right, we'veseen huge savings. But there's a lot of misconceptions outthere about RBP, and that can make trying to have a realconversation about it as frustrating as fighting the Black Knightof Monty Python fame.

|To help you fight this silly knight, here are five common mythsabout RBP, and the facts and figures you need to disarmthem.

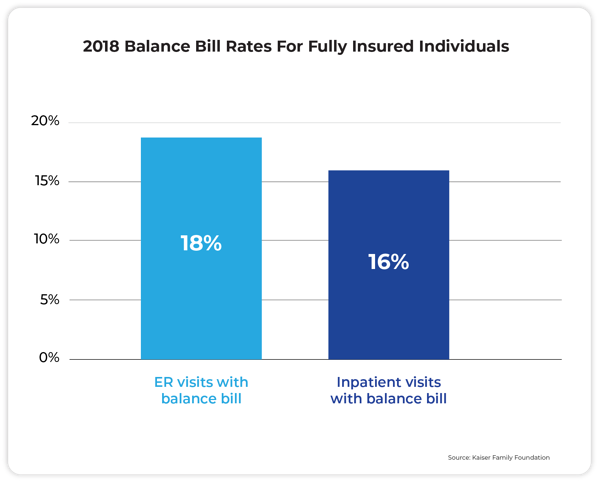

|Myth 1: RBP is plagued withbalance billing

|Fact: Fully insured plans face just asmuch balance billing as reference-based pricing. In fact, 16percent of fully insured inpatient visits in 2018 got a balancebill, and 18 percent were balanced bill for ER. If balance billingis the problem, the major carrier networks don't offer as muchcoverage as people think.

|

⬆️ One reason balance billing might be so high hereis that 70 percent of people surveyed did not know they were out ofnetwork.

|Myth 2: Balance bills arepurely the patient's responsibility

|Fact: Maybe this was true in the earlydays of RBP, but today, co-fiduciary partners typically indemnifypatients from any harm. They also provide services such aslitigation support, along with traditional bill auditing andpre-certification. Building the right "health stack" of re-pricer,medical manager, and member concierge gives all parties peace ofmind. This is important because 8 out of 10 medical bills containat least one error, even in PPO plans where you can't auditthem.

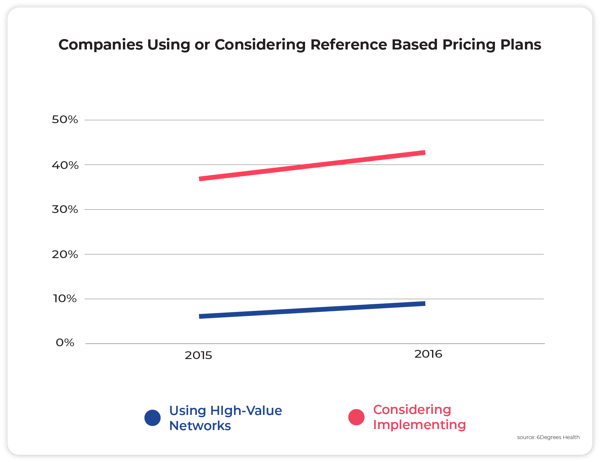

|Myth 3: RBP is a fad, not along-term solution

|Fact: "High performance networks" aregrowing in popularity year-over-year. One key to any successful RBPlaunch is getting the C-suite, HR, and the advisor on the same pageand committed to the change. Up front and continuous membereducation makes all the difference.

|

⬆️ From 2015 to 2016, the number of companiesrunning RBP plans grew by 50 percent. The number ofcompanies that said they were considering these plans grew by 16percent.

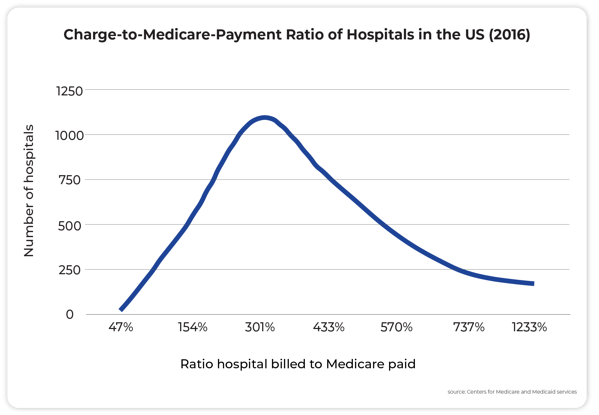

|Myth 4: Carriers have betternegotiated rates

|Fact: Hospital prices are made up, andso are BUCAH discounts. Don't be fooled: Fifty percent off of a1,000 percent markup is still overpriced by 450 percent. RBP pricesare at least related to the cost of a procedure, rather thanarbitrary numbers that hospitals and big insurers agree on.

|

⬆️ There is a huge range in the price thathospitals charge related to Medicare – sometimes as muchas 1600 percent!

||

Myth 5: Only second ratedoctors negotiate

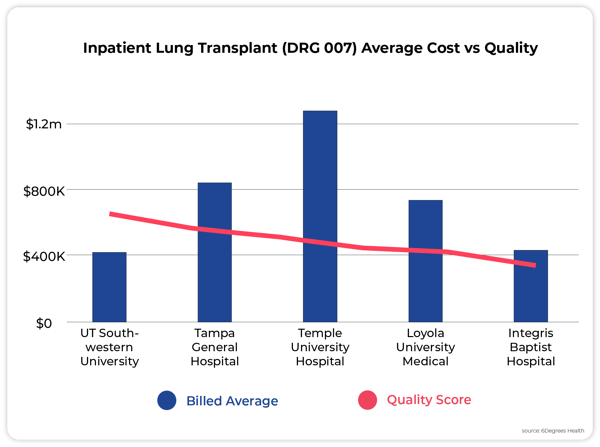

|Fact: Hospital quality and hospitalbilling practices aren't related. According to data shared by6Degrees Health, hospital quality shows little relationship to thebilled price of various surgical procedures.

|

⬆️ In this instance, the most expensive,Temple University Hospital, is middle quality, while thehighest quality, UT Southwestern University Hospital, isamong the lowest bill rates

|_____________________________________________________________________

|Grant Parker is the director of marketing at Flume Health.This piece originally appeared on the Flume Healthblog.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.