Gil Lowerre is president at EastbridgeConsulting Group; Bonnie Brazzell is vice president of EastbridgeConsulting Group.

Gil Lowerre is president at EastbridgeConsulting Group; Bonnie Brazzell is vice president of EastbridgeConsulting Group.

What are the attributes of a good voluntary benefit? The industryhas historically sorted out would-be new entrants before manyproducers knew they existed. Various elements could be debated, butthere are at least two components common to most successfulproducts: benefit strategy relevance and programmechanics.

|The idea of product relevance to an employer's benefit strategyis important. Nearly all voluntary benefits that achieve genuinemarket acceptance are aimed at supporting an employee's physical orfinancial well-being, while products that fall outside of thesegoals seem to have challenges. For example, introducing a voluntaryprogram for golf lessons likely wouldnot fit the overall benefit strategy for most employers. As much assome employees might like such a perk, there simply is not enoughrelevance to justify it. Successful voluntary benefits are thoseemployees want/need and that help ensure their family's personaland financial health.

|Program mechanics must also be considered, particularlyenrollment and payment method. Today, open enrollment has become asmuch about voluntary programs as it is about medical planelections. Many producers now use this method to provide employeesa comprehensive approach to their benefit selections, sinceprograms introduced off-cycle are often void of employer supportand employee attention.

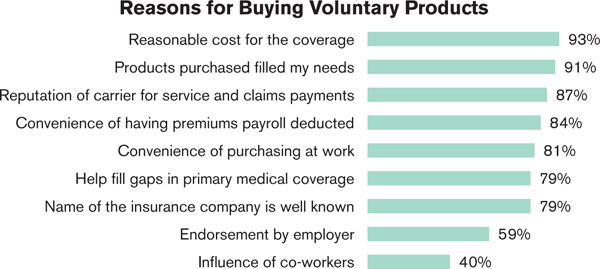

|As for payment method, research shows that payroll deduction isnot only an important payment mechanism, but also a driver in theemployee sale. According to Eastbridge's recent employee survey,payroll deduction was the preferred method of payment for voluntarybenefits among employees, and 84 percent view the convenience ofpayroll deduction as a reason to buy avoluntary product.

|In such a fast-moving market, new approaches are always on thehorizon. Off-cycle enrollments could realize more widespreadsuccess in the future, and new solutions for the payment ofbenefits may take root. However, the combination of a definedenrollment period with a consolidated election environment andpayroll deduction creates not only an education experience, but apurchase flow, as well. The success of this recipe can be seen insome increasingly popular non-traditional categories.

|Consider purchasing programs and identity-protection services.Both are relevant to employee financial well-being.Identity-protection services are frequently elected in theemployers' enrollment system and are regularly introduced toemployees during open enrollment. Purchasing programs may take lessadvantage of open enrollment, but both products still tap intopayroll deduction.

|More products will try to capitalize on the growth of thevoluntary market. But be wary of programs that are not trulyrelevant to your client's strategy or fail to utilize the tacticsand mechanics with demonstrated success in voluntary.

|

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.