Anthem wants IngenioRX to beless focused on rebates and more intent on keeping drug costs aslow as possible. (Photo: Diego M. Radzinschi/THE NATIONAL LAWJOURNAL)

Anthem wants IngenioRX to beless focused on rebates and more intent on keeping drug costs aslow as possible. (Photo: Diego M. Radzinschi/THE NATIONAL LAWJOURNAL)

CVS Health Corp. and Cigna Inc. spent a combined $122 billion on Aetna Inc. andExpress Scripts Holding Co. in deals that linked health insurerswith pharmacy benefit managers, the health-caremiddlemen that negotiate drug costs. Their rival Anthem Inc. thinksit can do the same thing while saving money instead of spendingit.

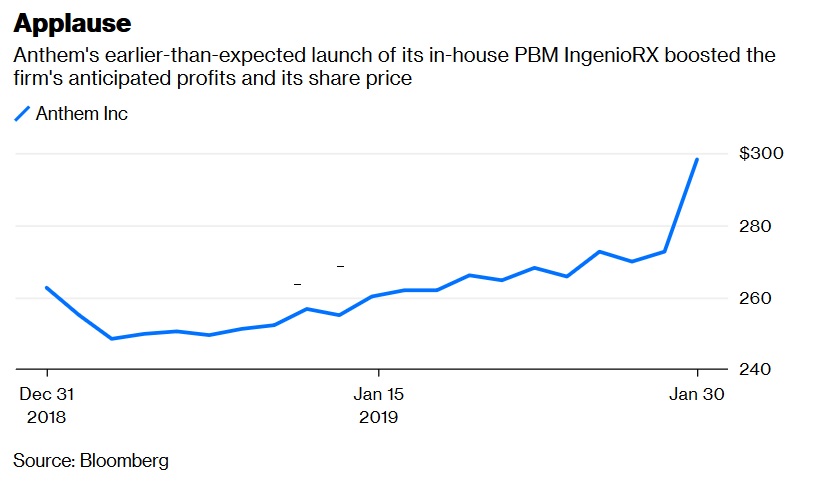

|Along with fourth-quarter profit that beat analyst expectationsWednesday, Anthem said it is accelerating the launch of itsin-house PBM IngenioRX to March from apreviously planned start time in 2020. The company also announcedhigher 2019 profit guidance than analysts were expecting because itanticipates significant drug-cost savings. Investors seemedenthused, sending Anthem's shares higher by a meaty 10 percent.

|Related: 3 ways Anthem seems… different

|Anthem has a lot to prove. Building a drug-price negotiatingunit from scratch isn't trivial, and the company is doing it on avery tight timeline. But it arguably has the right ambitions andstrategy.

|

Negotiating drug costs is all about scale. PBMs can extractrebates from drugmakers because they can nudge patients to use onesimilar drug over another, and make medicines trickier to obtain.The more prescriptions it can manage, the bigger the rebate it canextract. Taking a cut of these rebates has traditionally been amajor source of profit for PBMs.

|Anthem is America's second-largest insurer, so IngenioRx won'tbe a total minnow. It's also borrowing some of CVS's scale, as therival company will process claims and fill prescriptions forIngenio for five years. But Anthem's PBM will still be far smallerthan those of its rivals, which also include UnitedHealthGroupInc.'s Optum unit. So in order to compete and reach its veryambitious post-transition goal of $4 billion a year in annual costsavings, Anthem will have to create a very different sort ofPBM.

|Existing PBMs have been accused of focusing on maximizingprofitable drugmaker rebates at the expense of patients and overalldrug costs. Anthem sued its previous PBM partner Express Scripts in2016 for allegedly overcharging it by $3 billion a year for drugs.That touched off a messy dispute that eventually led to Anthem'scurrent strategic shift.

|Anthem wants IngenioRX to be less focused on rebates and more intent on keeping drug costsas low as possible. Starting from scratch has its advantages onthat front. For one, the company doesn't have a legacy business totransform, or a giant new company to integrate. That should give itan advantage in its effort to pioneer a new model. With CVShandling a lot of the infrastructure, Anthem can focus onintegrating IngenioRx with its insurance business in order to pushoverall health spending lower.

|Anthem has already pursued cost-control strategies that anin-house PBM could push even further. One of its units was able tosafely switch Medicare patients from expensive newer insulins tocheaper older drugs. Patients and the health system as a wholesaved a significant amount of money. A more rebate-focusedorganization would be less inclined to do this. Newer insulins likeLantus are among the most heavily rebated medicines around, andhave been quite profitable for PBMs.

|If Anthem is serious about reinventing the PBM, IngenioRx shouldhelp it pursue more of these kinds of opportunities – and, with theearlier launch, sooner than investors thought.

|Max Nisen ([email protected]) is aBloomberg Opinion columnist covering biotech, pharma and healthcare. He previously wrote about management and corporate strategyfor Quartz and Business Insider. This column does not necessarilyreflect the opinion of the editorial board or Bloomberg LP and itsowners. To contact the editor responsible for this story:Beth Williams at [email protected].

|Copyright 2019 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.