Although often underestimated by benefit professionals, savvyadvisors (i.e., brokers and agents) recognize the big potentialwithin the small case (99 or fewer employees) market. This segmentaccounts for 98 percent of all private U.S. businesses and employsone-third of the nation's private workforce.

|Insurance benefits have become increasingly available atsmall businesses since 2012. This trendcoincides with an improved business climate for small employers.Three in 10 of these firms say that they are expanding, up from 19percent expressing similar optimism six years earlier.

|Related: 3 ways to position your small business benefitsoffering for success in 2019

|According to new LIMRA research, approximately 70 percent ofsmall employers offering insurance benefits obtained coverage viaan agent or broker. However, this person has not necessarilyachieved “advisor status” in the employer's mind.

|Only 53 percent of these businesses indicate that they presentlyhave an insurance benefit advisor. Several factors likelycontribute to this disconnect, though advisors clearly need to gobeyond facilitating the purchase process in order for employers toconsider them a trusted business partner.

|Small businesses are also uncertain about the necessity of theadvisor role. Despite having fewer benefits resources (e.g., HumanResources staff) than larger organizations, 45 percent believe thatthey could obtain insurance benefits without the help of aninsurance professional. This perception is even higher amongemployers that already offer insurance to their workforce.

|In spite of this skepticism, most clients appear satisfied withtheir present relationships. More than 4 in 5 believe that theirinsurance benefit professional provides valuable insight andadvice, not just transactional support. When looking forward, manyof these businesses envision this relationship remaining stable orexpanding. One in three expects their advisor to become moreimportant over time (Figure 1).

|

Figure 1: Employer outlook for their advisorrelationship

|Small Businesses Currently Using Insurance Advisors

|A trusted advisor relationship is likely developing atthese firms. How do they compare to employers holding a lessoptimistic outlook? Our research identifies three importantdifferences. Small businesses anticipating an enhanced relationshipwith their advisor:

- More often work with other advisors,specifically, for retirement or pension benefits, executivebenefits, and annuities and investments. Theseemployers are more likely to use agents and brokers for otherbusiness needs. A positive experience with an advisor in one facetmay prompt them to seek out similar partnerships in otherareas.

- Appear more open to working with advisors affiliatedwith a single carrier. While these employers still favorindependent brokers, this preference is subdued compared to theless enthusiastic small businesses. This underscores an opportunityfor the agents representing one insurer to compete in the smallbusinesses segment. Keep in mind that many of these employers donot yet offer any insurance benefits, suggestingsignificant untapped market potential.

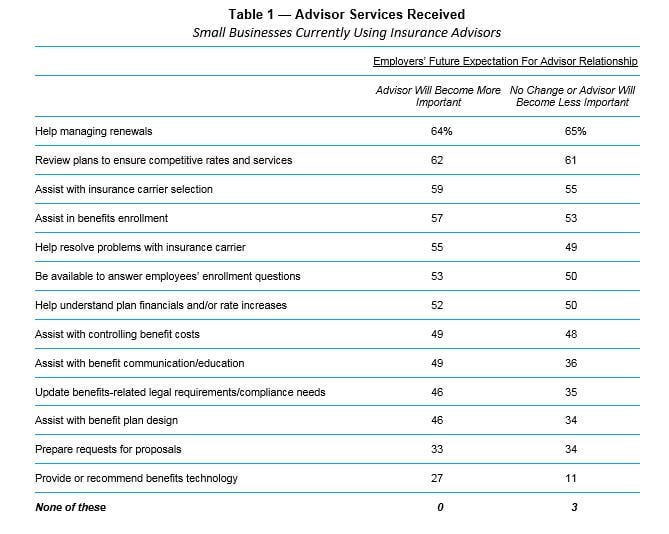

- Are more connected to certain advisorservices. A LIMRA study examined 13 services related toinsurance benefits that employers sometimes receive from theiradvisor. On average, small businesses receive six of theseservices. Helping employers manage renewals and reviewing theirexisting plans are the most widely available items, with no oneservice provided to more than 2 in 3 employers (Table 1).

However, firms that expect their advisor's importance to growhave greater access to:

- assistance with benefits communication

- legal/compliance updates

- help with plan design, and

- benefits technology access/recommendations

When delivered effectively, these items can help advisors cementbonds with existing clients, and likely, generate additionalopportunities in the future.

|Ron Neyer's area of expertise is monitoring andcommunicating trends in workplace insurance distribution. Hemanages carrier practice studies, as well as research projectsfocusing on employers, employees, and brokers/advisors.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.