Editor's Note: Since this piece was publishedin Benefits Selling, AnthemInc. purchased Cigna Corp. for $48.4billion.

|When Aetna announced its intention to acquire Humana for $37billion in early July, the shock-wave effect was almostinstantaneous. Insurance commissioners and attorneys general inseveral states announced their intentions to review the merger,stock in both companies dropped, and some industry experts—andoutsiders—wondered whether this could be a harbinger of the futureof health insurance, or even a step in the direction of asingle-payer system.

|Then, in a smaller but still significant deal, Centene's acquisition of Health Net for $6.3 billionwas announced, and the speculation about the potential impact onthe industry grew more pointed.

|Players in the health benefits world disagree about what thedeals mean, and even whether they mean anything at all.

|“Are regulators going to allow this to change the industry?”asks Kevin Ramsier, CEO and managing partner at Vesticor Advisors.“That's hard to predict; I think they're probably likely to limitthe numbers of these major mergers, so only the people first to theparty get the green light.”

|However, he added, “Big deals like this tend to trickle down,and I do think we'll see more of these health insurers pay intomore areas of the industry—technology platforms, patient engagementplatforms, pharmaceutical companies and a host of otheradd-ons.”

|Mike Sullivan, executive vice president and CMO at DigitalInsurance/Digital Benefit Advisors, says bigger deals in thecarrier space could be increasingly common as they begin to reflectthe consolidation and integration that's already taken place tosome extent in the health care provider sphere.

|“Carrier consolidation is following what's going on in theprovider segment,” he says. “Our entire system has been built onpricing leverage—how big are you, and when we're sitting across thetable negotiating pricing, who carries a bigger stick? It's anatural by-product of the fact that the business is gettingsignificantly tougher.”

|Scott Carver, president at PlanSource, notes that “there's stilla lot of fluidity around whether or not these deals will cometogether.” But, he added, “If they do, it sets up a much moreaccelerated pace for industry consolidation. It could have a verysignificant impact on our industry.”

|Location, location, location

|

|

Susan Combs, president at Combs & Co., says that New Yorkseems to go through a merger cycle “every five to 10 years. Seven,eight years ago, we had Oxford, United and HealthNet as threeseparate companies. Now, in New York, they're all one.

|“I know we're talking about major players, but in New York,Oxford, United and HealthNet were all major carriers,” she adds.“It resulted in higher rates.”

|The situation, however, has changed. “We have all thesemicro-carriers born out of the exchange,” Combs says. “Now thatthere are these smaller networks with localized coverage, I thinkit is a matter of time before consolidation happens again.”

|Localized coverage is thriving in some parts of the country, sothere's reason to believe it could continue to do so despitecarrier consolidation.

|“Health care is still very geography-centric,” Carver says.“While you might have large players who dominate at some level, Ithink there's still very much a need for localized insurance, ifyou will, that reflects the local provider community and theconstituents who reside there.”

|Some larger carriers, of course, will target those markets.Still, one of the most reliable ways for carriers to acquire newclients is to acquire a company. “There might be certain marketsthat you want to go after geographically—segments of the populationyou want to target that you're going to be in a much betterposition to target after a merger,” says Joe Torella, president ofthe employee benefits division at HUB International Northeast. “Itreally is all about having profitable membership on the books, andcarriers can't always go out and get new membership by organicgrowth.”

|What's PPACA got to do with it?

|Health care experts offer several reasons why the passage ofthe Patient Protection and Affordable Care Act is going todrive further carrier integration.

|One obvious effect of the law is the 80 percent medical lossratio established by PPACA, which requires insurance companies toinvest 80 cents out of every dollar received from consumers onclaims or expenses that improve the quality of clients' healthcare. Complying with the new MLR guideline means that economies ofscale wouldn't be a luxury for carriers—they could become anecessity. Most insurance companies can't operate at that level,says Eric Wilson, principal at Wilson & Associates.

|“PPACA has led to structural uncertainty in the business,”Sullivan says, “and when there's structural uncertainty, you needto cover your bases relative to your clients. Scale is one way inwhich industries and companies deal with uncertainty.”

|PPACA also implemented the formation of accountable careorganizations on the provider side of the equation. ACOs took onmore of the financial risk of caring for chronically ill patientpopulations. In turn, those ACOs began working much more closelywith carriers.

|“ACOs are popping up everywhere now,” says Ron Goldstein, CEO atChoice Administrators. “We're seeing the more local, regionalcarriers doing a better job, especially with branding and what theycan bring to the table in that small geographic area.”

||An 800-pound gorilla in the room

|Of course, some industry insiders are worried that carriermergers could be the beginning of a move toward a single-payersystem.

|Combs, for one, thinks that's an overreaction.

|“Look at who has that kind of system,” she adds. “You're talkingabout countries that have a population the size of the state ofMissouri. You can keep track of 5 million people.

|“Even if there was a single-payer system that goes into placelike there is in Canada, all the companies would be doingsupplemental insurance,” she says. “The national plan is whatconsumers have if they can't afford anything else, and people don'twant to wait to see the doctor, so all of our clients who haveoffices in Canada have supplemental coverage.”

|Carver agrees.

|“If it happened in the private sector, then I think monopolylaws would be invoked and it would be prevented,” Carver says. “Theonly way we'd get to single payer is if it were government-driven.I don't see that happening.”

|Torella notes that Medicare is a perfect example of why thegovernment wouldn't go to a single-payer system, noting rampant amounts of fraudand abuse within the government system.

|“It's very difficult to manage the delivery of care in the sameway you would deliver life insurance,” Torella says. “If you have a seriousillness, navigating the system is very difficult.

|Plus, he adds, “I don't think people realize that in othersingle payer systems, you give up an awful lot in the transactionof health care, and I don't think certain markets are ready to giveup that autonomy and access.”

|Still, as Ramsier points out, “There is a lot of support forsingle-payer models, and supporters say health care is a right ofevery citizen. There are still an enormous number of Americans whoare under-insured—they have insurance but can't really use itbecause of high copays and deductibles.”

|On the con side, he adds, “the best arguments I've heard againstsingle-payer is that the government's power to dictate is limitedto two key areas in that system: the services that are provided andthe reimbursement rate. Then you hear warnings about what happensto the level of care and wait times.”

|Blurred lines

|“The silver lining for me is that the lines will continue toblur between who's a provider and who's a carrier, because that'swhat we need,” Sullivan says. “Competition is going to emerge. I'dlove to see new, equity-funded entrants. It's very tough to see newparticipants on the carrier side becoming relevant, but you seesome of that in the small group market.

|“We may just find that providers and carriers exist less interms of silos and more in terms of 'co-opetition.' I think we maysee more of that. And that may be good for consumers.”

|Because ACOs carry some of the financial risk for patient care,this segment of the provider community is especially apt to workwith carriers. “We're starting to see ACOs exhibit an appetite forparticipating in private exchanges,” Carver says. “We run our ownprivate exchange, and we also power several other private exchangesfor brokers. ACOs have expressed interest in participating inthem.”

|Will we still need brokers tomorrow?

|The trend toward increased transparency in complex transactionsis already a source of potential disruption to the traditionalhealth benefits model—and when that trend aligns with significantcarrier mergers, it's no wonder brokers begin to worry about thelongevity of their careers. Streamlined companies and marketplacesoften mean simplified processes or, at least, fewer players tomuddy the waters.

|“If anything, there will be fewer plans in the marketplace,”Goldstein says. “Group carriers get together and do a realmerger—two carriers become one—and you're not going to have 82plans between the two of them in the end; you'll have 35.”

|Carver said it's also likely plans will become “morestandardized, more commoditized and significantly more transparent”if consolidation catches on as a trend.

|“So helping employers, particularly on the group side, gothrough an election process will become an area of expertise lessneeded in the market.”

|However, American consumers seem to prefer choice—to someextent.

|“There are so many options out there, and I think in general,that's what the American public wants,” Ramsier says. “I thinkthere will always be a need for professionals.

|“Health care is so personal,” he adds. “Every single situationis completely different, and just grabbing something off the shelfmight not be what you need, or might not be what your neighborneeds. Having a relationship with someone whose job is to stay intune with the different changes and options out there will alwaysbe in demand.”

|“There is so much going on in the industry, and so much of itinvolves greater levels of complexity,” Sullivan says. “But whatisn't being delivered, what doesn't exist fundamentally, is wisdomfor employers and consumers that will help them know what to do.Brokers and advisors need to understand how to bring a greaterlevel of simplicity into the space.”

|PPACA also streamlined health plans by using what Wilson calls a“cookie-cutter approach. Whereas before, this plan might offermental health services and this company might offermaternity coverage, now most of the plans are the samein a lot of ways.”

|What differentiates plans and carriers now, he adds, is whereeach excels. One carrier might have better prescription coveragethan another with a wider network. And brokers can provide the mostvalue to consumers through their knowledge of the nuances of eachplan and carrier.

||The long and winding road

|

|

“Brokers are going to have to change their model, and they'regoing to have to look to non-medical benefits and insurance linesto draw their revenue streams, which are very viable,” Carver says.“As these medical plans with higher deductibles and maybe morelimited coverage become popular, there are also a number of gapplans out there and things that can provide additional health andfinancial security for folks that can be deliveredthrough a benefit program.

|“This shouldn't be gloom and doom,” Carver adds. “Folks who arewilling to adapt their business models will thrive.”

|Brokers will also have to think more about individuals thancompanies when it comes to health benefits, Ramsier says.

|“I think it comes down to relationships,” he says. “Therelationships have really been at the employer level. Now theindustry is peeling that onion back on a personal level andunderstanding the needs and wants and desires of the person who'schoosing a policy. That has become more important than ever, and Ithink that's going to continue to be the case. It's about thepeople who work in the company and not the company itself.”

|“We'd be in trouble if we didn't find ways for thesystem to reinvigorate itself, good or bad,” Torella says. “Youcan't have thousands of different islands doing things differently;sometimes, consolidation might be beneficial.”

|Sullivan also believes that brokers need to rethink the servicesthey provide. “Everybody is redefining what exists inside the fourwalls, whether it be providers or carriers,” he notes. “I thinkthat should extend to the advisors as well. When you start to thinkabout the possibilities and not all the risks and challengesassociated with the business, it's a very liberating thing.”

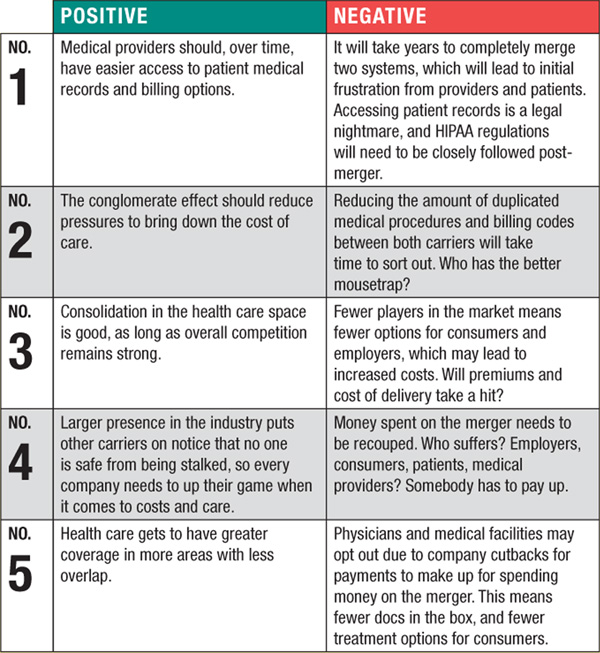

|Pros and cons to the Aetna-Humana merger

|By Mark Roberts

|Though it will take time for the dust to settle on theAetna-Humana merger, the deal already raises a number ofconsiderations, pro and con. At the end of the day, depending onwhose perspective is voiced, the new group is a big winner or a bigloser. It remains to be seen, as the merger won't even be completeduntil 2016. Time will tell.

|Money is definitely a factor in the decision, as each companyhas more than $100 billion in annual revenue. Aetna is the thirdlargest U.S. health insurer, and Humana ranks No. 4. Together, theywould sit atop the industry.

|The agreement would bolster Aetna's presence in the Medicaidprogram and Tricare coverage for military personnel and theirfamilies, as well as nearly triple Aetna's Medicare Advantagebusiness. The merger hopes to avoid too much anti-trust scrutinyfrom the federal government, typical in big deals like thisone.

|From the sidelines, here are a few positives and negatives tothe Aetna-Humana merger.

|

|

It's a brave new world, according to the Supreme Court andeveryone else with an opinion that counts. Will the merger betweenAetna and Humana survive? Possibly—and probably. There's too muchat stake for each organization for it not to move forward. Let'shope private pay doesn't eventually become public payout.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.