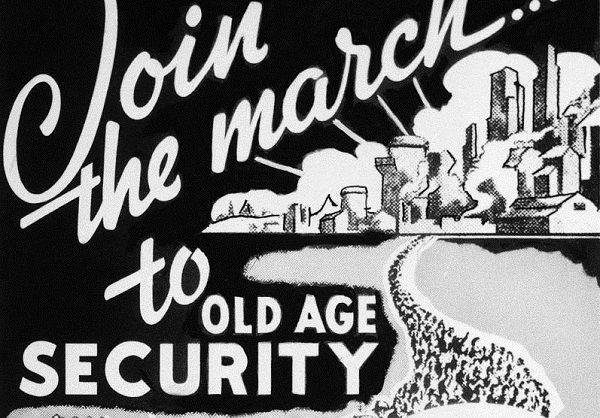

A 1936 poster issued by the SocialSecurity Board to promote the application for Social Security cardsfor Americans. (AP Photo)

A 1936 poster issued by the SocialSecurity Board to promote the application for Social Security cardsfor Americans. (AP Photo)

Although the deficit in the Social Security program is expected to increaseeven prior to the coronavirus pandemic, a new report from the Center for Retirement Researchat Boston College points out that the program's financing shortfallover the next 75 years is "manageable" and, once the pandemic hasbeen dealt with, can—and should—be addressed to allow it tocontinue to pay full promised benefits to retirees.

|Fewer babies, reduced payroll taxes, low inflation andinterest rates

Four factors weigh on the 75-year deficit, which has increasedfrom 2.78 percent to 3.21 percent of taxable payroll. Those factorsare the following:

- repeal of the tax on high premium health plans, resulting inlower earnings and payroll taxes

- a lower assumed total fertility rate

- lower inflation, which reduces earnings and payroll taxesbefore it hits benefits

- and a lower interest rate, which means less discounting oflarge future deficits.

Between a lower fertility rate, which cuts the number of futureparticipants in the program, and a wave of retiring boomers, theratio of workers to retirees has fallen from about 3:1 to 2:1; thathas raised costs accordingly. When the effect of longer lifespansis added in—meaning that retirees collect benefits for a longerperiod of time—there is a problem along the road ahead.

|In addition, the Great Recession took a toll on the SocialSecurity trust fund, which had been expected not to be needed tohelp pay benefits until several years later than happened inactuality. Currently what's being drawn on is the interest on thetrust fund; but since payroll taxes are presently inadequate tocover all the legislated benefits they are intended to cover, thatmeans the program will have to start drawing on the principal inthe trust fund.

|However, says the report, not only does the trust fund depletiondate remain at 2035, payroll taxes will still be able to coverapproximately 79 percent of promised benefits. And the coronavirusis unlikely "to fundamentally alter the long-term financial statusof the program."

|What the pandemic has done, though, is to highlight howimportant the Social Security program is to millions of Americansand their financial well-being, as well as to pose potentialproblems that could be solved by policymakers as previous problemshave been.

|The report adds that there will be some effects of Covid-19 onsome groups of retirees: "To the extent that COVID-19 results in adecline in average earnings in 2020, those born in 1960 (who turn60 in 2020) could see a permanent cut in their benefits. Theproblem arises because past earnings and the benefit formula areadjusted by Social Security's Average Wage Index." The resultingcalculations could result in a "notch" group.

|No public trustees since 2015

In addition, the report points out that there has been noreplacement of public trustees, who have been missing since 2015.Says the report, "These slots should be filled. Public trusteesplay an important role in overseeing the program and communicatingits status to the public. Their continued absence reflects afailure with the political process, not with the programitself."

|The report concludes, "[O]nce this crisis subsides, stabilizingSocial Security's finances should be a high priority to restoreconfidence in our ability to manage our fiscal policy and to assureworking Americans that they will receive the income they need inretirement. The long-run deficit can be eliminated only by puttingmore money into the system or by cutting benefits. There is nosilver bullet."

|READ MORE:

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.