A lot can change in just one year. Last summer, benefitsprofessionals anticipated the likely election of Hillary Clintonand the continuation and possible expansion of the Affordable CareAct. Now they are adjusting to the brave new world of a DonaldTrump administration and an uncertain future for national healthpolicy.

|Related: Trump approval rating tumbles after health carevote

|But the industry is taking the changes in stride, according tothe just-released 2017 BenefitsPRO Health Care Survey. Nearly 350professionals from all industry sectors (see sidebar) shared theirthoughts on current issues and what lies ahead for the remainder of2017 and beyond.

|More than one-half of respondents (55 percent) believe the Trumppresidency will have a positive effect on their business, while 32percent expect it to have a negative impact. Exactly one-half wouldlike to see the ACA retained and repaired, while 28 percent prefera gradual repeal and replace, and 22 percent want it repealed andreplaced immediately.

|Financial pulse

Although political issues may be fun to debate, sales willalways be the lifeblood of the industry. Some of the most revealingresponses in the survey show how benefits providers of all sizesview their financial situations. This starts with retention,because keeping a current client is every bit as important asgaining a new one.

|Related: Small biz owners sound off on health care &Trump

|The most significant client losses were in small-group accounts(less than 100 lives), where 47 percent of respondents reportbetween 1 percent and 24 percent of their clients dropped coveragein 2016. As might be expected, the ability to maintain coverageincreased as the size of the business increased.

|Twenty-five percent of brokers report their mid-market clients(101 to 500 lives) dropped coverage last year. This percentagedrops to 14 percent for large groups (501 to 3,000 lives) and 7percent for national accounts (more than 3,000 lives). Sixty-fourpercent of those surveyed expect the percentage of groups droppingcoverage to stay the same in 2017, while equal percentages (14percent) believe it will increase or decrease a little.

|Despite the losses, most brokers are optimistic about theirprospects for the rest of 2017. More than half (54 percent) ofthose who responded expect average health insurance commissions toincrease or at least remain the same this year. Thirty percentanticipate a decrease, but by no more than 25 percent. Only 4percent expect commissions to drop by more than half. Seventy-eightpercent expect total compensation from ancillary or bundled productsales to increase this year, while not a single respondent expectsdecreased sales.

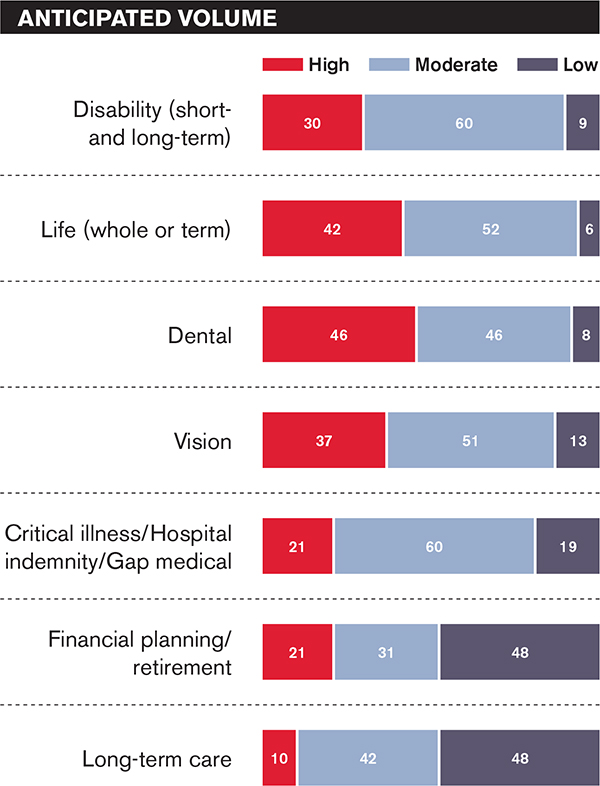

|Brokers are even more optimistic about health insuranceprospects for 2018. Fifty-six percent look forward to steady orincreased commissions, while only 18 percent expect a decrease. Agrowing portfolio of ancillary products to sell may be one reasonfor this optimism. BenefitsPRO asked whichproducts they intend to sell and what volume of each theyanticipate.

|Given these expectations, it's no surprise the voluntary benefitsector continues to grow. Fifty-five percent of respondents areneutral or strongly agree with the statement that they will usevoluntary benefits to offset anticipated commission losses fromhealth insurance this year. The same percentage views privateexchanges as an opportunity to sell more voluntaryproducts.

Brokers have a good idea of what it will take for them to sellmore voluntary products. When asked to rank their No. 1 criterion,they say lower prices (42 percent); simpler and more convenientenrollment options (28 percent); increased member and employereducation (17 percent); consumer life-stage bundles (8 percent);and carriers with better brands (8 percent).

|Related: 6 non-traditional voluntary trends for2017

||State exchange insights

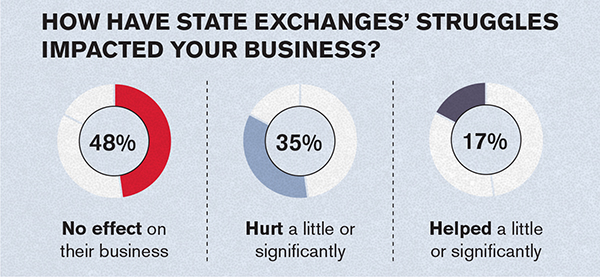

Although problems facing state exchanges under the ACA have beenwell publicized, their impact on brokers appears to be mixed.Nearly one-half (48 percent) of survey respondents say thestruggles of these exchanges have had no effect on their business.Thirty-five percent have been hurt a little or significantly, while17 percent have been helped a little or significantly.

One clue as to why the exchanges have no effect on so manybrokers is there is little demand to help individuals enroll.Thirty-four percent of respondents say their book of businessdoesn't handle individuals, and another 37 percent say demand iseither weak or non-existent. No wonder less than 10 percent sayenrolling individuals on the public exchange is worth theeffort.

|What about private exchanges? Nearly 6 in 10 of those respondingsay they do not have a private exchange partner for enrollment andbenefits administration. Twenty-six percent work with a singleprivate exchange partner, and 16 percent use two. Only 16 percenthave invested in developing their own proprietary private exchangetechnology.

|Related: Brokers giving up on ACA

|The nature of group clients continues to change. Nearly one-half(49 percent) of brokers say more of their accounts will use definedcontribution funding this year. The percentage varies by the sizeof the group. Brokers expect a move to defined contribution bybetween 1 percent and 24 percent of small groups; 39 percent ofsmall-market groups; 21 percent of large groups; and 15 percent ofnational accounts.

||Enrollment 101

The bottom line in the brokerage business is to engage withindividual or group clients and get them to enroll. Face-to-facemeetings are overwhelmingly the most common way to make thishappen.

|Related: Open enrollment: When preparation meetsopportunity

|Fifty-three percent of respondents say meeting in a groupsetting at the worksite is the primary enrollment technique, while36 percent cited one-on-one meetings in the workplace. However, 39percent say their top method is using an electronic enrollment toolindependently.

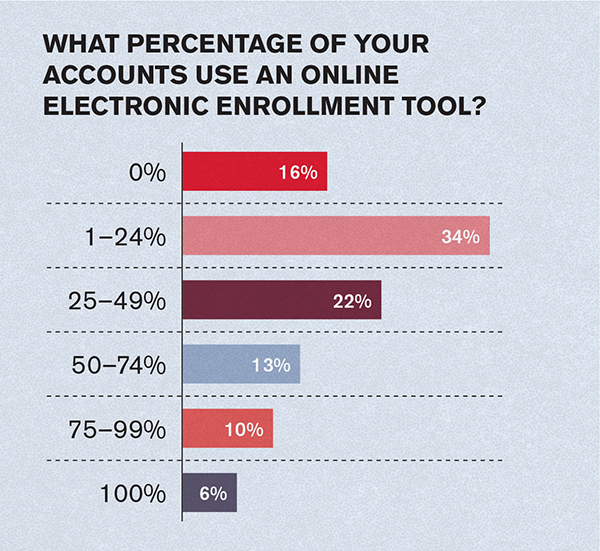

BenefitsPRO asked brokers what percentage of theirclients currently use an online electronic enrollment tool. Only 16percent say none do, and 6 percent say they all use thistechnology. Thirty-four percent say between 1 percent and 24percent do; 22 percent say from 25 percent to 49 percent; 13percent responded 50 percent to 74 percent; and 10 percent say 75percent to 100 percent.

|Sixty-five percent of brokers say offering enrollment or benefitadministration technology and/or an online solution to clients is acritical component of their value proposition. Only 10 percentdisagree.

|Carrier criteria

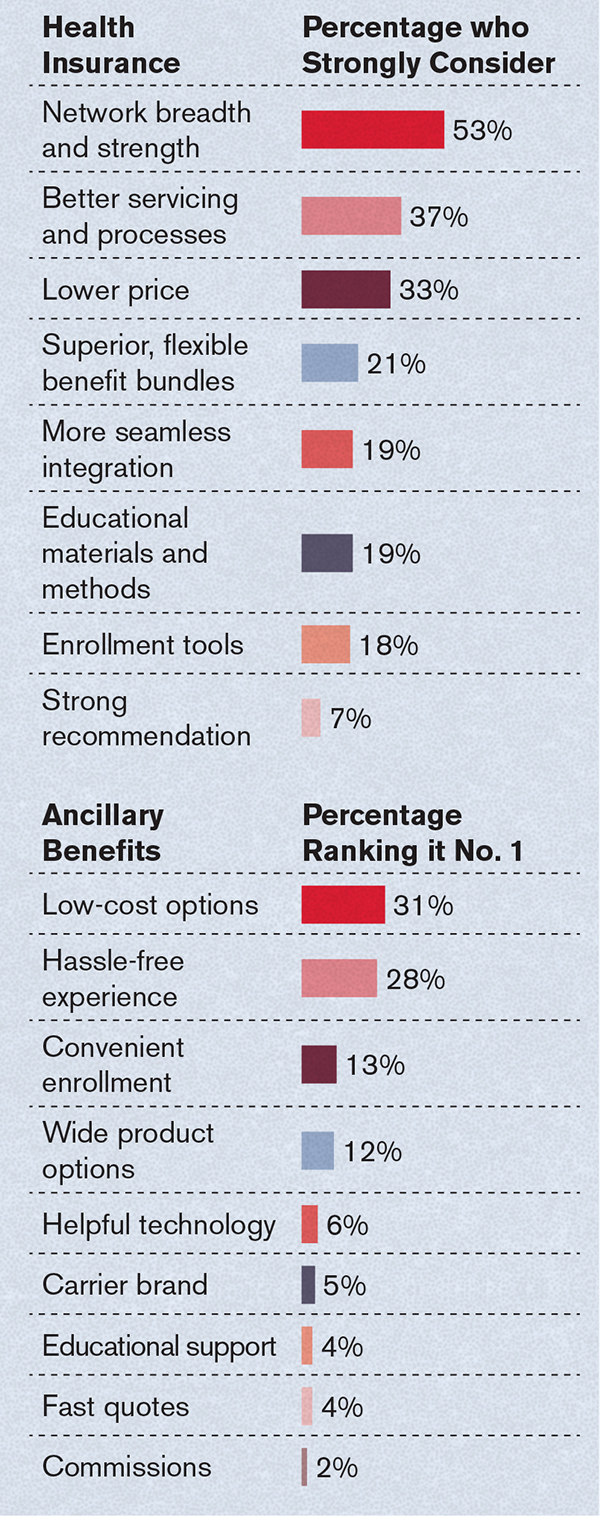

Clearly, the benefits selling industry is changing, and carriersneed to adjust or be left behind. Brokers have clear ideas of whatthey expect from carriers, both for health insurance and ancillaryproducts. The survey asked which factors they strongly consider inboth categories.

|

A look ahead

BenefitsPRO asked those taking the survey to lookinto their crystal ball and predict what may happen bothindustrywide and in their own companies in the future. It lookslike the merger-and-acquisition trend will continue over the nextfive years:

Twenty-seven percent expect their organization to acquire ormerge with another broker/agent organization.

The same percentage believes their company will buy out the bookof business of a retiring broker or agent.

Fourteen percent look for another broker/agent to acquire theirorganization.

Fourteen percent also say their company will leave the healthinsurance brokerage business.

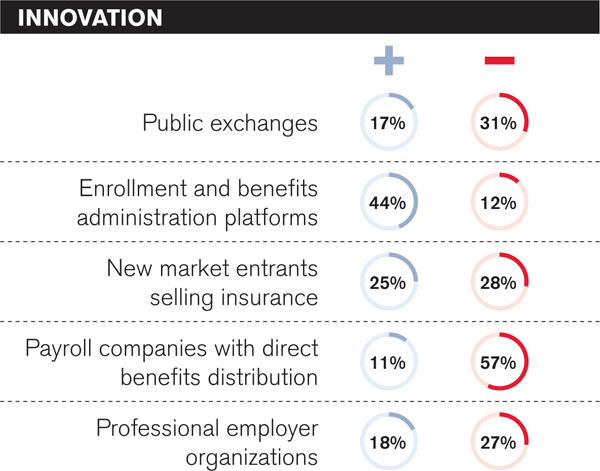

Brokers anticipate several innovations that could affectbusiness performance during the next three years. However, theydon't always agree on whether the impact will be positive ornegative.

|Many brokers report they expect to increase their focus on thefollowing services, which they already offer:

Promoting ancillary insurance coverage, 84 percent

Promoting health plan consumer engagement and health andwellness programs, 58 percent.

Promoting third-party consumer engagement and health andwellness programs, 43 percent.

And as for potential threats, 53 percent find the new wave ofdisruptive companies entering the industry to be “somewhatconcerning.”

|

Will any or all of these predictions come to pass? As theelection of 2016 showed, trying to predict the future can be achallenge. Be sure to check out the 2018 survey to stay on top ofthe latest trends.

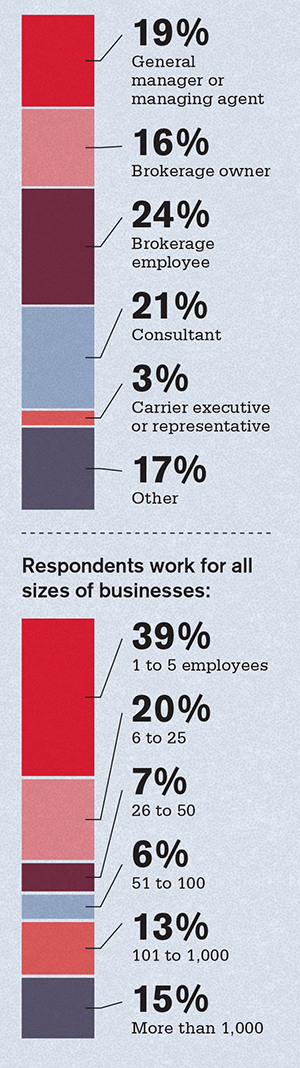

||Meet the survey respondents

The BenefitsPRO 2017 Health Care Survey was conducted fromFebruary through May. The 336 respondents represented most keypositions:

|

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.