You probably already evaluate the portabilityof each product as a part of your carrier/product selection, but doyou fully understand the programming and support they offer?(Photo: Shutterstock)

You probably already evaluate the portabilityof each product as a part of your carrier/product selection, but doyou fully understand the programming and support they offer?(Photo: Shutterstock)

In part one of this series, we posited that to getthe most from a sale, both a highly integrated communicationstrategy for initial enrollment and a well-defined re-enrollmentstrategy were essential. But is there another piece of low-hangingfruit that you are overlooking to help maximize case revenue?

|As workforce demographics change, and as theaverage employee tenure at any given company grows shorter, whatactions are you and your carrier partners taking when employeeschange jobs or retire?

| Bonnie Brazzell and Nick Rockwell,Eastbridge Consulting Group, Inc.

Bonnie Brazzell and Nick Rockwell,Eastbridge Consulting Group, Inc.

Related: How to prevent turnover of toptalent

|You probably already evaluate the portability of each product as a part of yourcarrier/product selection to ensure employees have the contractualright to keep their coverage. You may also evaluate whether theemployee can keep the same benefits at the same rates or whetherthere are restrictions. This type of assessment is a great startingplace.

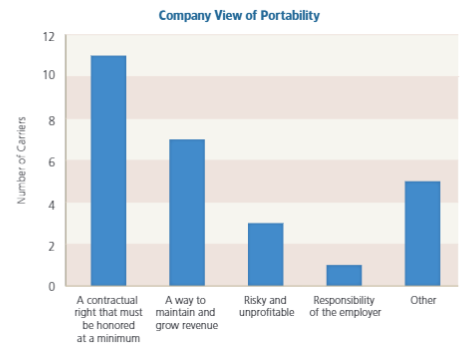

|If you view portability like many insurance carriers do, yourevaluation process may stop there. This graph from our conservationresearch suggests that more companies view portability as acontractual right that must be honored at a minimum, as opposed tobeing a way to maintain and grow revenue.

However, you can do more to understand what kind of programmingand support your carrier partners have in place for ported policiesto safeguard your revenue stream and profitability for theircompany.

|Ask your carrier partners what their retention rate is forported policies. While a few carriers in the research list rates inthe double digits, one as high as 20 percent, most carriers retainbetween 5 percent and 8 percent of their policies through theirconservation efforts. In addition, many carriers do not trackpersistency at all. This question allows you to get a pulse on howserious the company is about retention.

|Do they pay commissions on ported coverage? Some do, some donot. Make sure incentives are aligned to their program.

|Do they send any communication directly to employees when theircoverage lapses? According to our recent Billing Practices report,60 percent of carriers do not send any communication directly toemployees when their coverage lapses or if the entire group lapses.Many carriers are hands off and see employee notification as theemployer's responsibility. This is an area where you may win pointswith employers by advocating for less employer involvement in thisprocess and more carrier initiative.

|If your carrier sends a communication, what kind ofcommunication is it? Our research has found that most carriers senda simple premium due notice and only a few take the opportunity tore-market and re-educate the employee on the value of theircoverage through marketing communications or customer serviceinteraction. Demand more.

|Armed with a deeper understanding of your carrier partner'sport-marketing program, you bring a nuanced approach to carrierselection to ensure that you are truly getting the most from asale.

|Read more:

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.