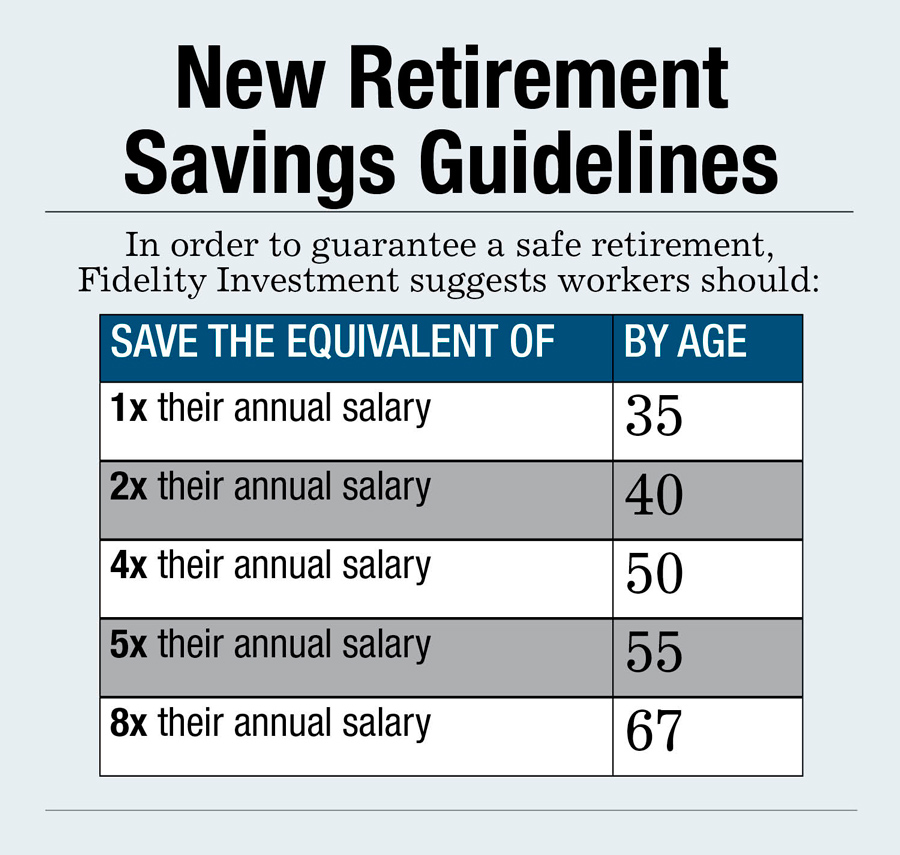

Fidelity Investments has issued new savings guidelines suggesting that workers save at least eight times their final salary in order to meet basic income needs in retirement.

In the set of age-based targets released Wednesday, Fidelity says employees should have the equivalent of their annual salary in savings by age 35 in order to reach the first benchmark en route to that goal.

To stay on pace, individuals should then plan to have saved twice their salary by 40, four times' salary by 50, five times by 55 and six times by 60.

Recommended For You

Under that scenario, then, someone with a $60,000 salary would need to have $240,000 in savings at age 50 to be on track.

Under that scenario, then, someone with a $60,000 salary would need to have $240,000 in savings at age 50 to be on track.

Although many will need more, especially at higher pay levels, saving eight times' income by age 67 should provide most workers with roughly 85 percent of their pre-retirement income inretirement, according to Fidelity.

The nation's largest 401(k) administrator is distributing the guidelines as what it calls a rule of thumb to help employees become more active in their retirement planning. Its 12 million accountholders had an average balance of about $73,000 at the end of June.

"We constantly are asked by participants, 'How do I know if I'm on track and what do I set as a target to ensure I will have sufficient income in retirement?'" said Beth McHugh, vice president of thought leadership at Boston-based Fidelity. "The ultimate goal is to get them more engaged and get them to seek guidance — either directly from one of our representatives or through one of our online tools."

Setting a savings target that's a multiple of income is an increasingly popular concept in financial planning. Its advocates believe it is a simpler and more manageable way of monitoring progress toward retirement security than trying to achieve a certain level of assets.

Most advisers say you'll need to make anywhere from 70 percent to 85 percent of your pre-retirement income to maintain a similar standard of living in retirement, although it can vary widely depending on lifestyle.

Fidelity's 8X savings guideline, which is a lower target than some published scenarios, is based on a worker saving in a 401(k) or other workplace retirement plan from age 25 to 67, then living until 92. The worker would begin by contributing 6 percent of annual salary, then raise the amount 1 percent every year until reaching 12 percent, all the while receiving a 3 percent match from the employer.

The calculation is based on achieving average annual portfolio growth of 5.5 percent.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.