Zenefits payroll is here—and it's free. But how free is it?Really, the only product or service Zenefits provides totally forfree is a very light HR solution in order to hook companies in. Theinstant one of these companies tries to tack on additional productsor extensions in some way, shape or form, the company is paying forthem.

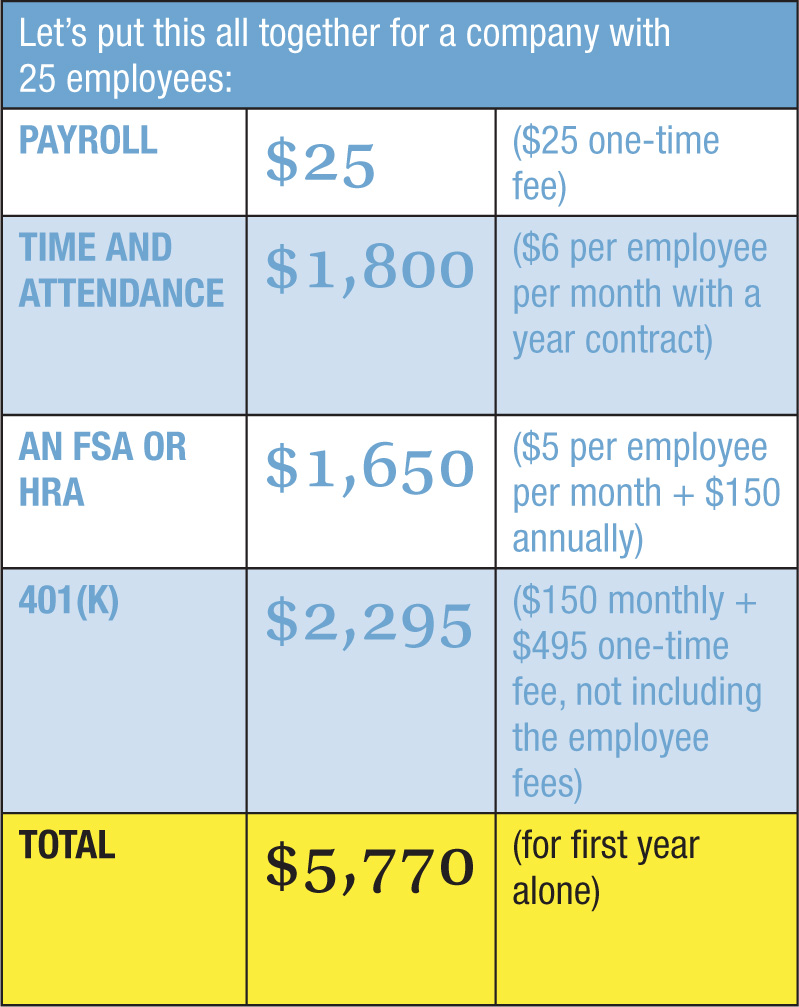

|In the context of payroll, there is a base version promoted asfree, but from the start, there is a $25 setup fee and a couple ofother service and penalty fees for items like expedited payroll,tax amendments or insufficient fees.

|From there, think about how payroll is calculated. Yes, if thereare only salaried employees, payroll is typically a flat amountbased on an annual salary. But what about hourly employees? Howwill the time employees work make it into payroll? ThroughZenefits' time and attendance software, of course, at a whopping $6per employee per month with a year contract (or $8 per employee permonth on a month-to-month contract). Typically, you'll see around$3-$5 in the market for much more feature-rich solutions.

|If we continue down the calculation path, there's gross pay(total pay the employee earns) and the net pay (what the employeetakes home). The net pay is calculated based on the gross pay minusa myriad of deductions such as taxes, Social Security, benefits,etc. Now, if this payroll is “self-driving,” how can companiesautomatically deduct the contributions employees make to theirbenefits packages? Again, through Zenefits additional services, ofcourse. They automatically handle deductions for any benefitsprovided by Zenefits, including health or voluntary insurance, FSA,HRA, HSA, 401(k), etc.

|If companies decide to manage their existing insurance plansthrough Zenefits, they will have to sign a letter to the carrier(s)making Zenefits the broker of record, and thereby allowing them tocollect the commission from the carrier. OK, technically that'sfree for the company. However, if the company doesn't renew anexisting plan, they're limited to the options Zenefits makesavailable in its exchanges, which may be a higher rate than currentplans or other plans on the mark not included in the exchange.

|On top of that, there is the FSA, which costs companies $4-$5per employee per month with a $150 annual fee. Or an HRA option,which costs companies $5 per employee per month with a $150 annualfee. And lastly on the account front, perhaps an HSA, which has nodirect cost to the employer, but a $2.50 fee paid by the employeeon a monthly basis.

|On the 401(k) front, the price ranges from $105 to $410 permonth for the employer plus a $495 one-time setup fee. Then, eachparticipating employee is charged $4 per month plus five basispoints annually (about $5.50 for every $10,000 an employee has inthe account).

|

How free is free now? Free is being used as a mousetrap for theacquisition of new clients by Zenefits. Before long, companies willfind that there are actually a lot of costs and fees that will popup, and once they manage their processes in Zenefits' solutions, itbecomes difficult for them to leave.

|At the end of the day, one thing is clear: Companies are movingtoward technology to help them manage the spectrum of HR, payrolland benefits. Gone are the days of manual processes. Brokers needto remain competitive with the companies that provide this type oftechnology. And to do that, brokers need to put technology inplace, whether they build it or license it, and begin providing—orpartner with a company that provides—payroll.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.