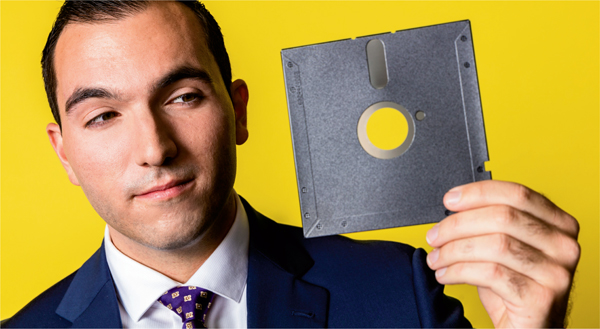

In business, or arguably anything you do, timing is one of themost crucial factors. Not only is timing unpredictable, but it canlead you down a road you never thought you would travel—and thatcan be a good thing or a bad thing. In college, I had a footballcoach who went from cutting the grass at a tech start-up company tobecoming a sales rep for one of the first companies in America tomass produce the floppy disc. I'm still in my twenties, so I havenever actually seen a floppy disc, but the moral of the story ishis timing to go work for the start-up in a relatively unknownindustry opened up an opportunity for him to get into sales. Andthe rest was history. My coach ended up amassing millions ofdollars, rose to EVP of the company, retired at 50 and now coachesat his alma mater just for fun. A truly incredible story aboutgood timing. If he goes to cut the grass five years later,the company has already exploded and there's no room for him. Fiveyears prior and they don't even have the capital to hire him,period.

|If you ask me, 2015 was one of those “floppy disc” years for thebenefits industry, a time where things change and there areimmeasurable opportunities that can't even be truly fathomed yet.As a brand new college graduate, I weighed options to go work formany different nationally recognized companies. But when I took amore objective look before making my final decision, I askedmyself, 'Where is the opportunity to do something that nobody hasever done before?' I found that opportunity in employee benefits.The industry is changing dramatically; we are at a crossroads andhave the privilege of rewriting the book on how to design healthplans for employee benefits packages.

|Investment banking five years ago was the same as it will befive years from today, and a lawyer five years ago operated hispractice in the same way he will five years from now. But if abenefits professional relies on what he did five years ago to runhis business going forward, he will surely be toast. Thereis no way a broker or a carrier rep can survive by doing what thosebefore them did, and therein lies the opportunity to become arevolutionary.

|In a time when PPACA and health care issues arebecoming the primary topic of political debates, benefitsprofessionals are left to take whatever ruling they end up withfrom Washington, and make it work in the best way possible fortheir clients. Looking back, 2015 included key events that willcertainly be featured in future CEBS textbooks.

|The Cadillac tax became a huge topic for debate—a proposedaspect of PPACA that would tax “high-worth” health plans at 40percent for every dollar above a certain threshold. We saw moreissues stem from that, such as how the tax will be calculated, andhow inflation will be accounted for. Because of these factors,economists say one in three health plans over the next few yearsmay be subject to the tax.

|Another hot-button issue is record setting rises in premiums. Weall read the many articles published this year about rates going upand how many employers have a desire to shift costs to theemployee. As a result, high-deductible plans are put into effectand people get uneasy about the rising out-of-pocket expenses theymay incur. In a society where most Americans don't have more than$500 in their savings accounts, many are starting to panic. Butcould these issues create a “floppy disc moment” for benefitsprofessionals to do something that hasn't been done before?

| The year 2015 was marked with the rise of twovery important components of health care: wellness programs and voluntarybenefit offerings. It is my assertion, and the assertion of manymajor players in this industry, that voluntary benefits andwellness can serve as keys to putting financial control back intothe hands of employers. By implementing wellness programs thatpromote and incentivize preventative and routine care, we will seelower claims utilization over time and create a cost containmentmechanism for employers and employees alike.

The year 2015 was marked with the rise of twovery important components of health care: wellness programs and voluntarybenefit offerings. It is my assertion, and the assertion of manymajor players in this industry, that voluntary benefits andwellness can serve as keys to putting financial control back intothe hands of employers. By implementing wellness programs thatpromote and incentivize preventative and routine care, we will seelower claims utilization over time and create a cost containmentmechanism for employers and employees alike.

One of the biggest advantages in offering voluntary benefits isthat in most cases, they fall under Section 125 of the InternalRevenue Code, also called a “cafeteria plan.” Because of this, theycan be administered by payroll deduction on a pre-tax basis byemployers, saving them money on their bottom line and providingemployees with very feasible group rates that equip them with anabundance of cash benefits in the event of a critical illness,accident or hospital stay. Professionals in our industry see theseplans as a mechanism to bridge the gaps in coverage that arecreated by the ever more prevalent high deductible health plans.Innovations such as these have gained incredible traction in 2015,and we are seeing brokers becoming better able to deliver on theirpromise to provide the best solutions for their clients and standout among their competitors.

|2015 has been a year where innovation became not a matter of if,not a matter of when, but a matter of how soon. Trulyforward-thinking benefits professionals rose to the occasion thisyear, looked the issues of health care reform in the eye, anddelivered solutions that saved the employer groups theyrepresent. They also opened up a door to new and unparalleledsuccess for themselves. We should all be excited for whateverchanges and subsequent opportunities 2016 will bring.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.