From the rush of open enrollmentto keeping pace in an ever changing industry, brokers areconstantly on the move. Connecting clients with the right benefitoptions comes from a deep understanding of emerging trends, newentrants, regional considerations and marketplace dynamics. Yet,the ability to best serve clients all comes down to one importantquestion: What do consumers want from a health plan?

From the rush of open enrollmentto keeping pace in an ever changing industry, brokers areconstantly on the move. Connecting clients with the right benefitoptions comes from a deep understanding of emerging trends, newentrants, regional considerations and marketplace dynamics. Yet,the ability to best serve clients all comes down to one importantquestion: What do consumers want from a health plan?

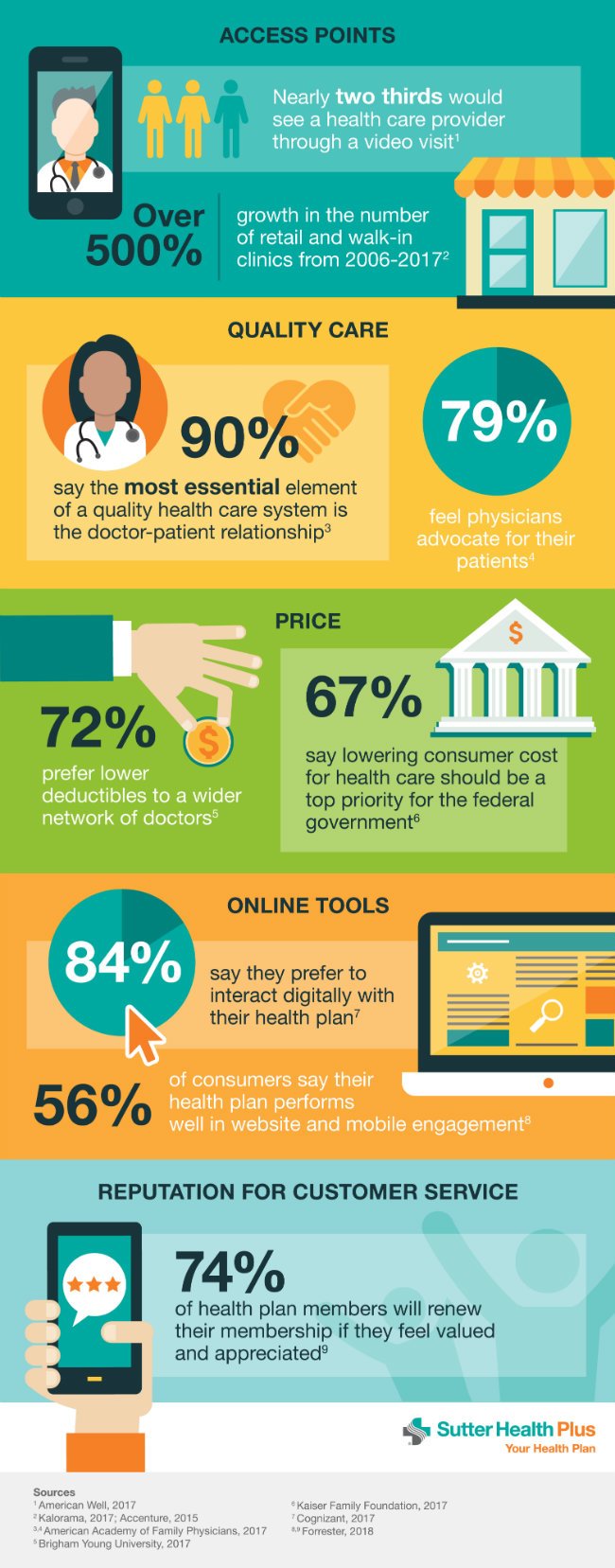

We reviewed data on consumer preferences in health care. Afterciting multiple studies from elite organizations including theAmerican Academy of Family Physicians, Brigham Young University andthe Kaiser Family Foundation, five core fundamentals stand out:convenient access points, quality care, affordability, easy-to-useonline tools and member-centric customer service.

|For brokers, recognizing these market demands can go a long wayin pairing a client and their employees with the best health planoptions available. Let’s examine each one.

|Access points Nearly two-thirds of consumerswould consider seeing a health care provider through a video visit,according to a 2017 American Well survey. Telemedicinetechnology appeals to varying demographics. Think of a ruralresident far removed from the nearest available clinic, or an urbanprofessional whose doctor visits get derailed by traffic andparking hassles. Communicating with a doctor by smartphone, laptopor tablet can often meet a person’s immediate needs, literally,where they are.

|On the brick-and-mortar side, retail clinics are in high demand across thenation. The number of these clinics — where consumers receiveeveryday primary care services like immunizations and treatment forminor illnesses — increased over 500 percent between 2006 and 2017,according to a recent Kalorama study.

|Quality care When consumers choose a healthcare team, relationships matter. According to a 2017 study by theAmerican Academy of Family Physicians, 90percent of consumers say the most essential element of a qualityhealth care system is the doctor-patient relationship. Because people want their doctors to truly care andadvocate on their behalf, HMO plans represent a strong option intoday’s market. The structure of HMO plans centers on a primarycare physician (PCP) partnering with patients to manage mostaspects of care, including referrals and care decisions.

|In the same survey, 95 percent of consumers were somewhat orvery satisfied with their overall relationship with theirphysician, and 80 percent said they had thought very little or notat all about changing physicians. This speaks volumes about theimportance of strong doctor/patient relationships, and offeringclients a network of providers with a proven record ofquality.

|Price A 2017 Brigham Young University study stated that 72 percent ofconsumers polled would prefer a lower deductible versus a widernetwork of doctors. This indicates that cost is a deciding factorfor about three-quarters of health plan shoppers. When developinghealth plan offerings for clients, the majority of options shouldcontinue promoting low deductibles, with a small selection of morerobust plans with additional benefits.

|Online tools Americans embrace onlinetechnology to manage many aspects of their health care. A 2016 Cognizant poll revealed 84 percent ofconsumers preferred to interact digitally with their health plans.But two years later, only 56 percent of consumers said their healthplans perform well on website and mobile management, according to a2018 Forrester study. Right now, there’s a biggap between what consumers want and what they are experiencing inthe digital arena. From member portals to secure messaging with acare team, brokers should play a crucial role in researching andeducating clients on accessing each health plan’s onlineofferings.

|Customer service Attention to the customer isvital in any service-based environment, and health care is nodifferent. Forrester’s 2018 study states that 74 percentof health plan members will renew their membership if they feelvalued and appreciated. A member’s interactions with customerservice staff shapes the sentiment for the health plan experience,the study concluded. How resolutely the health plan resolves commonissues — benefit, claims and eligibility inquiries, for example —determines the strength of this emotional connection. Brokersshould ask carriers to define their member experience andillustrate what sets them apart in the market.

|Conclusion We live in a fast-moving,hyper-connected world. The same technology that seems to make ourlives busier also drives healthy innovation and accessibility.Integrated care, concierge service, same-day in-person andvirtual solutions for everyday health needs, and 24/7 digitalaccess are not projections for the future — it’s all availableright here, right now.

|By staying in front of consumer trends and expectations, brokerscan direct clients to the best coverage for their dollars spent,including new ways to access quality care and convenient service —and showcase their expertise in the marketplace.

|

Rob Carnaroli serves as vice president of sales for Sutter HealthPlus, a Northern California health plan offering comprehensivecoverage and multiple commercial lines of business with access toSutter’s quality provider network—it’s the high-value, integratedcare experience today’s employers and consumers want.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.