Staring at a subway advertisement, Steve Rousseau ponderedupending the delicate balance of his personal budget. The adpromised a lower interest rate and smaller payments for studentdebtors who were willing to refinance. Rousseau, 27, is five yearsout of college. He has about $15,000 left to pay on private andfederal loans that helped fund a diploma from Hofstra University.What to do?

|Related: Millennials short on savings

|Weeks after seeing the promotion, he has chosen to do nothing.“Going to the private sector for financial advice, especially withstudent debt, feels fraught,” he explained. “There aren’tgovernment resources that could clearly explain the proper way tomanage student debt that would be more trustworthy.”

|The vast majority of student debtors are in Rousseau's shoes:About 62 percent are familiar with student loan refinancing, butmore than two-thirds haven't refinanced, according toa poll of 1,001 American studentdebtors.

|Related: What voluntary brokers need to know aboutmillennials student debt

|For undergraduates who finished college in 2014, the averagestudent debt total was $28,950, an amount generally split betweenprivate loans and government loans. (The latter come with suchperks as income-driven repayments.)

|There's no overarching reason why they don't refinance, though20.1 percent pointed to the federal loan option that ties paymentamounts to what they're earning, and they didn't want to risklosing it.

|Related: 6 positive trends in student debt

About a quarter of those who answered the poll, conductedfrom June 30 to July 3 by Google Consumer Surveys on behalf ofrefinance firm Student Loan Hero, said they simply weren't aware ofhow to refinance. And 8.4 percent said they planned to seekforgiveness for their loans. (A third didn't specify why theyweren't interested in refinancing; only 2 percent had been rejectedwhen they attempted to refinance.)

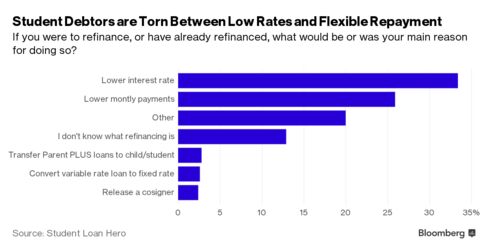

The study found that those who did want to refinance were hopingfor a lower interest rate, with 33.4 percent saying that this wastheir primary motivation. But when asked if they would be willingto give up the income-driven repayment option for the moreattractive rate, the results were murkier.

|The majority, 39.4 percent, said they weren't sure that a lowinterest rate was worth the trade-off. An additional 35.9 percentsaid it definitely wasn't worth it. Only 24.7 percent said they'dprefer a low interest rate.

|"You really sacrifice the flexibility if you were to refinance,"explained Tyler Dolan, a financial planner with the Society ofGrownups, a Brookline, Mass., financial literacy group. "Youmight be able to find a lower interest rate, but that's not theonly consideration."

|Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.