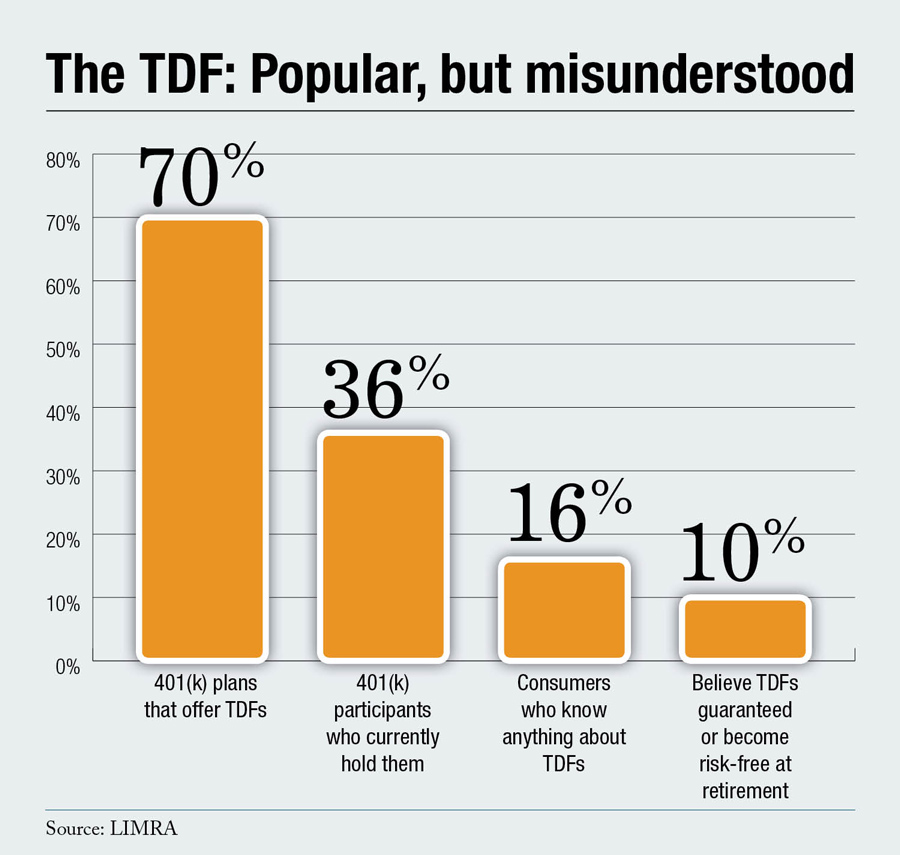

Despite being one of the most popular investments in modern 401(k) plans, when it comes to TDFs, most participants apparently remain completely unaware of what they are and how they work.

It's an observation made by a recent LIMRA survey and it suggests that retirement advisors and plan sponsors have plenty of educational opportunities to let participants know how and why TDFs work – especially if those participants already have them as part of their 401(k) portfolio. And as TDFs are expected to become the predominant component in 401(k) investments in the future.

The good news, however, is that those consumers who've taken the time to learn about TDFs tend to have a much higher level of confidence in their own retirement future. The general public, not so much.

The good news, however, is that those consumers who've taken the time to learn about TDFs tend to have a much higher level of confidence in their own retirement future. The general public, not so much.

Continue Reading for Free

Register and gain access to:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.