In the opening weeksof 2019, pharma companies have boosted list prices on hundreds oftreatments, including widely used painkillers and cardiovasculardrugs. (Photo: Shutterstock)

In the opening weeksof 2019, pharma companies have boosted list prices on hundreds oftreatments, including widely used painkillers and cardiovasculardrugs. (Photo: Shutterstock)

Two years ago, fear that Donald Trump would clamp down on drug prices roiled the healthindustry's biggest annual gathering.

|Now, pushback on prices has become part of a newnormal for which many pharmaceutical executives have developed areliable script: Drug costs should reflect the value treatments deliver to patients, they say.Savings shouldn't come at the expense of innovation. And thecompanies they run have been restrained and transparent in takingprice increases.

|In response, the Trump administration and Congress are gearingup for a renewed campaign to bring the companies to heel. The topU.S. health official said Wednesday that prices must come down,while lawmakers prepared to roll out new proposals to limitincreases.

|Related: Drugmakers caught between pressure from investors,regulators

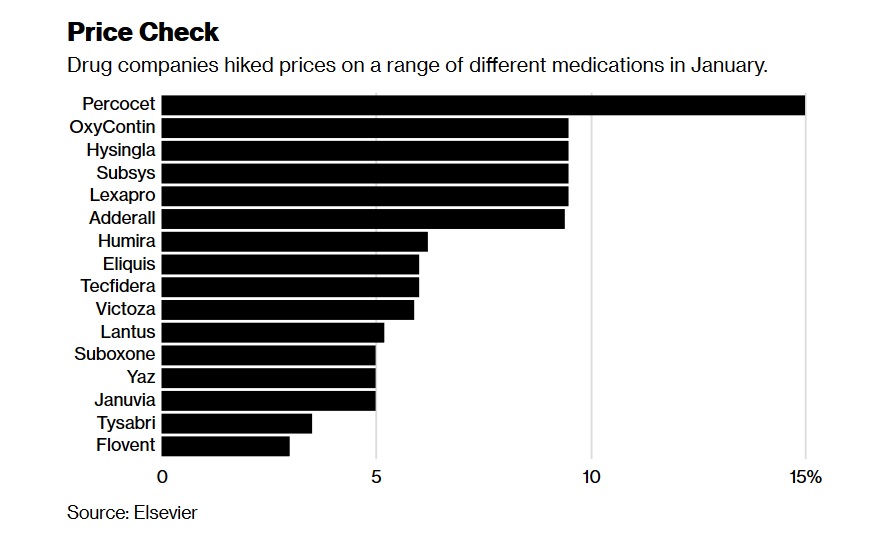

|Meanwhile, drug costs are marching higher. Days ahead of this week's J.P.Morgan Healthcare Conference in San Francisco — where a backdropwith a gold capsule and glittering, jewel-like DNA strand wasdraped behind panelists — pharma companies boosted list prices onhundreds of treatments, including widely used painkillers andcardiovascular drugs.

|This week, prices of dozens more medicines were raised,according to the health-information analytics company Elsevier.Among them was Novo Nordisk A/S type-2 diabetes drug Victoza, whichwas boosted 5.9 percent. The company said in a statement that it'skept annual list-price increases below 10 percent, in accordancewith an earlier pledge.

| Despite the current spotlight,some executives say the controversy is focused on the wrongissues.

Despite the current spotlight,some executives say the controversy is focused on the wrongissues.

“It's not a real problem; it's all politics,” said BioMarinPharmaceutical Inc. Chief Executive Jean-Jacques Bienaime in aninterview on the eve of the J.P. Morgan conference.

|Washington has been watching the recent price moves with growingimpatience. On Tuesday, Trump summoned his top health officials tothe White House to discuss the increases, which he also lashed outat in a weekend tweet. Last year, Trump persuaded some companies topause planned increases.

|Senator Bernie Sanders, the Vermont independent, andRepresentative Elijah Cummings, a Democrat from Maryland, plan tointroduce drug-pricing legislation Thursday, according to a personfamiliar with the matter.

|The bills would authorize importation of cheaper drugs fromabroad, let Medicare negotiate prescription prices and require thegovernment to list “excessively priced” treatments. The measuresalso would permit generic-drug companies to sell lower-costversions of medicines that still have patent protection if brandedprices climb too high.

|Cummings indicated on Wednesday that there would be publichearings on drug prices.

|Industry figures say the price issue is more nuanced than thepublic debate. Several executives said this year's increases havebeen modest. Others said companies should be compensated for takingrisks that lead to treatments for once-intractable diseases.

|“The price debate goes on, and those who are able to innovatewill be rewarded for their innovation,” said Michel Vounatsos, CEOof Biogen Inc. “This is what this country stands for.”

|Good behavior

The Trump administration last year issued a blueprint for lowering pharmaceuticalcosts. The proposal included indexing drug prices paid by programslike Medicare to what governments in other countries pay. It alsoasked pharmaceutical companies to include prices in TV ads.

|Variations on those ideas have been taken up by some companies.Eli Lilly & Co., which this week agreed to acquirecancer-treatment maker Loxo Oncology Inc. for $8 billion, said itwould direct TV-ad viewers to websites with more comprehensivepricing information.

|The administration also praised a handful of pharmaceuticalgiants for cutting prices.

|“We've seen some good behavior from companies such as Merck,Gilead and Amgen, who announced lower prices for their drugs,”Health Secretary Alex Azar, a former executive of Eli Lilly,tweeted on Wednesday. “We need to see more.”

|Azar said that the administration would continue to look forways to push down list prices of drugs, adding “prices must comedown.”

|State and local governments are also pushing for savings. As theindustry celebrated itself in San Francisco, California's newgovernor proposed using the state's bargaining muscle to negotiatelower prices. And New York City's mayor floated a plan to spend$100 million to provide affordable health care to residents.

|Innovation's cost

Some drugmakers at the J.P. Morgan summit drew a line betweenthe high cost of innovative treatments for uncommon diseases andthe steady drumbeat of increases for older products.

|“What frustrates me the most when we talk about this issue,we're often talking about the most impactful, innovative therapies.Those are a little fraction of the actual cost of health care,”said Douglas Ingram, CEO of Sarepta Therapeutics Inc., the maker ofa therapy for a rare form of muscular dystrophy.

|“The great bulk of expense that is potentially wasteful is notcoming from innovative therapies that treat rare disease,” Ingramsaid on the sidelines of the conference. “It's coming from, amongother things, old drugs that continue to be given price increaseswithout justification year over year over year.”

|Other executives said patients themselves weren't spending theirown money on the most innovative and expensive medicines becauseinsurers and other payers bear most of the cost. Spark TherapeuticsInc. Chief Business Officer Dan Faga said at the parallel BiotechShowcase conference that the company has shipped 75 vials ofLuxturna, a new gene therapy for rare inherited blindness that ispriced at $850,000, or $425,000 per eye.

|“Not one patient has paid anything out of pocket,” saidFaga.

|New equilibrium

In a presentation Tuesday, Amgen Inc. CEO Robert Bradway saidthe industry's growth would be driven by the number of patientstaking prescription drugs, not price increases for existingtherapies.

|“It's not going to be feasible or practical” to grow throughprice hikes alone, Bradway said.

|The head of the $126 billion biotechnology giant highlighted itsgrowing biosimilar business. Biosimilars are akin to generic drugs,essentially lower-cost copycats of complex therapies like certaincancer treatments. But biosimilars have been slow to reach the U.S.market because of contracting strategies and legal skirmishes overintellectual property.

|Such battles are likely to help keep the fight overpharmaceutical costs front and center for some time.

|“Drug pricing is going to continue to be an issue goingforward,” said Amgen Vice President David Piacquad. “You're goingto see a new equilibrium.”

|— With assistance by Rebecca Spalding, James Paton, andBailey Lipschultz

|Read more:

- New bipartisan bill targets drug prices–andMylan

- Merck lowers prices as Trump's attacks on drugprices gain steam

- Reference-based pricing: a panacea for high drugprices?

Copyright 2019 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.