(Photo: SusanaGonzalez/Bloomberg)

(Photo: SusanaGonzalez/Bloomberg)

The Treasury Department and Small BusinessAdministration released updated guidance Wednesday statingthat the SBA will deem all loans with original amounts under $2million to be in good faith, meaning the loans won't bechallenged.

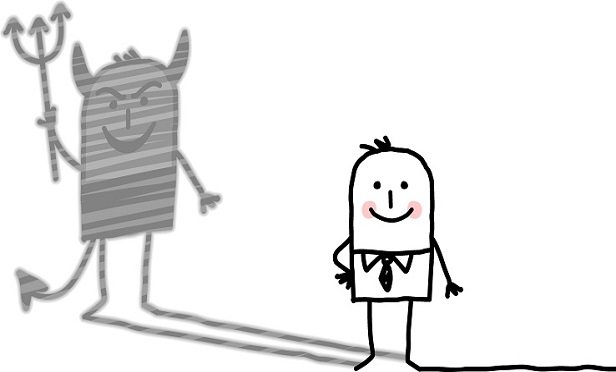

|Debate is ensuing as to whether the guidance gives loan takers alicense to steal or if it's a fair "walking back" of the SBA andTreasury's previous guidance.

|Question 46 of its updated FAQ asks: How will SBA reviewborrowers' required good-faith certification concerning thenecessity of their loan request?

|SBA says: "Any borrower that, together with its affiliates,received PPP loans with an original principal amount of less than$2 million will be deemed to have made the required certificationconcerning the necessity of the loan request in good faith. SBA hasdetermined that this safe harbor is appropriate because borrowerswith loans below this threshold are generally less likely to havehad access to adequate sources of liquidity in the current economicenvironment than borrowers that obtained larger loans."

|Jim Richards, founder and principal of RegTech Consulting, afinancial-crimes risk management firm in San Francisco, said in aLinkedIn post that the SBA's decision was "stunning."

|The SBA's decision "involves the 'good faith certification' of,among other things, that 'current economic uncertainty makes thisloan request necessary to support the ongoing operations of theapplicant,'" Richards said.

|"There will be grey areas where the borrower maybe didn't reallyneed the loan. But there will be situations where a borrower flatout lied about needing the loan — or grant if the loan isforgiven," according to Richards.

|With the updated FAQ, SBA "is essentially saying that as long asthe PPP loan is less than $2 million, borrowers can flat out lieabout needing the loan because SBA is not going to check — in fact,SBA deems these loans to be made in good faith. And for PPP loansof more than $2 million, if SBA catches the borrower in a flat outlie about needing the loan, as long as the borrower then pays theloan back, SBA won't pursue enforcement or refer the borrower toother agencies (e.g, the Department of Justice)," Richard said.

|The SBA said that consumers shouldreport any fraud incidents to its Office of Inspector General Hotline.

|Jeff Levine, lead financial planning nerd for Kitces.com and acolleague of Michael Kitces at Buckingham Wealth Partners, said Wednesday in a tweet that "while its great tofinally have some certainty on how the certification requirementwill be interpreted, Q&A #46 creates a significant moral hazardwith respect to the PPP program."

|Notably, Levine continued, Treasury "justgave businesses that made outrageously aggressive certificationswhat essentially amounts to a license to steal from the Americantaxpayer … as long as they 'only' stole $2 million or less. To beclear, many, if not most PPP loan recipients are likely welldeserving of such funds."

|Levine added: "But I can share w/ you that I have personallyspoken w/ several biz owners (both w/in and outside of thefinancial planning community), who absolutely, unequivocally, 100%pushed the boundaries (putting it lightly)."

|He said that, while he understood the SBA's rationale for thedecision — a need to focus limited resources on bigger audits —"there's a HUGE difference between saying 'We're going to FOCUS onthe bigger loans' and 'We're going to completely IGNORE smallerloans and ONLY look at the larger ones.'"

|Jeff Bialos, a partner at Eversheds Sutherlandin Washington, however, told ThinkAdvisor in aThursday email that characterizing the SBA's updatedguidance as a license to steal is "unfair."

|SBA and Treasury "effectively sought to retroactively move thegoal posts — and change the meaning of the economic certificationto mean that a party could not in good faith make it and obtainfunding if it had other sources of liquidity," Bialos said.

|"That position was subject to serious question," he continued."The CARES Act made it clear that availability of other credit, acondition of traditional SBA loans, did not apply to PPPloans."

|In short, "Congress made a conscious choice not to apply thatcriteria to PPP loans. It's well established that under the 'fairnotice' doctrine, you cannot prosecute a party for conduct that itdid not know was prohibited," Bialos said. "Certainly that is thesituation here. Numerous borrowers made good faith certificationsthat the 'uncertainty' required funding for their operations —without regard to whether other credit is available. That wasn't arequirement. It therefore would be unfair to seek legal actionagainst parties that took PPP funding under thiscertification."

|What SBA and Treasury "have therefore done is walk back theirmove of the goal posts in a fair manner," Bialos said.

|READ MORE:

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In