Next week's May jobs report is forecast to show an unemploymentrate of around 20%, the highest since the Great Depression. (Photo:Andrew Harrer/Bloomberg)

Next week's May jobs report is forecast to show an unemploymentrate of around 20%, the highest since the Great Depression. (Photo:Andrew Harrer/Bloomberg)

(Bloomberg) –U.S. states' jobless rolls shrank for the firsttime during the coronavirus pandemic in a sign people are startingto return to work, even as millions more Americans filed forunemployment benefits.

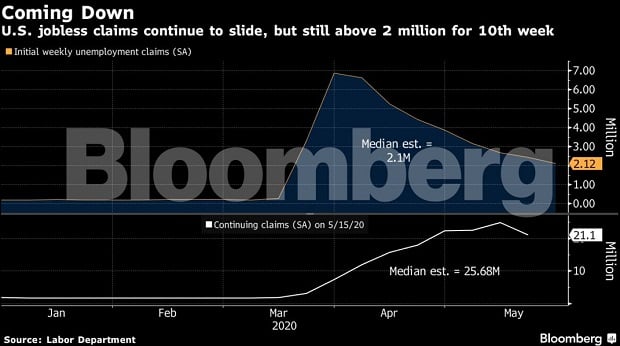

|Continuing claims, which tally Americans' ongoing benefit claimsin state programs, fell to 21.1 million for the week ended May 16,Labor Department figures showed Thursday. Those data are reportedwith a one-week lag. That suggests the job market is starting torebound as businesses reopen. Analysts had expected an increase incontinuing claims.

|Related: $1.3 trillion down: These COVID-19-era unemploymentstats are not pretty

|But the economic damage from the pandemic is still hitting hardthroughout the country. Initial jobless claims for regular stateprograms totaled 2.12 million in the week ended May 23, to bringthe 2 1/2-month total above 40 million. The median estimate in aBloomberg survey of economists called for 2.1 million claims.

|

U.S. equities were higher Thursday, while 10-year Treasuryyields were little changed.

|Despite optimism in financial markets, economists expect therecovery from the pandemic to take years, and with no vaccine orsignificant treatment yet available, a return to normal activity isunlikely. The U.S. reached a grim milestone of 100,000 deaths fromthe virus on Wednesday, the highest official toll in the world.

|Next week's May jobs report is forecast to show an unemploymentrate of around 20%, the highest since the Great Depression, when itpeaked at an estimated 25.6%.

|"The data still point to a pretty significant loss of jobs butat least the numbers are moving in the right direction," said AnetaMarkowska, chief financial economist at Jefferies Group. "Eventhough initial claims are still very elevated, the fact thatcontinuing claims are declining means businesses are actuallybringing a lot of workers back in and that is more than offsettingthe new filings."

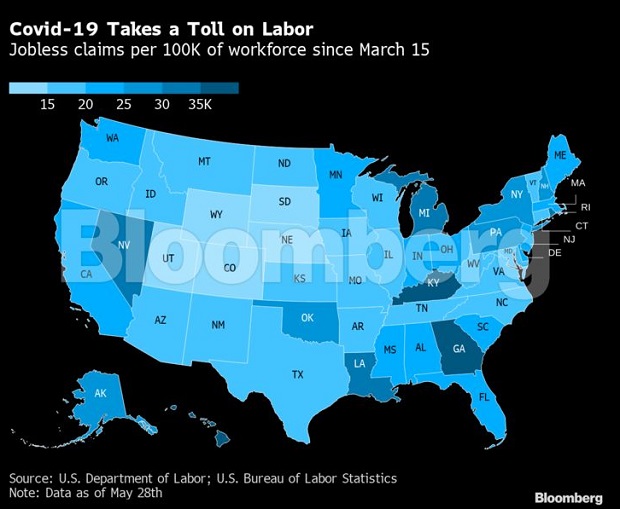

|While the latest initial-claims tally was down from the priorweek's 2.45 million and marked the eighth straight weekly decline,it's still far above the 212,000 average of initial claims in thefirst two months of 2020 and the pre-pandemic record of 695,000.California, New York, Florida and Georgia had the highest initialclaims last week.

|Pantheon Macroeconomics chief economist Ian Shepherdson flaggedone caveat with the continuing claims numbers: While "gross hiringis beginning to rebound," the figure "overstates the true extent ofthe hiring," given that California — where residents file everyother week — posted a 1.4 million unadjusted decline, Shepherdsonsaid in note. Florida also showed a drop of 1.6 million.

|Thursday's report also showed that filings under the separate,federal Pandemic Unemployment Assistance program — which expandsunemployment benefits to those not traditionally eligible, such theself-employed and gig workers — fell to 1.19 million from 1.25million on an unadjusted basis, covering 32 states. The priorweek's figure was revised lower by about 1 million due to an errorby Massachusetts.

|The latest week's figure for the federal pandemic claims broughtthe total number under federal and state programs to 3.11 millionlast week, down from 3.43 million the prior week. Many states arestill reporting zero claims under the federal program.

|Total continuing claims under all state and federal programs —which provides the broadest look at the number of Americansclaiming unemployment benefits — rose to 31 million in the weekended May 9 from 27.3 million. That number isn't adjusted forseasonality and other factors.

|A separate report Thursday showed U.S. orders for durable goodssank sharply for a second month in April as the pandemic wreckedhavoc on the manufacturing industry.

|

State unemployment offices have struggled to keep up with recorddemand for benefits amid the economy's sudden stop and wave oflayoffs since mid-March. Many applicants have waited on edge forthe payments without receiving them.

|California, the most populous state, said Wednesday it's seeking1,800 additional staff to help process claims, joining about 3,000current and temporary employees working on the issue. The statesaid 700 employees worked over the Memorial Day weekend,particularly to process claims that arrived via paper.

|The weekly federal report has been marred by data errors andquirks recently, with mistakes from Connecticut and Massachusettsswinging the national figures and California distorting thecontinuing claims because of the biweekly schedule for residents tofile.

|–With assistance from Kristy Scheuble, Sophie Caronello,Edith Moy and Samuel Dodge.

|Read more:

- Middle-income retirement participants 'hit fromboth sides' by COVID-19

- Study: Nearly half of adults say their family haslost work or income amid the pandemic

- 10 ways to plan for retirement should we faceanother "lost decade"

Copyright 2020 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.