Investors see an opportunity tohelp companies gain control over their health-insurance costs whileproviding better, more convenient care for their workers. (Photo:Shutterstock)

Investors see an opportunity tohelp companies gain control over their health-insurance costs whileproviding better, more convenient care for their workers. (Photo:Shutterstock)

A group of investors is putting up $165 million to fuel anexpansion of Paladina Health, bringing a recent surge of private funds flowing into companies that runprimary-care clinics to more than ahalf-billion dollars.

|The venture capital firm New Enterprise Associates is leadingthe investment after acquiring Paladina for a reported $100 millionearlier this year from dialysis provider DaVita Inc. Paladina,which runs medical clinics for employers, plans to use the money tobuild new clinics and acquire other firms.

|Related: Direct primary care helps employers get more whilepaying less

|Operators like Paladina promise companies a way to gain controlover their health-insurance costs, while providing better, moreconvenient care for their workers. Employers are increasingly involving themselves more deeplyin the health-care system to rein in spending, after efforts to cutcosts through high-deductible plans and other changes fellshort.

|“Employers are under incredible pressure from a cost basis,”said Scott Shreeve, chief executive officer of Crossover Health,another operator of workplace clinics. “They're starting to realizethat this is the last part of their supply chain that they reallydon't manage.”

|

Investors are focusing on primary care for its potential to helplimit costs and restructure care in other parts of the $3.5trillion U.S. health system. Primary-care physicians, who are amongthe cheapest doctors to employ, can play a big rolein helping patients navigate the system, reducing the need forcostly tests, specialist visits and hospital stays. Insurers andthe U.S. government are increasingly striking deals where the careproviders get to keep some of those savings for themselves, apotentially lucrative arrangement.

|“There's a lot of momentum behind providing value-based care,”said Chris Miller, Paladina's CEO. “Everyone is seeing health-carecosts rise dramatically.”

|Carlyle's Move

Other private investors have also recently put large sums intoworkplace clinics. The private-equity firmCarlyle Group LP is investing up to $350 million in One Medical,which is also working to sign up employer clients for its clinics.Iora Health, which operates primary-care sites for elderly patientsin the U.S. Medicare program, raised $100 million earlier thisyear.

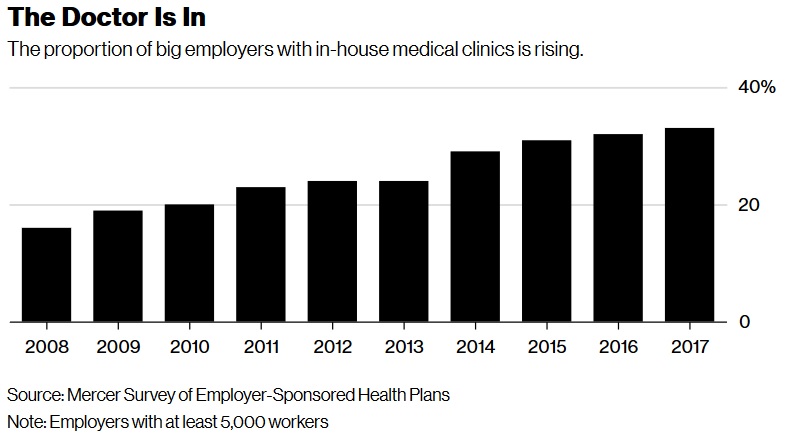

|About 33 percent of companies with more than 5,000 employeesoffer clinics on or near their work sites, up from 24 percent fiveyears ago, according to an annual survey conducted by theconsulting firm Mercer.

|Companies like Paladina and One Medical promise savings fromkeeping workers healthy and out of the hospital, and by providingthem with quick access to medical care without the need for a visitto an urgent-care clinic or emergency room. Denver-based Paladinasays its doctors can help guide patients, making sure they seespecialists who provide care at a low cost.

|“Our primary-care physicians become the quarterback of care,”Miller said. “We can save patients money by doing things that costa lot less.”

|Striking Deals

The bets on transforming health care extend beyond the clinicinvestments. CVS Health Corp. is acquiring the health insurer AetnaInc., wagering that the combined firm can improve care forcustomers by turning CVS stores into health hubs. UnitedHealthGroup Inc.'s OptumCare unit has been on a doctor-buying spree,building a collection of at least 30,000 doctors, including a $4.9billion deal to acquire physician groups from DaVita.

|Meanwhile, companies like Walmart Inc. and General Motors Co.are striking deals directly with health systems to care for theirworkers. Amazon.com Inc., Berkshire Hathaway Inc. and JPMorganChase & Co. hired the surgeon and journalist Atul Gawande tolead a joint venture that's aiming to improve care and lower costsfor their workers.

|“Employers are trying to be good stewards of their health-carespending and get the most value they can,” said Mercer's JeffDobro, who consults with employers on how to work with hospitalsand other health-care providers. “They're like, Why have we beenasleep at the wheel for so many decades?”

|Health-care investors including Oak HC/FT, Alta Partners, andGreenspring Associates are also investing in Paladina, according toa statement.

|Paladina will use its new funds to expand into additionalmarkets and may buy some similar companies in the next severalmonths, Miller said. The company now has 53 clinics in 10 states.Over time, Paladina will consider caring for Medicare patients aswell, Miller said.

|A recent study from RAND provides some support for theworkplace-clinic strategy. Researchers found that opening healthclinics in schools was associated with lower health costs andhospital visits among teachers who used them.

|Amir Dan Rubin, CEO of One Medical, said his company will usethe Carlyle funds to more than double the number of clinics itoperates, from 72 currently. The company operates in eight cities,and plans to expand to more locations as it seeks to sign up moreemployers, he said. In July, One Medical announced plans to enterSan Diego next year.

|Carlyle is investing roughly $220 million into One Medical, andwill purchase about $130 million of shares from existing investors,Rubin said. Before the Carlyle investment, One Medical had raisedabout $180 million. Rubin declined to provide the currentvaluation.

|Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.