Defined contribution plan sponsors say they have a higher level of confidence in their target-date fund knowledge and offerings compared to a year ago.

But what sponsors don't know or don't understand about target-date funds could present a fiduciary risk.

Key findings from a survey by Janus Capital Group show sponsors are offering more target-date funds and believe their employees understand these popular 401(k) features, which will reset a portfolio's asset mix according to a time frame that's appropriate for the investor.

Recommended For You

The closer the investor (plan participant) is to the target date – usually retirement – the more conservative the asset mix becomes, moving toward cash and fixed income elements while reducing equity exposure.

According to Janus, data from the survey revealed "contradictory responses and the existence of a significant percentage of sponsors seemingly unaware or unconcerned about areas that could present real fiduciary risk."

"The evolution of target-date funds continues at a brisk pace, and many good and valuable refinements will undoubtedly follow in the coming years," said Russ Shipman, senior vice president and managing director of Janus' Retirement Strategy Group. "With Baby Boomers' laser-like focus on retirement income, we believe interest rate risk within the fixed income allocations of target-date funds will soon get much-deserved air time and scrutiny. Just as equity bets drove material differences in 2010-dated products during the 2008 market swoon, so too could ill-advised fixed income duration profiles for near-dated target-date fund offerings in a rising rate environment."

Other key findings:

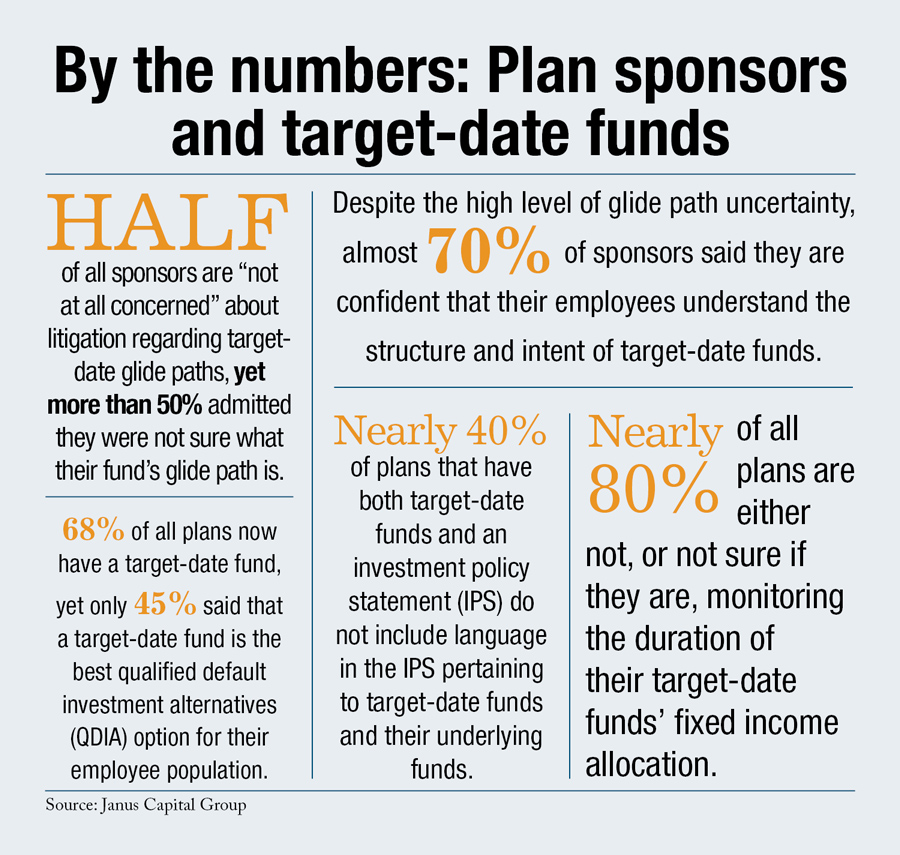

- Half of all sponsors are "not at all concerned" about litigation regarding target-date glide paths, yet more than 50% admitted they were not sure what their fund's glide path is.

- Despite the high level of glide path uncertainty, almost 70% of sponsors said they are confident that their employees understand the structure and intent of target-date funds.

- Nearly 80% of all plans are either not, or not sure if they are, monitoring the duration of their target-date funds' fixed income allocation.

- 68% of all plans now have a target-date fund, yet only 45% said that a target-date fund is the best qualified default investment alternatives (QDIA) option for their employee population.

- Nearly 40% of plans that have both target-date funds and an investment policy statement (IPS) do not include language in the IPS pertaining to target-date funds and their underlying funds.

The survey also revealed that balanced funds are perceived by plan sponsors as the best QDIA option for investment transparency and lower fees, and are on-par with target-date funds as the best choice for overall performance. While almost half of respondents indicated that target-date funds are the best QDIA for their employee populations, balanced and target-risk funds were the combined second choice, with 20% of respondents indicating that these products are the best option. Additionally, 22% of plans said they would be willing to replace their target-date funds with balanced or target-risk funds to eliminate the "to" or "through" glide path dilemma.

"The affinity for target-date funds is justifiably broad and deep, but future generations of the products may continue to see increased pressure from balanced funds," said Shipman. "Given balanced funds' simplicity and proven track records, we have observed plan sponsors, both big and small, routinely selecting them as a QDIA."

The survey, which has been conducted annually for five years in conjunction with Asset International, Inc., focuses on QDIA fund selection, construction, monitoring and satisfaction. It reflected comments from a cross-section of nearly 7,000 DC plan sponsors from a wide range of industries across the country, with strong representation from the large and mega plan segments. The survey was conducted via an online questionnaire from July to September 2011.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.