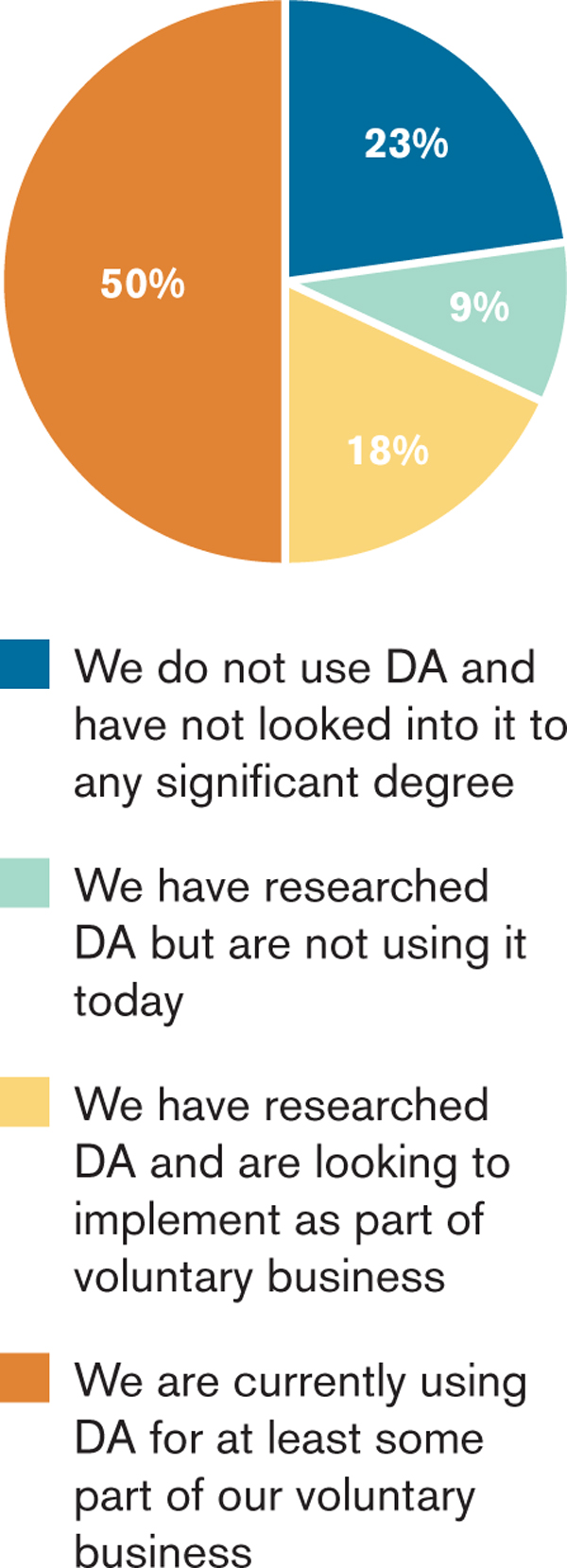

More companies are turning to the insights data analytics can provide to theirbusiness—and voluntary benefit manufacturers are no exception. Arecent Eastbridge survey on the topic revealed that 50 percent ofcarriers are currently using data analytics for at least some pieceof their voluntary business. Another 20 percent are planning toimplement analytics in the near future. These carriers are lookingto use this data to help them better understand customer needs,increase persistency and provide better customer service.

|Although most carriers are drawing on data from their administrative systems, many are also miningdata from their billing and enrollment systems. Some are going sofar as to build small internal teams dedicated to this effort,while others have chosen to outsource this type of analysis.

|Clearly, the era of big data is creeping into the voluntaryindustry, and for many carriers, this information has the potentialto pay big dividends. But as product manufacturers and othervoluntary players further invest in analytics, it's important notto be left behind and squeezed out of the information game. Brokerswho don't gain insights from their own data are likely to findcarriers knowing more about their business than they do.

|So, what are you doing to take advantage of the data in your ownoperations? Do you know the metrics of your business, or are yourunning on intuition alone?

|Consider client satisfaction, for example. Like most brokers,you may have a general sense of your customers' satisfactionlevels. But do you really know the details? Do you pollyour clients in a way that allows you to compare their needs?Conducting client surveys is one way to identify trends occurringin your own backyard.

|What about your own systems? Looking at participation throughthe lens of employee access is one thing. But could you go downanother layer? What might we learn from an analysis of productsequencing during enrollment, or from the total number of benefitsoffered? Understanding these types of statistics can help you tellbetter stories and get better results. With many employers leaningtoward self-service and other more “hands-off” enrollmentstrategies, helping your client see the outcomes of variousenrollment strategies may assist you in keeping or gaining theemployee access you need, not to mention helping you earn morecommissions.

|Keep in mind that it doesn't all have to fall completely on yourshoulders. Most producers can't or don't want to spend their nightsand weekends cobbling together spreadsheets of information. That'swhy many of them coordinate this data with their enrollment,benefit administration, payroll or even billing vendors. Lean onthese organizations for the information you need to better serveyour clients, and consider their insights when choosing yourcarrier partners.

|

As data analytics gets more sophisticated in the voluntaryindustry, remember that you shouldn't be at the bottom of the datafood chain. If you take the time to uncover trends in your ownbusiness, you'll be more confident in where to focus your effortsand, ultimately, where to achieve greater results and income. Thealternative may be to find yourself reacting to the competitioninstead of surpassing it.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.