In a year when major insurers like Aetna and Humana are pullingout of state exchanges left and right—leaving some 35,000 people in45 counties with no insurance options, and 3 million more in 1,388counties with just one—a growth story like Oscar's is not onlyrare, it's virtually unheard-of.

|This five-year-old upstart insurance company (currently offeringindividual coverage in New York, California and Texas) aims toexpand its individual market to three new states and offer plansfor businesses in four new states by 2018. Oscar reports thatengagement with its key features is up 35 percent year-over-year,and that 23 percent of members use its telemedicine feature—eighttimes the national average of 3 percent.

|It launched in 2012 because cofounders Mario Schlosser and JoshKushner (yes, Jared's brother) were experiencing separate healthincidents and took note of how difficult and confusing it was tonavigate their health care plans. “No one was there to help themalong the way,” explains Sophia Norella, director of Oscar forBusiness and team member at Oscar since 2013.

|They wanted Oscar to be different—and according to memberfeedback, it is.

|“When we ask our members what they think of Oscar, far and awaywhat we hear them say the most is: 'Oscar is easy,'” saysNorella.

|So, what's Oscar's secret?

|A curated network

|A traditional insurance company puts together “essentially aphone book of doctors,” says Norella. “If someone needs a doctor,they get that 'phone book' and they need to figure out what to dowith it—find the right doctor for the particular situation they'reexperiencing.”

|Oscar took a different approach from the beginning. Instead ofbuilding a broad or a narrow network, the health plan creates a“curated” network in each market. “We algorithmically look to ourmembership—where they live, what they look like, what their careneeds are—and we make sure we've got the right coverage in ournetwork for the care they might need at any point.”

|Oscar also uses quality metrics to select the care providers inits network. But the goal isn't to add every high-quality providerpossible to the network; rather, Oscar aims to direct its memberstoward a conveniently located care provider who does excellentwork. The company keeps tabs on providers through its internal“network scorecard,” which shows the quality of members' experienceand their access to health care in different regions.

|A research team at Oscar “is responsible for defining andevaluating the quality of the network on an ongoing basis,” writesNick Reber, the Vice President of Provider Strategy &Operations at Oscar, on the company's website.

|“Instead of members having to sift through that phone book, wehelp them find the right care provider,” Norella says.

|'Deeply integrating' with care providers

|

Like many other insurance carriers, Oscar has recognized that ithas access to data and member information that would help careproviders become more efficient and effective. And it's working toshare what it knows.

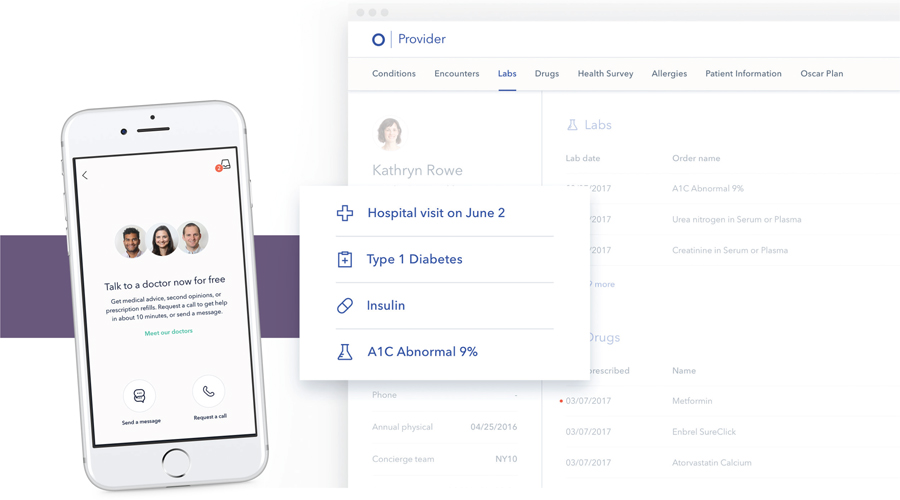

|“We're building tools for providers that will help them getaccess to member data, including their health history, lab results,allergies and prescription information,” Norella explains. “We'realso integrating with their systems so members can do onlineappointment booking, and we are continuing to roll out newfeatures.”

|One of those features is Oscar's clinical dashboard, describedin a blog post by Oscar Chief Technology Officer Dr. Alan Warren as“a tool that gives doctors a more holistic view—Oscar's view—into apatient's medical journey and flags clinically relevantinformation.”

|Warren added that the clinical dashboard “synthesizes a member'shealth history, medical encounters, lab results, active and pastprescriptions, hospital admits and discharge alerts, allergies andmore into a readable profile of a member's current state ofhealth.”

|The company also built integrations with its telemedicinefeature, as well as hospital systems, so that a physician who'spressed for time can quickly and easily see and scan any patient'scurrent health information without having to pull up and siftthrough an entire health record.

|A concierge experience

|

“Our underlying philosophy is very focused on the consumer,”notes Norella. “We don't just get involved with our members afterthey pay a claim; we like to think of ourselves as the entry pointinto their care experience.”

|What does that mean, exactly?

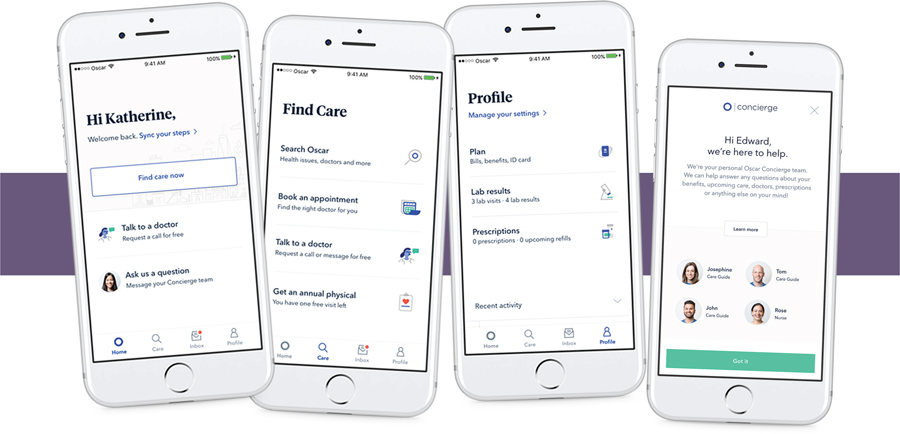

|Every Oscar member has a concierge team dedicated to theirhealth care service. That team includes three “care guides” and anurse. “These people can answer any questions members have,”Norella says, “whether they have a question about a bill, need helpfinding a doctor, or 'My doctor told me to do this, can you help mefigure it out?'”

|Oscar was also one of the first health insurance carriers tooffer a free 24/7 telemedicine feature, according to Norella, whichgives members access to a care provider without needing to book anappointment or even leave the house.

|And the company is “continuing to roll out member-centricfeatures, like a health center for primary care in Brooklyn andonline appointment booking,” she adds. “Everything we're doing isproviding our members with an experience that makes it extremelyeasy to get care, whether they need a lot of care for an ongoingmedical condition or whether they only occasionally need care.”

|Bringing it to business

|In 2017, Oscar began opening up its plans to businesses, inaddition to the individual health insurance market. Right now,Oscar for Business is live in New York, and Norella says that(pending regulatory approval) it's planning to roll out Oscar forBusiness in New Jersey, Tennessee and California in 2018.

|“We're rolling it out into additional markets in 2018 andcontinuing to iterate and improve on that experience for brokersand benefit administrators to make the group insurance side ofthings as easy as we've made the individual side of things,” shesays.

|“We're giving benefit administrators that same concierge levelof service, with dedicated support reps who can help with anythingand digital tools to manage the benefits,” Norella adds. “We knowbenefits administrators have a million things going on, and we arehere to take the load off of them.”

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.