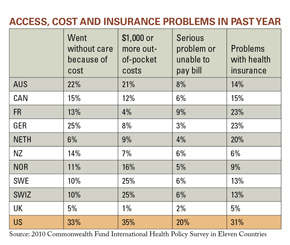

An 11-country survey from The Commonwealth Fund finds that adults in the United States are far more likely than those in 10 other industrialized nations to go without health care because of costs, have trouble paying medical bills, encounter high medical bills even when insured, and have disputes with their insurers or discover insurance wouldn't pay as they expected.

The U.S. stands out for the most negative insurance-related experiences, according to the report. One third (33 percent) of U.S. adults went without recommended care, did not see a doctor when sick, or failed to fill prescriptions because of costs, compared to as few as 5 percent to 6 percent in the Netherlands and the U.K.

In addition, one-fifth of U.S. adults had major problems paying medical bills, compared to 9 percent in France, the next highest country, 2 percent in the U.K., 3 percent in Germany, and 4 percent in the Netherlands.

Uninsured and insured U.S. adults reported equally high rates of out-of-pocket costs, with one-third (35 percent) of U.S. adults paying $1,000 or more out-of-pocket in the past year for medical bills, significantly higher than all of the other countries.

The study analyzes findings from the Commonwealth Fund 2010 International Health Policy Survey in Eleven Countries, focusing on insurance and access to health care experiences reported by 19,700 adults from 11 countries:

- Australia

- Canada

- France

- Germany

- The Netherlands

- New Zealand

- Norway

- Sweden

- Switzerland

- United Kingdom

- United States

The study reveals widespread disparities by income within the United States. Lower income U.S. adults were far more likely than those with above average incomes to report difficulty with medical bills and timely access to health care.

"We spend far more on health care than any of these countries, but this study highlights pervasive gaps in U.S. health insurance that put families' health and budgets at risk," said Commonwealth Fund Senior Vice President Cathy Schoen, lead author of the article, in a statement. "In fact, the U.S. is the only country in the study where having health insurance doesn't guarantee you access to health care or financial protection when you're sick. This is avoidable--other countries have designed their insurance systems to value access and limit out-of-pocket costs."

U.S. Health System Stands Out for Insurance Problems, Income Disparities

The U.S. also stood out for its complex insurance system, the study found. Thirty-one percent of U.S. adults either spent a lot of time dealing with insurance paperwork, had their insurer deny a claim, or had their insurer pay less than they anticipated.

In contrast, only 13 percent of adults in Switzerland, 20 percent of adults in the Netherlands, and 23 percent of adults in Germany--all countries with competitive health insurance markets--reported these problems. U.S. adults under 65 were the most likely to experience problems dealing with their health insurance providers--the 65 and older Medicare population was much less likely to report these issues.

According to the study, the U.S. stood alone among the countries for its persistent and wide disparities among income groups--even for those with insurance. Although the uninsured were at highest risk for skipping needed care, working-age U.S. adults with below-average incomes who were insured all year were significantly more likely than those with above-average incomes to go without needed care because of costs and have serious problems paying medical bills--nearly half (46 percent) went without needed care and one third had one bill problem, double the rates reported by above-average income insured adults.

"What we are hearing directly from adults around the world, and what we hear regularly at home, is that there is substantial room for improvement in the U.S. health insurance system," said Commonwealth Fund President Karen Davis. "The good news is that there are opportunities to learn from other countries, and Affordable Care Act reforms will provide affordable insurance options for the uninsured, make sure insurance pays for essential care, and provide financial security for millions."

U.S. Lags Other Countries in Access to Care When Sick; Leads with Other Countries in Access to Specialists

Looking beyond how health insurance affects access to health care, the survey found substantial differences among countries on access to care when sick, access after hours, and wait times for more specialized care.

Swiss, New Zealand, Dutch, and U.K. adults were the most likely to report same- or next-day access to doctors when sick, with 70 percent of adults in the U.K and 93 percent of Swiss adults reporting rapid access. In contrast, only 57 percent of adults in Sweden and the U.S., and less than half in Canada and Norway were seen this quickly.

Reflecting national policy requirements for after-hours care arrangements, about two-thirds of Dutch, New Zealand, and U.K. adults found it easy to get care after hours without going to the emergency room. In contrast, two-thirds of Swedish, Canadian, French, and U.S. adults said it was difficult.

Regarding specialists, in addition to the U.S., German, Swiss, U.K, and Dutch adults reported typically rapid access to specialists with 70 percent to 83 percent of adults in all five countries reporting they were seen in less than four weeks.

Confidence in Affording Care and Getting Effective Care When Needed

Only 58 percent of U.S. adults were confident they would be able to afford the care they needed--the lowest rate in the survey. U.K., Swiss, and Dutch adults were the most confident they would be able to afford needed care.

Asked if they were confident they would receive the most effective care, 70 percent of U.S. adults were confident, compared with 84 percent to 92 percent of adults in France, Germany, the Netherlands, New Zealand, Switzerland, and the U.K.

Differences by Income

In all countries except the U.K., adults with incomes below the national average were more likely than those with higher than average income to report trouble with medical bills and problems with access to care because of costs. However, income gaps were widest in the U.S., with a spread of as much as 19 percentage points between low- and high-income adults.

Regarding access to primary care and waiting times, the U.K was notable for having few differences by income, and Switzerland and Germany stood out for rapid access to primary and specialist care for below-average income as well as above-average income adults. The U.S. stood out for significant income gaps in primary care access, after hours, and specialists, even for those who were insured all year.

Insurance Design Matters

The study included countries with diverse insurance arrangements, including three countries-- Germany, the Netherlands, and Switzerland--that have achieved near-universal coverage with competitive health insurance markets, a requirement that all residents have insurance, and provisions to assure that insurance and care are affordable.

Each of these countries has developed insurance system rules that ensure people with health insurance are protected. Countries that require people to pay for some portion of their health care costs out-of-pocket, such as France, Germany, and Switzerland have limited out-of-pocket costs to patients. Germany limits out-of-pocket costs based on income, and France lowers or eliminates cost-sharing for those with chronic conditions and for medications that have been proven to be highly effective. To address insurance affordability, Swiss and Dutch systems provide assistance in paying premiums to 30 percent to 40 percent of their populations.

The authors note that with insurance expansions under health reform, the U.S. performance should improve over time. However, out-of-pocket spending will remain high compared to other countries, and affordability provisions may need to be strengthened over time.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.