Illustration by MichelleThompson

Illustration by MichelleThompson

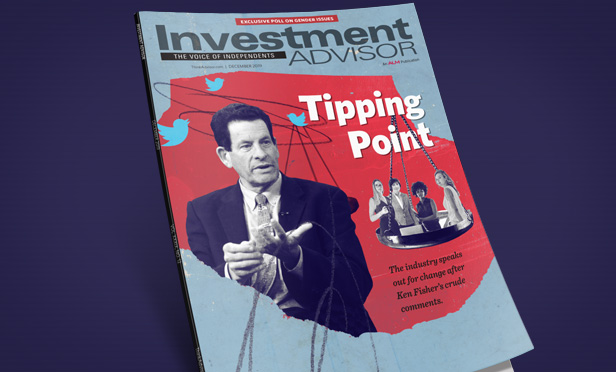

A typical fireside chat at an event in October quickly turnedinto a firestorm after billionaire investment advisor Ken Fishermade crude remarks that have sparked a renewed discussion on thetreatment of women in financial services.

|In the weeks following the incident, industry leaders and manyothers have spoken out about such bad behavior, some $3.4 billionof Fisher Investment's $115 billion of assets reportedly haveflowed out, and a growing number of organizations are putting codesof conduct in place to prevent such behavior.

|The industry seems to have reached a tipping point in genderissues, as news stories tied to the Fisher matter continue todominate headlines and water-cooler conversations.

|To best evaluate the prospects for meaningful change in theindustry's treatment of women, we spoke with business leaders andother participants and conducted an exclusive advisor poll onFisher's behavior and broader gender-related topics — the resultsof which are highlighted here.

|First, what happened

Fisher Investments' founder and chair had made crude remarksbefore. But this time — on Oct. 8 at the Tiburon CEO Summit — wasdifferent.

|Early the next day, conference attendee Alex Chalekian reactedto them in a video posted on Twitter, which quickly went viral. Hedescribed them as "a true debacle. It was horrible.

|Things that were said by Ken Fisher were just absolutelyhorrifying."

|Chalekian, head of Lake Avenue Financial and RIA IntegratedPartners' practice acquisitions, said Fisher referred to"genitalia, … picking up a … girl, …. Jeffrey Epstein, … and [made]other inappropriate comments at the conference."

|He and others at the event were "disgusted by this, and many ofthe women expressed to me that this is why they don't like comingto these conferences. It makes them very uncomfortable. And thisobviously doesn't help the situation."

|In the remarks, Fisher described prospecting for new clientslike "going up to a girl in a bar … going up to a woman in a barand saying, 'Hey, I want to talk about what's in your pants,'"according to an audio recording obtained by CNBC.

|Rachel Robasciotti, founder of wealth manager Robasciotti &Philipson, was one of less than 20 women among the 220 guests atthe Oct. 9 event. "I sat in the audience stunned by what I washearing," she said in a blog post (and on television).

|"When you are on stage, you're there because others want tolearn from you … ," Robasciotti explained. "When your descriptionof the world uses women as sexual objects and refers to employeesas if they were cattle, it has an impact on real people in andoutside of the room."

|Sonya Dreizler, founder of the impact-investing consulting firmSolutions With Sonya and another conference participant, also spokeout: "Since this content is not about business issues, I'm choosingto break [the event's] code of privacy to confirm that the commentsfrom the stage were indeed outrageous."

|Fisher also made crude statements at an event in 2018. "Therewere similar comments to what Alex [Chalekian] referenced aboutadvances towards women and just some sexual comments that you couldtell the audience was uncomfortable with. And there were commentsafterwards about how they could not believe … what [Fisher said],"according to advisor Justin Castelli of RLS Wealth Management.

|Equally unbelievable to some have been Fisher's responses to therecent remarks. After seeing Chalekian's video, Fisher first saidin a statement: "While I said most of the words he cited, he wasn'thearing the context of what I was communicating and seems to havemisconstrued its essence — certainly misconstrued my intendedmeaning."

|He added: "The rest is just nonsense. … To the extent he orothers in that large crowd were offended, I apologize mostsincerely."

|Fisher told Bloomberg: "I have given a lot of talks, a lot oftimes, in a lot of places and said stuff like this and never gottenthat type of response. Mostly the audience understands what I amsaying." Still, he added, "I regret I accepted that speechinvitation because it was kind of a pain in the neck. I wonder ifanybody will be candid at one of these Tiburon events again."

|A more official apology was issued on Oct. 10: "Some of thewords and phrases I used during a recent conference to make certainpoints were clearly wrong, and I shouldn't have made them. Irealize this kind of language has no place in our company orindustry. I sincerely apologize."

|Nearly a month later, though, the firm returned to its defensivestance. "Any fair account … would acknowledge that Ken used thelanguage he did to underscore how some advisors … behave in pushingtheir services on prospective clients. Given most people's privacyabout their financial life, aggressive sales pitches are theequivalent of a crude come-on in a bar.

|His point was, that's no way for a financial advisor to behave,"according to John Dillard, the firm's head of global publicrelations, who spoke recently to the Los Angeles Times.

|Ironically, Fisher's firm has been accused of such behavior.Since 2016, 125 individuals have filed grievances against FisherInvestments with the Federal Trade Commission, Bloombergreports.

|The firm's "hardball" tactics include marketing phone calls,spam emails and impersonations of supposed friends, co-workers andgovernment officials. In September, Fisher told ThinkAdvisor thefirm spends some 6% of revenues on marketing.

|"The firm itself, and Ken to a certain extent, has a reputationin the industry that rubs people the wrong way," said KirstenPlonner, communications chief of FiComm Partners. "People [have]turned a blind eye, and he's known for making off-color remarks;there's nothing illegal or criminal about that, except [on Oct. 8],it really struck a nerve in a big way."

|Advisor reactions

Poll data collected by Investment Advisor/ThinkAdvisor.comsupport Plonner's conclusion. In addition, the survey results pointto a strong consensus on bad behavior in the industry and how torespond to it, though there is less agreement on how widespread theproblem is.

|• The majority of financial professionals polledbelieve Fisher's off-color remarks were sexist/highlyinappropriate, garnering 70% of the 1,350-plus responses overall —with 85% of women and 65% of men expressing this view.

|• Even stronger is the consensus view over withdrawingassets from Fisher Investments as an appropriate response to hiscomments: It has the approval of 86% of responses (92% ofwomen's/83% of men's).

|• When asked if these redemptions send a clear messagethat his behavior is unacceptable, 88% of those taking the poll(91% women/87% men) say "yes."

|• A strong majority, 84%, view Fisher's banning fromtwo industry events (where he's made lewd remarks) as anappropriate response, and 75% would not attend an event with Fisheras a speaker.

|• The consensus, though, breaks down over thefrequency of behavior displayed by Fisher and others. Most womenpolled, 61%, say such behavior is common in the industry vs. aminority of men, 30%.

|• As for initial reactions to the specific commentsmade by Fisher, 47% of men were shocked/disgusted vs. 39% of women.Some 38% of women found the remarks unsurprising vs. 26% of men.(Others were either surprised or not shocked/disgusted.)

|• Concerning the general problem of verbal harassmentin the business, 80% of women say it is somewhat or very common vs.48% of men.

|• In terms of physical harassment and its frequency,59% of women believe it is somewhat or very common vs. 27% ofmen.

|• There is a strong consensus on ending mandatoryarbitration and giving employees the right to sue over sexualharassment at work: 82% of women and 67% of men support this move,or 71% of all respondents.

|

Forward momentum

Overall, the #MeToo movement, Fearless Girl statue and workbeing done by Wall Street veterans like Sallie Krawcheck — alongwith the shifting views of advisors young and old — are making animpact, those working in financial services say.

|"We've all heard it, but none of us are at [Fisher's] status,and [about] two years ago, lots of people were less likely to saysomething," said RLS Wealth Management's Castelli. "In the pastcouple of years, we are done letting this stuff happen and want tobe advocates for everyone … and not let this stuff go."

|Like others in the business, William H. McCance was shocked whenhe first heard the Fisher news. "I thought, 'Oh no. We've taken 10huge steps backwards,' " said the president of TrustAdvisory Group, a broker-dealer/RIA. For some jobs at TAG,there's one female applicant for every five men who apply."Comments like those of Ken Fisher don't help us at all," hesaid.

|The response to the remarks, though, has impressed him. "Fisherwas called out quickly. The #Metoo movement has done a tremendousjob at allowing people to focus on this [type of behavior],"McCance said. "The reaction was exactly appropriate to what thecomments were. Things aligned perfectly."

|The executive, who has two adult daughters, believes theindustry began making improvements in its treatment of womenstarting in the 1990s. "To me, this [Fisher episode] is amanifestation of the past coming back, like the paint underneathshowing through. It means we have to keep painting the wall, so itstays the color we want it to be. We have to continue to bevigilant … and speak out when we see situations such as this."

|Deeper changes in the industry, McCance cautions, are likely "totake a long, long time." Still, his daughters have shown him themomentum. "They've said they'd walk out of a job interview if theyfelt a question was inappropriate," he said.

|Others are more upbeat on what the latest developments mean.When asked if they represent a turning point for the industry,Marci Bair, president of Bair Financial Planning, was unequivocal: "Yes, [they've] sparked enough interestand conversation that hopefully it's not just a two-day event."

|What's changed? "This is the first public acknowledgement of thebehavior of someone … in financial services who's that well knownand that high profile," Bair said. "Today, with social media, it'seasy to put something out there — which Ken Fisher and others needto be aware of."

|"I hope … advisors and others will think before they speak," sheexplained. "And as we put together conferences and invitations, wewill vet [speakers] better and have more diversity and inclusion ofthose we ask to speak."

|Chalekian's video — viewed over 100,000 times in the first weekalone — "shows the changing of advisors' attitudes," Bair said."This time was different, because Alex spoke out and otherssupported him." Plus, the 69-year-old Fisher was banned from theevent where the comments were made.

|Old playbook is 'done'

While there are "lots of lessons to learn" from Fisher's remarksand the attention they are receiving, one stands out: "The oldplaybook does not play anymore. It's done," according to AprilRudin, CEO of the Rudin Group, a strategic marketing firm.

|With Chalekian's video, the wealth industry has a clear view of"the huge disconnect between the generations — and within that, therole of women and men in the industry," Rudin said. "If theindustry wants to attract women, it has to sing a different songand change its appeal."

|And it's not only women, she adds. "As the industry tries toattract and engage with other generations, its content and conceptsneed to address them. Next-gen advisors and leaders have adifferent barometer. This is why Fisher's playbook didn't play withthe audience [on Oct. 8]."

|In a blog, the 43-year-old Chalekian shared: "We reached what Ican only hope is another tipping point … on topics that before now,we've only tip-toed around." These topics include equality,diversity and inclusion.

|"Sometimes it takes an unexpected catalyst to jolt us awake.Something feels different this time," he said. "The energy andenthusiasm for tangible change is gathering strength fueled byhundreds, no, thousands of us in this business who are doneaccepting the status quo."

|As one survey respondent put it: "The shocking thing with KenFisher is that he did it into a microphone in the middle of theday. Honestly, enough is enough."

|Another shared: "The Fisher [situation] is a pivot point in theindustry. The comments are so egregious that even the oldest of'old school' are taking notice. It's clear from this incident thatthe consequences of such behavior will be impactful."

|What else can/should/will change?

Views vary on additional measures the industry can take to raiseawareness and to improve its treatment of women. Today, everyonecan be "a micro-media outlet," Chalekian said. "Don't assume youwon't be heard or that no one cares — use your platform tohighlight the good and call out the bad."

|On Twitter, TD Ameritrade Institutional Director of InnovationDani Fava said: "Our society is at an inflection point andelevating awareness about what's acceptable and what's not isimportant. KEEP. DOING. THAT."

|Cambridge Investment Research, for instance, recently adopted acode of conduct to address harassment at conferences and in otherbusiness interactions. "We … believe this should be a turning pointto bring awareness to the reality that it does happen and shouldnot be tolerated at any level, on or off the record," President andCEO Amy Webber said in a statement.

|Such steps show the Fisher remarks and ensuing fallout are"making a difference" in gender issues in the business, said PearlPlanning President Melissa Joy, CFP: "But as for a tipping point,this is hard to say given our low numbers. It's hard to visualize.It provides oxygen, or space, for an important topic. The door hasbeen nudged open a bit wider."

|Members of the industry should review their gender biases andaddress them regularly, for instance. "Since I'm a woman, peopleassume I want to focus on only women clients, but I want both menand women," Joy explained.

|The advisor appreciates "how many men have stepped up, listenedmore and are moving the conversation forward, [but] our professionhas lingered in its percentage of women. It's better than somethink, but it's still so low, especially at the leadership level …," she said.

|"Unconscious bias plays out in advice given to clients in manyways, in terms of portfolios, decision-making, etc.," Joy said."That story is unwritten. Along with women having a safe andthriving workplace, it matters."

|The industry has diagnosed its problem, and now its members need"to speak up when [they] see or hear something, participate toelevate women in this industry and stay curious" especially aboutbiases, said Sheri Fitts, who hosts Women Rocking Wall Streetpodcasts.

|The Fisher developments represent "a tiny, tiny crack of awindow that's been opened" rather than a "tidal wave of change,"she said. The industry involves "too much money and a[conservative] culture, and it moves too slowly. I've been in thebusiness for about 30 years. I hope I'm wrong."

|It's too early to tell if this incident is the industry's #MeToomoment, says Nia Impact Capital CEO Kristin Hull. It may bring moreattention to how few women work in finance and serve as a call toaction for opening doors so more women can.

|Wealth manager Robasciotti hopes "this watershed moment" bringsmore people to the table and get leaders "to step boldly towards anindustry that works for everyone," she said.

|Our survey shows the industry's mixed views on the long-tastingimpact of Fisher's comments on the industry's treatment of womenwith 47% overall (51% of women, 46% of men) saying they areimportant but unlikely to produce meaningful change; 40% overall(43% of women and 40%) stating they are a watershed and shouldproduce such change; and 13% (5% of women and 15% of men) of theview that they are unimportant.

|The real, lasting impacts of the Fisher comments and falloutdepend on the industry's response, says FiComm's Plonner, whostrongly believes this is the #MeToo moment for financial services.The industry has been trying to solve its gender challenge for aawhile. "But this struck a nerve, and the industry seized theopportunity to say, 'Enough is enough,'" she said.

|The tipping point that's been reached is ambiguous, according toPlonner: "It's now a matter of who takes up the challenge and howthey take up the opportunities at hand. Are we going to dosomething, or … let it peter out? Are we going to stop talking andstart walking? Great things could come from this. Time willtell."

|READ MORE:

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.