The Benefits Selling/Eastbridge Voluntary survey was conductedagain this year, and more than 325 brokers — a combination ofemployee benefit brokers, traditional voluntary brokers, enrollmentcompanies, etc. — responded. While the participant diversity maskssome of the trends that differentiate broker segments, thiscross-section gives us a clearer picture of what's happening in theoverall marketplace, especially when compared next to last year'sdata.

|Brokers are coming to a consensus on many issues. They’re verylikely to be selling voluntary and appear to be increasing theirfocus on the line. They believe PPACA is a driver of their increased voluntarysales and that those sales will grow faster in the future thantheir non-voluntary sales. It would appear the debates about thedirection of voluntary sales and their relationship toPPACA-mandated changes are over.

|While these changes were predicted, others might be surprising.Despite the aggressive promotion of private exchanges and definedcontribution strategies, readers are only occasionally recommendingthem and, when they do, they’re seldom successful in selling thesestrategies. While adoption might be just a matter of time, thattime is not now.

|On the other hand, brokers approach the business in unique ways.They demonstrate a lack of uniformity in the products they sell,the number of carriers they use, and what they expect from thosecarriers.

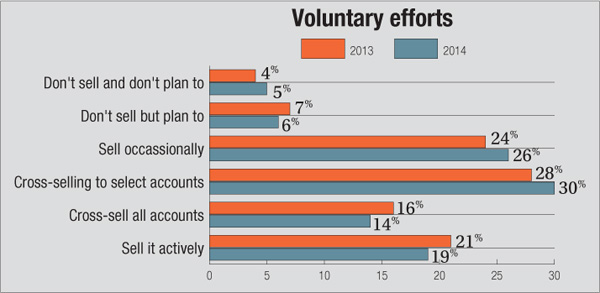

||Voluntary efforts

|Last year we found that the majority of brokers now sellvoluntary, at least occasionally, and this continues to be thecase. Again this year, just 11 percent of the survey respondentsdon't sell voluntary and the majority of those who aren't sellingit, plan to do so in the future.

|

|

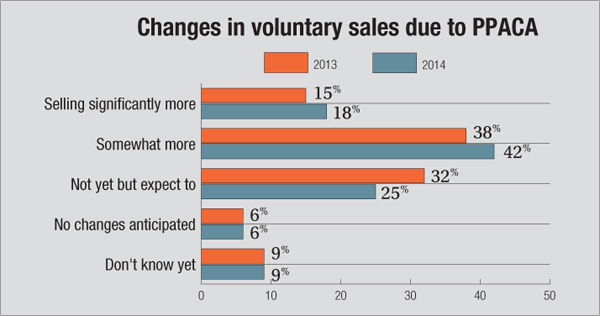

Sales predictions

|

Most brokers claim the Patient Protection and Affordable CareAct forced them to sell more voluntary. In fact, 60 percent of thebrokers surveyed sell more voluntary today, up from 53 percent lastyear.

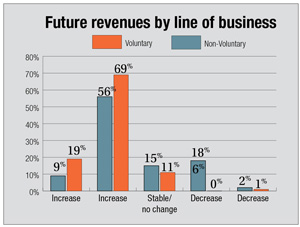

|A majority of the respondents believe both their voluntary andnon-voluntary business revenues will increase in the future, butmore so in their voluntary lines. An overwhelming majority (88percent) expect their voluntary revenues to increase, compared tojust 64 percent for their non-voluntary lines.

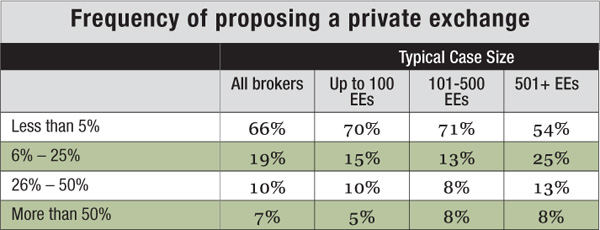

||Slow-moving on private exchanges

|Our survey results suggest brokers aren't rushing their clientsto move to private exchanges or defined contributionplans. Large-case brokers are more likely to recommend privateexchanges than are smaller-case brokers; however, the majority ofbrokers, regardless of their typical case size, suggest this lessthan 5 percent of the time. In the large-case group, 79 percent ofbrokers recommend private exchanges to clients between 0 percentand 25 percent of the time.

|The success with which private exchanges are actuallyimplemented in a case also is low, even among the large-casebrokers. According to the data, 79 percent of large-case brokersrecommend a private exchange less than 25 percent of the time and64 percent are successful less than 25 percent of the time.

|When private exchanges are recommended, defined contributionoften isn't included. In fact, a majority said defined contributionis included less than 25 percent of the time. Among large-casebrokers, defined contribution seems to be more prevalent, but 61percent still said they include defined contribution less than 25percent of the time.

|

Products and carriers

|

The voluntary products sold most often by brokerswere very similar to what we saw last year. However, the percentagenaming accident coverage as one of their top three voluntaryproducts increased significantly from 36 percent to 47 percent.Critical illness also increased somewhat this year.

|More brokers also are selling “non-traditional” voluntarybenefits. Wellness programs were again the most commonly soldnon-traditional voluntary product, but the percentage actuallydecreased some from the 2013 survey. More brokers also are sellingdiscount health plans, legal plans, and ID theft coverage this year compared to theprevious year.

|Read: Top 5 selling voluntary products

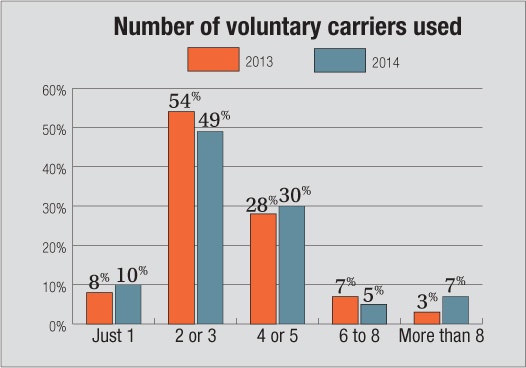

|Most brokers use multiple carriers for their voluntary businessover the course of a year. However, a majority use just two orthree different carriers. Only 38 percent use four or morecarriers.

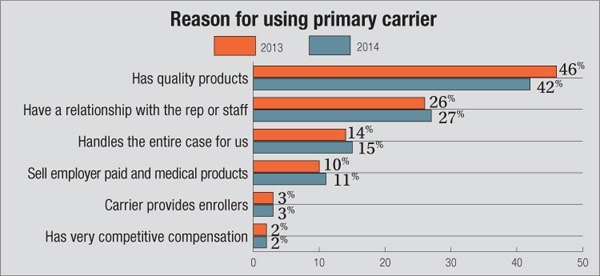

|When asked why they use a particular carrier most often,“quality products” topped the list. Brokers also consider therelationship with the carrier's staff, especially the field reps,as an important reason for using their top carrier.

||Enrollment methods

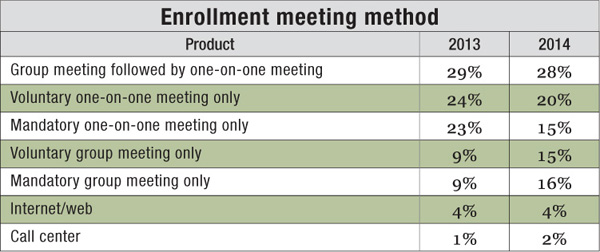

|When it comes to enrollment, the most common methods were acombination of group and one-on-one meetings or voluntary ormandatory one-on-one meetings only. Somewhat surprisingly, therewas no change in the use of the Internet or call centers this yearcompared to last year.

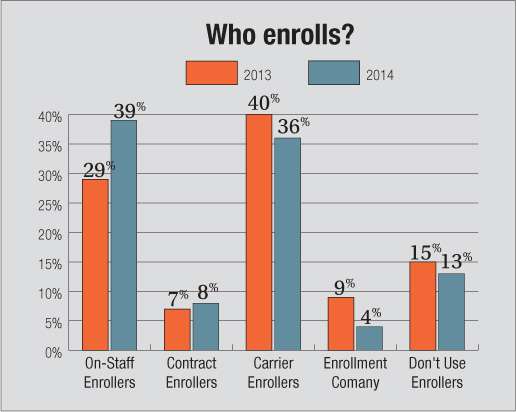

|For those brokers who use enrollers, there was an increase inthe percentage using carrier enrollers and/or enrollment companiesto handle their cases. On-staff and carrier enrollers continue tobe the most common source of enrollers.

|Among those who use an enrollment company or carrier enrollers,49 percent are “extremely” or “very” satisfied with theirperformance, up slightly from 46 percent in the last survey.Another 42 percent are “satisfied” and only 9 percent are“dissatisfied,” down from 13 percent last year.

|

Room for improvement

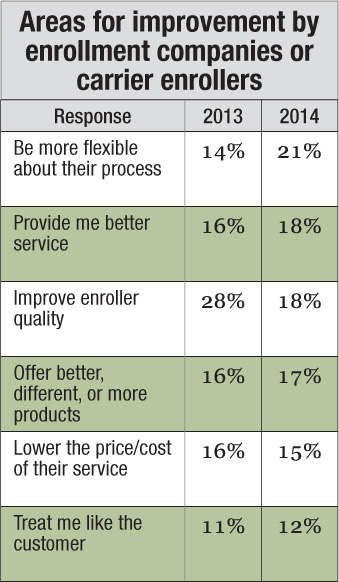

|When asked how the enrollment company or carrier could improve,the most common answer was “be flexible about their process.” Thisitem jumped up significantly compared to last year. This wasfollowed by: “provide me better service” and “improve theirenroller quality.”

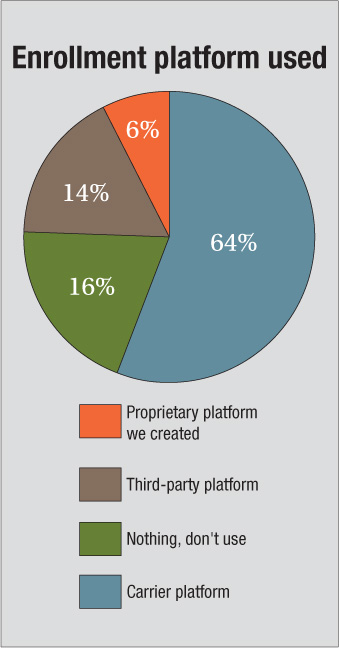

|The majority (64 percent) of the brokers surveyed said theytypically use a carrier's enrollment platform to handle theirenrollments while 16 percent do not use any technology platform.Fourteen percent use a third-party platform and 6 percent aproprietary platform they (or their agency) created orcommissioned.

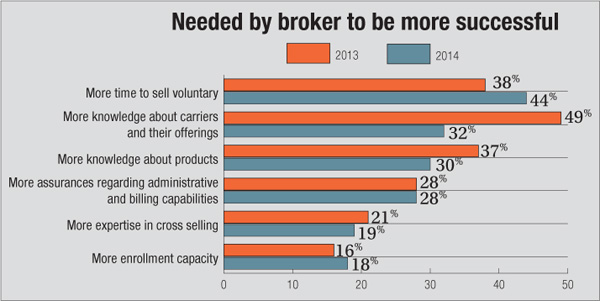

|The survey also looked at what brokers think they need in orderto be more successful in selling voluntary products.

|“More time to sell voluntary” was the No. 1 answer citedfollowed by “more knowledge about carriers and theirofferings.”

|

Summary

|The fog is starting to lift and the picture is becoming cleareras those brokers who haven't been involved with voluntary begin toenter the business, learn the basics and look forward to strongersales and improving results.

|But brokers also appear to be a diverse group, crafting theirunique approaches and processes in their march toward voluntarysuccess.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.