The trend toward benefits integration has been gaining tractionfor the last several years, with employers planning to increase theamount of integration over their current benefits programs,according to a 2010 survey of employers by Spring Consulting Group.With some employers achieving documented savings in lost time,direct costs, and return-to-work rates of 11 percent or morethrough their integrated programs, brokers and employers arebeginning to recognize the value of benefits programintegration.

|Brokers play an important role in introducing their employerclients to benefits integration. Their knowledge of the spectrum ofoptions available often provides the catalyst needed for a benefitsor risk manager, CEO or CFO to consider implementing an integratedbenefits program, with a goal of managing employee absence.

|

The Challenge to Employers

Employers are challenged today with increasingly complex leavelegislation, loss control, rising benefits costs, and concernsabout productivity due to employee absence. Their employees may beout of work because of a disability claim, a workers’ comp claim,or other leave of absence provided under the federal Family MedicalLeave Act, state leave laws, or employer-specific leavepolicies.

Each of these types of leave of absence has its own eligibilityrequirements and administrative process, which can complicate leavemanagement and make compliance with federal and state regulationsdifficult. To get a better handle on employee absence and leavemanagement administration, benefit integration has become apotential solution. Initiatives to reduce illness and disabilityabsences, as well as health-related lost productivity, are beingrecognized as an investment with a positive impact on the bottomline.

|When asked what benefits were achieved through programintegration, employers in the Spring Consulting survey said:

- Consistent administration

- Better tracking or reporting

- Easier or better experience for employees

- Reduced costs

- Increased control

- Improved compliance

The Role ofConsultant

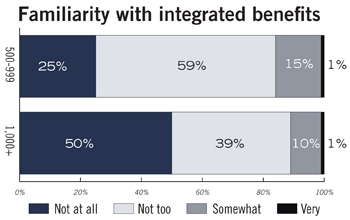

Much of the activity surrounding program integration has been withlarger employers, or those with more than 1,000 employees.Familiarity with the concept of integrated benefits was twice ashigh among brokers who focus on the larger employer market than itwas for brokers whose primary focus was on employers with 500 to999 employees, according to The Hartford’s 2010 Producer Study.That is beginning to change, however.

Research by the Integrated Benefits Institute found interest inbenefits integration among publicly traded for-profit employerswith more than 500 employees was high. When asked which programsshould be integrated, brokers in The Hartford’s survey said theyfelt that all combinations were important, but in particular,disability and workers compensation or disability and FMLA wereseen as very important or critical.

|The Hartford’s survey found that more than one-third of thebrokers who target employers with 500 or more employees saidoutsourcing leave management and benefit administration is veryimportant or critical to their clients. For many employers,employee absence has become an urgent matter in need of a solution.This is especially true with today’s reduced work force, where evena single worker’s absence may impact productivity.

|The ability to control lost-work time due to employee absenceand effectively address the administrative challenges associatedwith multiple benefits programs is a goal for employers of anysize. Brokers can help them reach that goal by working closely withvendors to drive innovation to ease administrative burdens, reducelost-work time, and better manage employee absence.

|By educating employers on benefits integration, brokers can:

- Respond to a developing market need

- Gain recognition among employers as a knowledgeableconsultant

- Leverage existing relationships to expand book of business

- Support internal cross-selling opportunities

- Increase sales

- Improve customer retention

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.