One might think today's sandwichgeneration has enough to worry about, with caring for their kidsand aging parents simultaneously, all while juggling a job and apersonal life. Now, with the proliferation of scams in the midst ofthe coronavirus pandemic, how do caregivers – the majority of whomare women – stay on top of that and everything else? Among theclients you work with, chances are many of their employees who arecaring for others are facing these challenges more than ever.

One might think today's sandwichgeneration has enough to worry about, with caring for their kidsand aging parents simultaneously, all while juggling a job and apersonal life. Now, with the proliferation of scams in the midst ofthe coronavirus pandemic, how do caregivers – the majority of whomare women – stay on top of that and everything else? Among theclients you work with, chances are many of their employees who arecaring for others are facing these challenges more than ever.

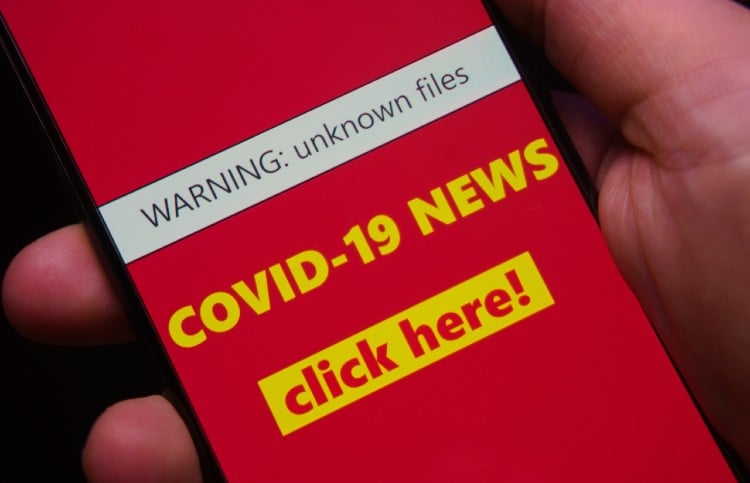

That's because the pandemic has created a perfect storm thatseverely threatens the security of our personally identifiableinformation, or PII. Consumers are spending more time on websites, social mediaand especially video chats. Meanwhile, an increasing number ofmalicious cybercriminals are pulling out all the stops to takeadvantage of peoples' emotions and uncertainty to defraud consumers. They're unleashingeverything in their arsenal, from phishing emails and fake texts,to robocalls and zoombombing.

|The people most targeted? Your kids and yourparents.

Ironically, keeping kids and older adults safe at home hascreated an even greater window of opportunity for identity thievesand scammers. First, children are virtually living online rightnow, taking classes, gaming and hanging out with friends on socialmedia (TikTok, anyone?). And seniors, with a heightened anxietyover the disease's impact, have even more free time to take calls,check emails or leaf through their daily mail.

|Second, according to Consumer Affairs, these two demographics aretargeted aggressively. Children are often singled out because bystealing a child's Social Security number, identity thieves canestablish a fraudulent "clean slate." And some studies suggest that peoplebecome more trusting as they age, which may explain why seniors aremore prone to being taken in by phone, email and internet phishingscams. This is cause for concern right now, as financialinformation and medical information is especially sensitive.

|Identity theft made easy

Identity theft takes on many forms, from tax fraud and financialtheft to fake websites and imposter scams. It can start with aninternet scam or someone stealing info from your mailbox. It couldbe your driver's license, a username and password, or medicalrecords, all of which are considered forms of identity theft.

|I had a recent conversation with Michael Bruemmer, an industrycolleague and Vice President of Consumer Protection at Experian, todiscuss how identity theft and scams have ratcheted up during thepandemic and what can be done to help protect against it. He saysidentity theft is now even easier to commit, for three mainreasons.

|Related: Legal, ID theft benefits can help employees stay ontrack at work

|He explains, "Number one, there is more data now available onthe dark web to use in building a synthetic Identity. For example,when you combine the records that are stolen, bought and sold onthe dark web, with all the social media info that people putonline, and then combine that with what's stolen through databreaches, you can create a full identity of someone without peopleeven knowing their personal information was used." The dark web isonly accessible through special software or authorization, so usersand website operators can remain anonymous or untraceable.

|Bruemmer also warns that people often think they are not atrisk, especially working from home. "During the pandemic, peoples'routines aren't the same; they may not be as cautious, not payingas much attention and are making common mistakes."

|"And finally," he says, "It's so much easier for hackers now.Even someone without expertise can buy a kit to launch a phishingattack. Plus, there has been such a large increase in corporateemail during the pandemic. For example, you get an email from afinancial institution that says 'we're confirming your updatedinformation, making sure your funds are protected, etc. Here areyour account numbers – log into your account.'" Bruemmer says thisis something that banks would never do, and it's probably someonetrying to download malware to your computer or phone.

|Not paying attention will cost you

According to Bruemmer, minors and seniors are more susceptibleto identity theft and scams because they are not sensitive to thedangers of working from home with an internet connection. "They arenot as security conscious and don't practice good security hygiene.Plus, they are social media active. Kids are on WhatsApp, Snapchat,Facebook etc. talking, interacting with friends."

|"Seniors are particularly at risk, because in most cases, theyare at or just past the point where they are attractive as a targetfor a financial scam," Bruemmer says. "That's because, unlikeyounger people, they have the ability to send a $5,000 money orderto someone in a foreign country who says a grandchild is inlockdown under pandemic restrictions."

|Much like other catastrophic events or natural disasters we'veencountered in the past, the current outbreak is unfortunately yetanother opportunity for hackers. Bruemmer states, "There are scamsfor wiring money, for supporting victims of the coronavirus, justlike other tragedies. They tug at peoples' hearts, but peoplearen't paying attention to the particulars in the message. Forexample, it's not the American Red Cross, it's someone posing asthem or pretending to be affiliated with them."

|He adds, "The number one cause for identity theft continues tobe someone doing something they shouldn't, like clicking on a link,downloading something that contains malware or shopping on anonsecure website versus a name brand one that is secure." One study has suggested that 3% ofcoronavirus-related domain names registered since January weremalicious, while another 5% were suspicious.

|Protecting your loved one's personal data

So, let's say you find yourself responsible for the identitiesand personal data of these two at-risk demographics. What can youdo to reduce the chances of it being stolen? Here are Bruemmer'stop three recommendations to teach your loved ones:

- Always use strong passwords and never reuse passwords.

- Don't respond to any email or click on any links, except ifit's from someone you were expecting.

- Be suspicious of all emails, phone calls, websites, etc.,especially now.

In addition to these tips, other identity theft experts suggestmonitoring credit reports – both yours and your children's (ifreports exist) to check for identity theft. Bruemmer adds, "Themonitoring of your credit file and online information is absolutelycritical for early detection."

|Steps to take if it happens

To help clients mitigate potential financial loss or damage toan employee's good name or credit, Bruemmer suggests taking thesesteps. "If you think you've been a victim of identity theft, thefirst thing to do is to report it to the local police. Most metrodepartments have a special unit who will file that report."

|Bruemmer says, "If a financial account has been compromised,call your financial institution and put a hold or close on theaccount. If you suspect a card is compromised or your personalinformation is stolen, reset your password, and use two-factorauthentication when possible as an extra layer of protection."

|He adds, "Ideally, you would have some sort of identity theftprotection to help prevent it from happening or use it to mitigatelosses if it does." Plans that offer identity theft monitoringand/or restoration services are often available through entitiessuch as a financial institution or a legal insurance plan.

|"You call the number and a fraud restoration specialist can gobeyond what you can do on your own. They can provide more specificadvice and can often take actions on your behalf because they'vedealt with that situation many times before."

|ID theft can take months to recover from and can greatly impacta person's credit score, good name and financial well-being. Aprofessional ID theft restoration specialist is an invaluableresource to have available when you need it most. It reduces thetime, stress and effort an employee would endure in the event thattheir identity is stolen.

|Dennis Healy is a member ofthe ARAG® executive team. Dennis is a passionateadvocate for legal insurance because he has seen firsthand how ithelps people receive the protection and legal help they need. Hehas nearly 30 years of insurance industry experience, with aprimary focus on the sale of group voluntary benefit products toemployer groups of all sizes through the brokers and consultantcommunity.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.