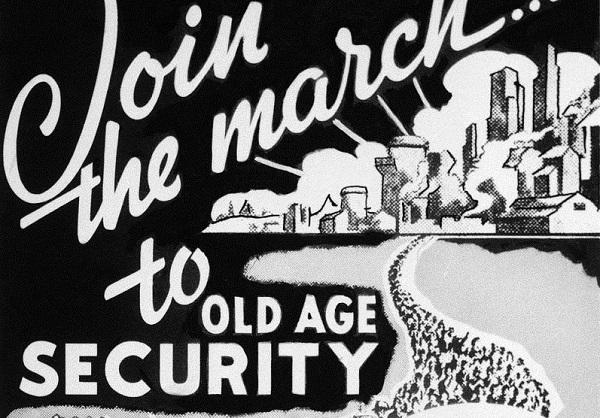

One think tank is addressing the question of how to reform SocialSecurity while also growing the economy. (Photo:Shutterstock)

One think tank is addressing the question of how to reform SocialSecurity while also growing the economy. (Photo:Shutterstock)

For decades, the fate of Social Security, the country's largest federalprogram, the largest source of retirement income for most seniors,and the second largest source of revenue for the TreasuryDepartment's coffers, has been well known.

|That hasn't kept lawmakers from dancing around the issue at themargins, if not avoiding the political third rail–a term coined bySpeaker of the House Tip O'Neil in the 1980s–altogether.

|The program's two trust funds will be exhausted by 2032,according to the Congressional Budget Office. Actuaries at theSocial Security Administration push that dateout to 2035. Either way, massive across-the-board cuts to allretires' scheduled benefits will be required absent changes in thelaw.

|Perhaps any discussion on reforming the imminently insolventprogram is good discussion. But Marc Goldwein, senior vicepresident and policy director at the Committee for a ResponsibleFederal Budget, has a "huge" problem with the ideasfloated on how to fix Social Security.

|"People are not putting the discussion in a growth context,"said Goldwein, the lead author of a new policy paper, PromotingEconomic Growth through Social Security Reform.

|"We always talk about Social Security reform in the context ofretirement and fiscal policy," he added. "But never as growthpolicy. What I want to happen is for people to start thinking aboutreform as an economic growth strategy. The most important idea inthe paper is we need to change the discussion."

|How can the largest "entitlement" program be a vehicle foreconomic growth?

The short answer: Through promoting more work among an agingworkforce, encouraging investment and retirement savings outside ofSocial Security, and bringing the program's revenues in line withits spending to assure fiscal sustainability.

|The long answer is technical and includes changes to the formulafor calculating benefits to include earnings after 35 years ofwork, raising the normal retirement and earliest eligibility agesby one year each, and creating a new Poverty Protection Benefit forthe most vulnerable Americans who can't work beyond age 62.

|To bring revenue in line with obligations, CRFB would phase in anew taxable minimum above today's $132,900 threshold, among othermeasures.

|What it does not do is increase payroll taxes, a cornerstone ofthe Social Security 2100 Act, which House Democrats are reportedlypositioning to move through the Ways and Means Committee.

|"I commend Rep. Larson," Goldwein said of John Larson, theConnecticut Democratic congressman, chair of the Ways and Means'Social Security subcommittee, and the initial sponsor of the SocialSecurity 2100 Act.

|"His bill shows the magnitude of how much needs to be done. Buthis way of reform isn't thinking about economicgrowth—the PennWharton Budget Model found it would shrink the economy by 2percent. And there is no way it would pass the Senate," saidGoldwein.

|Larson's bill would expand benefits for all Americans and createa baseline benefit of 125 percent of the poverty line. It wouldphase in an increase in the payroll tax for all workers, beginningwith a 0.1 increase starting in 2020, ultimately increasing theexisting payroll tax rate of 12.4 percent to 14.8 percent by2041.

|What kind of economic growth can be expected?

CRFB's paper claims the Pro-Growth Social Security Reformframework would significantly increase economic output over thelong term–-resulting in larger incomes, more wealth, and strongerpublic finances.

|The paper estimates the framework could increase Gross NationalProduct between 3.5 percent and 13 percent in 2050.

|Delaying the retirement age would create 1 to 3 percent ofgrowth in 2050. And recalibrating the benefit formula to accountfor all years of earnings would incentivize more people to stay inthe work force, leading to another 0.5 to 1.5 percent increase ineconomic activity, the paper says.

|Together, that would create a quarter point annual increase ineconomic growth, translating to an $8,000 increase in annualaverage income by 2050.

|"We are not saying this is the only way to get economic growthout of reform. What we are saying is there is a way to reformSocial Security and grow the economy," said Goldwein.

|One option for generating growth is to let Social Security'strust funds run dry and enact across-the-board benefit cuts. CBOsays that would generate 2.5 percent growth, less than CRFB'sframework, and what Goldwein calls the "dumbest way possible" toimplement reform.

|The faster growth projected under CRFB's framework would alsomitigate troubling federal debt projections, which the non-partisanthink tank says will be 160 percent of GDP by 2050. Under itsSocial Security reform model, faster growth and more tax revenuewould reduce the debt-to-GDP ratio by 20 percentage points.

|Supplemental Retirement Accounts

Under CRFB's framework, Congress would create SupplementalRetirement Accounts (SRAs).

|American workers would be automatically enrolled in SRAs at 2 to3 percent of wages, with the ability to opt out, and invested inlow-cost, well-diversified mutual funds that would be owned by thesavers.

|The result would be increases to national savings rates andincreased capital stock, both of which would add to economicgrowth.

|"The idea is not to replace Social Security, but to create moresavings on top of it," said Goldwein. "What better way to assureall Americans have access to a low-cost, safe retirement plan.Behavioral economics tells us most would not opt out of the plan.That would be good for retirement security. And good for theeconomy."

|Many of the ideas in CRFB's paper have been gestating withGoldwein for over a decade. He and authors Maya MacGuineas, CRFB'spresident, and Chris Towner, a policy analyst, spent over a yearand a half on the paper.

|"I don't expect a single member of Congress to take this planand pack it into legislation," said Goldwein. "But I do think theywill take pieces of it and put it into their own vision."

|READ MORE:

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In