Americansare fleeing rural areas in favor of urban centers, reducing thedemand for hospital services in already struggling communities.(Photo: Shutterstock)

Americansare fleeing rural areas in favor of urban centers, reducing thedemand for hospital services in already struggling communities.(Photo: Shutterstock)

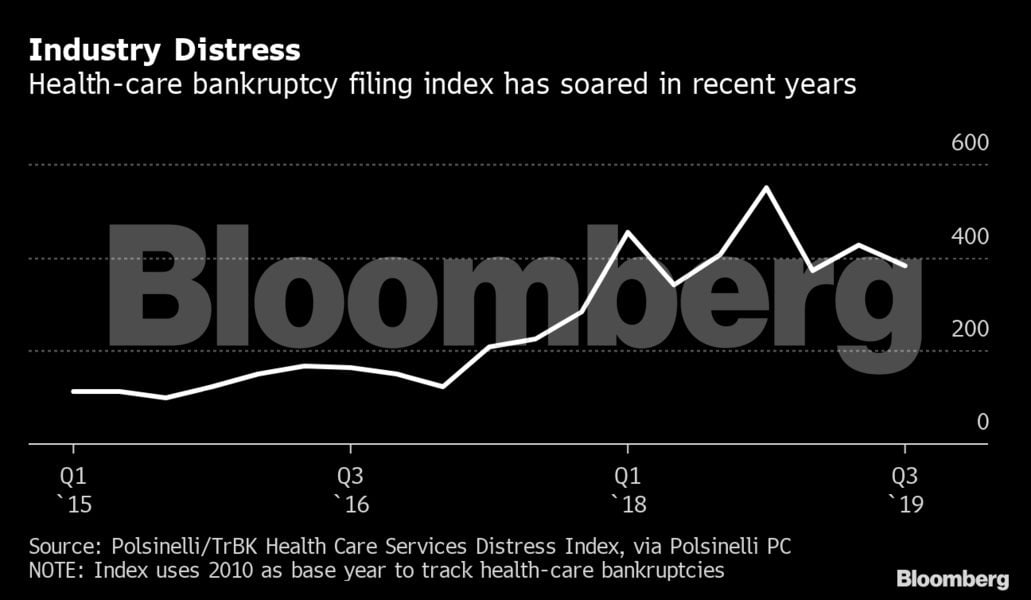

(Bloomberg) –A quiet crisis is unfolding for U.S. hospitals,with bankruptcies and closures threatening to leave some of thecountry's most vulnerable citizens without care. As a gauge ofdistress in the health-care sector has soared, at least 30hospitals entered bankruptcy in 2019, according to data compiled byBloomberg. They range from Hahnemann University Hospital indowntown Philadelphia to De Queen Medical Center in rural SevierCounty, Arkansas and Americore Health LLC, a company built onpreserving rural hospitals.

|There's more distress to come. Already this week, the bankruptowner of St. Vincent Medical Center in Los Angeles said it plans toshut the facility after a failed sale attempt.

|Related: Urban hospital's bankruptcy sheds light on'anarchy' of health care system

|The pressures on the sector are as tangled as the health-caresystem itself.

|Americans are fleeing rural areas in favor of urban centers,reducing the demand for hospital services in already strugglingcommunities. In both cities and towns, many hospitals that care forimpoverished citizens often rely heavily on government paymentsthat reimburse less than private insurers and may fail to coverrising costs.

|The American Hospital Association, an industry group, calculatedthat payments from Medicare and Medicaid, the federal programs forthe elderly and poor, lagged costs by $76.6 billion in 2018.Hospitals are also losing key income as more profitable proceduresmove to lower-cost outpatient centers.

|If that weren't enough, with both Republicans and Democratsmaking a political football out of health care ahead of the 2020presidential election, significant policy change could be near.

|"How are you supposed to craft a business plan if you don't knowif you're going to have an America with Medicare for all, or acomplete repeal of the Affordable Care Act, or a million options inthe middle?" said Sam Maizel, a partner with the Dentons US LLP lawfirm who focuses on health-care restructuring. "If you knewElizabeth Warren was going to get elected, you'd be writing a verydifferent business plan."

|

Ailing hospitals

Even before the election, the current system is beingchallenged, according to Georgetown University health-care policyprofessor Edwin Park. The Trump administration is trying to tighteneligibility rules for Medicaid, while a rule proposed late lastyear could also cut billions of dollars in supplemental payments tohospitals, he said. In a closely watched case, a district judge inFort Worth, Texas is weighing whether Obamacare can survive afteran appeals court ruled that its broad mandate requiring people tohave health insurance was unconstitutional.

|The usual playbook for managing distress doesn't readily apply.Shutting down a hospital isn't the same as boarding up astorefront. Hospitals are not only major employers, their closuresoften leave the most vulnerable patients bereft. Bankruptcy judgestend to push back on approving hospital closings in ways theywouldn't for a retailer, said Andrew Sherman, head of restructuringat law firm Sills Cummis & Gross PC.

|In May, a 25-bed hospital in Sevier County, Arkansas shut downafter sliding into such financial disrepair that a receiver wasappointed, local newspaper The De Queen Bee reported. For many ofthe county's 17,000 residents, the hospital's emergency roomprovided the only such services within an hour's drive, courtpapers show. In suburban Chicago, Westlake Hospital was losing morethan $1 million a month before it commenced a liquidationbankruptcy in August, sapping that community of about 550 jobs and230 hospital beds.

|"In a typical restructuring you're dealing with widgets,"Sherman said. "In a health-care restructuring you're dealing withpeople's lives."

|In many rural areas, the population just isn't large enough tojustify keeping the lights on, according to Bloomberg Intelligenceanalyst Mike Holland. Morgan Stanley analysts led by VikramMalhotra in 2018 found that 8% of U.S. hospitals were at risk ofclosing and another 10% were considered weak. AHA statisticsreleased Tuesday show the number of U.S. hospitals fell by 64 to6,146 in 2018, the most recent year available.

|

Industry distress

There's little reason to believe the situation has improved. ThePolsinelli TrBK Health Care Services Distress Index, which tracksbankruptcy filings in the health-care sector, had nearly quadrupledas of the third quarter. The index uses 2010 as its benchmarkyear.

|"Most of the cases we see, you're struggling to survive on acash basis to try to get to a sale process," Sherman said. "Peopleneed to understand that these hospitals will continue to falter.Communities are going to have to inject more money if they want tomaintain health care."

|Some of the more recent closings are the result of large healthsystems weeding out weaker facilities. That's the case withhospitals run by Community Health Systems Inc. and its spin-off,Quorum Health Corp.

|Quorum's revenues have been falling since it separated fromCommunity Health in 2016. After bleak third-quarter results, thecompany said it would ask lenders to modify its debt agreements andreiterated a warning that it may not be able to stay afloat. Itsshares and bonds plunged in the aftermath.

|Late last year, KKR & Co. offered to take the companyprivate at $1 a share in a deal that may help it refinance andstave off deeper distress.

|Debt piles

Community Health, meanwhile, has piled up about $5 billion inlosses in recent years as it labors under more than $13.5 billionin debt. A concentration of rural hospitals dependent on Medicareand Medicaid hurts Community Health, BI's Holland said. Expandedinsurance coverage under the 2010 Affordable Care Act, orObamacare, also means more people are getting care earlier and notending up in the company's hospitals, he said, or are beingdirected to lower-cost outpatient facilities.

|"It's a problem now for hospitals to have sufficient inpatientrevenues," said Eileen Appelbaum, co-director of the Center forEconomic and Policy Research.

|A representative for Community Health said in a statement thatfactors including its recent refinancing, asset sales and a programto increase margins have positioned the company to continue toimprove its operating performance.

|A representative from Quorum didn't respond to a request seekingcomment, while KKR declined to comment.

|While rural hospitals are most at risk of failing, thecontroversial shutdown of Philadelphia's Hahnemann UniversityHospital could invite more disruption in urban centers, Appelbaumsaid.

|Private-equity investor Joel Freedman bought Hahnemann in early2018, but failed to revitalize the money-losing hospital and shutit after a trip through bankruptcy. Excluded from the filing,however, was its prime real estate in the heart of the city, whichwas separated into another entity.

|Freedman didn't respond to requests for comment.

|Despite the successful 2006 acquisition of HCA Healthcare Inc.by a consortium that included Bain Capital LP and KKR, privateequity has found it isn't easy to make money running hospitals,Appelbaum said. The Hahnemann case may provide a new template, shesaid, calling the transaction "proof of concept" that if a hospitalisn't profitable, you can shutter it and sell the real estate.

|"Hahnemann is a safety-net hospital in a gentrifying area,"Appelbaum said. "Probably every major city in America hassafety-net hospitals in gentrifying areas, where the real estate isso much more valuable than the hospital to the private-equitycompany."

|–With assistance from Steven Church, Olivia Rockeman andRick Green.

|Read more:

- Rural hospitals bank on outsideinvestors

- NYC's healthcare-for-all collides with hospitalsbleeding cash

- Hospital closings average 30 peryear

Copyright 2020 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.