Source: Shutterstock.

Source: Shutterstock.

Consumers are increasingly concerned about their ability topay upcoming bills as the coronavirus continues to upend the U.S.economy, with many opening new credit cards or taking out personalloans to make ends meet, according to a survey conducted by the credit bureauTransUnion.

|In a survey of more than 2,000 adults, conducted in a two-dayspan in late May, 70% of consumers who reported being affectedfinancially by the pandemic said they were concerned about payingfuture bills. That figure reflected an increase from early May,when 66% of affected consumers reported having that concern.

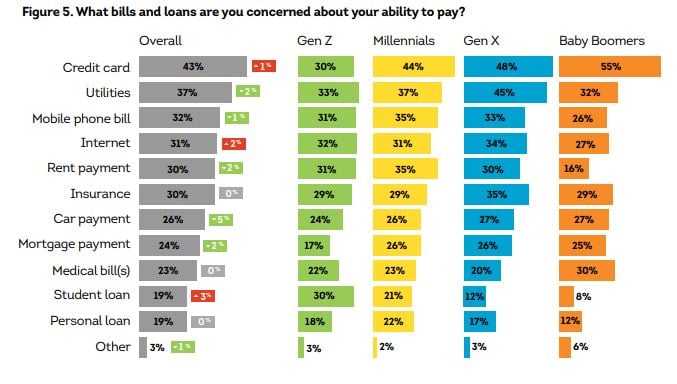

| Chart from TransUnion survey results.

Chart from TransUnion survey results.

TransUnion conducted its latest survey from May 28-29, in whatthe credit bureau referred to as "wave 9." An earlier survey wasconducted from May 4-5.

|The latest survey revealed growing economic anxiety, as moreconsumers cut back on saving for retirement. And as the benefit ofstimulus checks has diminished, consumers are increasingly eyeingloans and credit cards, the survey found.

|"Intent to apply for new credit is at its highest levels sinceearly March, with 15% intending to apply for personal loans and 12%intending to apply for new credit card," the TransUnion surveyfound. In the earlier survey, 12% of respondents said they intendedto apply for a personal loan, and 7% said they were intending toapply for a new credit card.

|The survey also revealed that African Americans are experiencinghigher-than-average financial hardship during the pandemic. Of theAfrican American respondents who said they were financiallyaffected by the pandemic, 32% reported job loss — an increase fromthe 26% who reported job loss in the prior survey.

|"Compared to impacted white consumers, impacted AfricanAmericans are disproportionately unable to pay bills and loans tomeet basic needs," TransUnion's survey said, noting that AfricanAmericans reported a higher inability to pay rent and to makeutility and car payments.

|READ MORE:

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.