We all know that most people aren't saving enough for retirement. More than half (57 percent) of workers say they have less than $25,000 in total savings and investments (excluding their home and defined benefit plans), according the 2013 Retirement Confidence Survey from EBRI and Mathew Greenwald & Associates.

See also: The good, the bad and the opportunity

Recommended For You

Most people know they need to save more. In fact, 85 percent of financial professionals say their clients' top retirement worry is outliving their savings, according to the Principal Financial Well-being Index of financial professionals across the country between taken this year between April 29 and May 11.

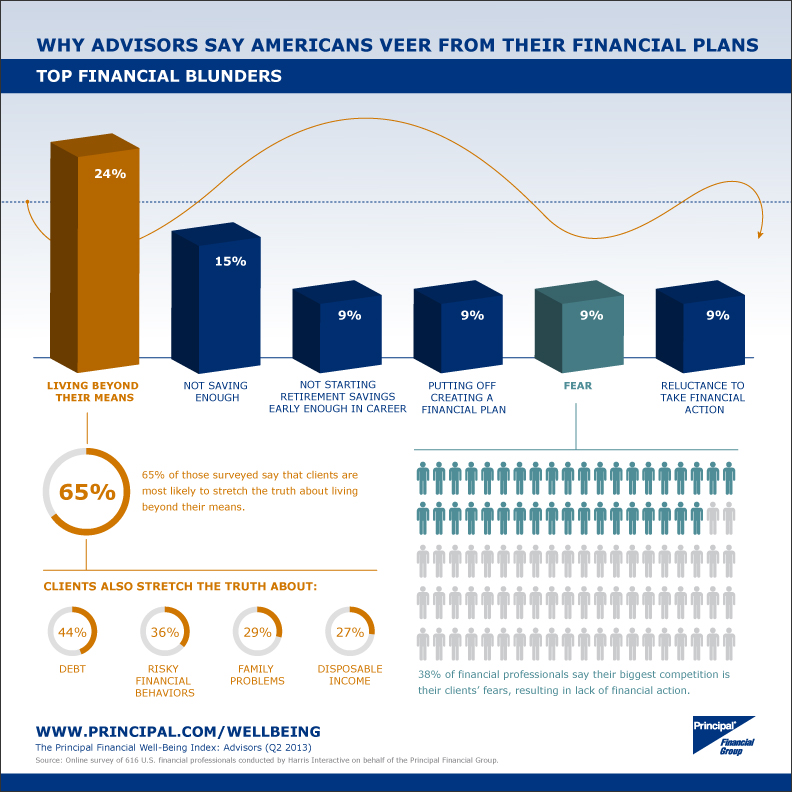

If investors know they aren't saving enough for retirement, what's getting in their way? Most likely, it's simple overspending. According to Ibid, 61 percent of financial professionals say overspending and living beyond their means are the biggest reasons investors veer from their financial plans are.

It isn't always easy to get a straight answer on spending from investors. Sixty-five percent of financial professionals say clients are most likely to stretch the truth about living within their means, says the Principal Index from Q2 2013.

How can financial professionals help clients — including retirement plan participants — live within their means and take action to save more? These three steps can help:

- Change the conversation from savings to income. Too often, individuals focus on how much they can afford to spend versus how much they can afford to save to meet their needs and wants today. Financial professionals have an opportunity to change the conversation. Start with the end first. Put the focus on how much income a client may actually need in retirement.

- Run the numbers. An estimate showing how a current savings balance may translate into monthly income in retirement is always an attention-getter, at any age.

- Encourage retirement plan designs that drive savings actions. Our studies and surveys shows that certain retirement plan design features can significantly increase participation and savings because they work with human nature. Employee participation rates increase dramatically — up to 70 percent — as employers add more key plan design features, such as automatic enrollment, automatic increase, online deferral changes and employer contribution. Retirement plans with at least two key features of any combination have an average total participant savings rate of 11 percent, which is significantly higher than the average participant savings rate, according to PSCA's 55th Annual Survey of Profit Sharing and 401(k) plans released a year ago.

Consulting with plan sponsors on this topic can also help you stay competitive. Plan support, including consulting on plan design, tops the list of what drives plan sponsor loyalty to their financial professionals, found the Cogent Retirement Planscape from last year.

Financial professionals recognize that helping participants focus on building retirement income during the savings phase can position them to help investors with their assets during the retirement phase. In the survey, helping clients manage income in retirement is the most common business change made in the past year, cited by two-thirds of financial professionals (67 percent).

Clearly we still don't know all the answers to get people to save more. Finding the right words or actions to not only motivate a commitment to save but then help ensure the actions are carried out will probably always be a challenge. Plan service providers may be able to help you educate plan sponsors on improving plan design and on more accurately measuring the results. They may also have tools and resources to help you educate and motivate plan participants to take action.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.