Editor's Note: This article is excerpted from Tools & Techniques of Life Insurance Planning, 6th edition, which delivers detailed information about the entire range of life insurance products that can be used by estate and financial planners in a wide variety of circumstances. It includes planning techniques for retirement income needs, estate and gift tax avoidance, estate liquidity needs, and long-term care planning.

At best, life insurance is a very complicated product that is extremely difficult to evaluate and compare. Life insurance policies are complex amalgams of varying legal, financial, and probabilistic elements that cannot really be reduced to an all-encompassing unitary measure for comparison purposes. However, there are a number of commonly used measures or methods for policy comparison that can be of aid in evaluating purchase alternatives. Keep in mind that none of these methods does, or could, take into account all of the factors that should be considered when making the purchase decision. But, if planners use several methods and they keep in mind the strengths and weaknesses of each during the comparison process, these methods will be quite helpful in at least eliminating policies that should not be considered. The following are commonly used policy comparison techniques.

Recommended For You

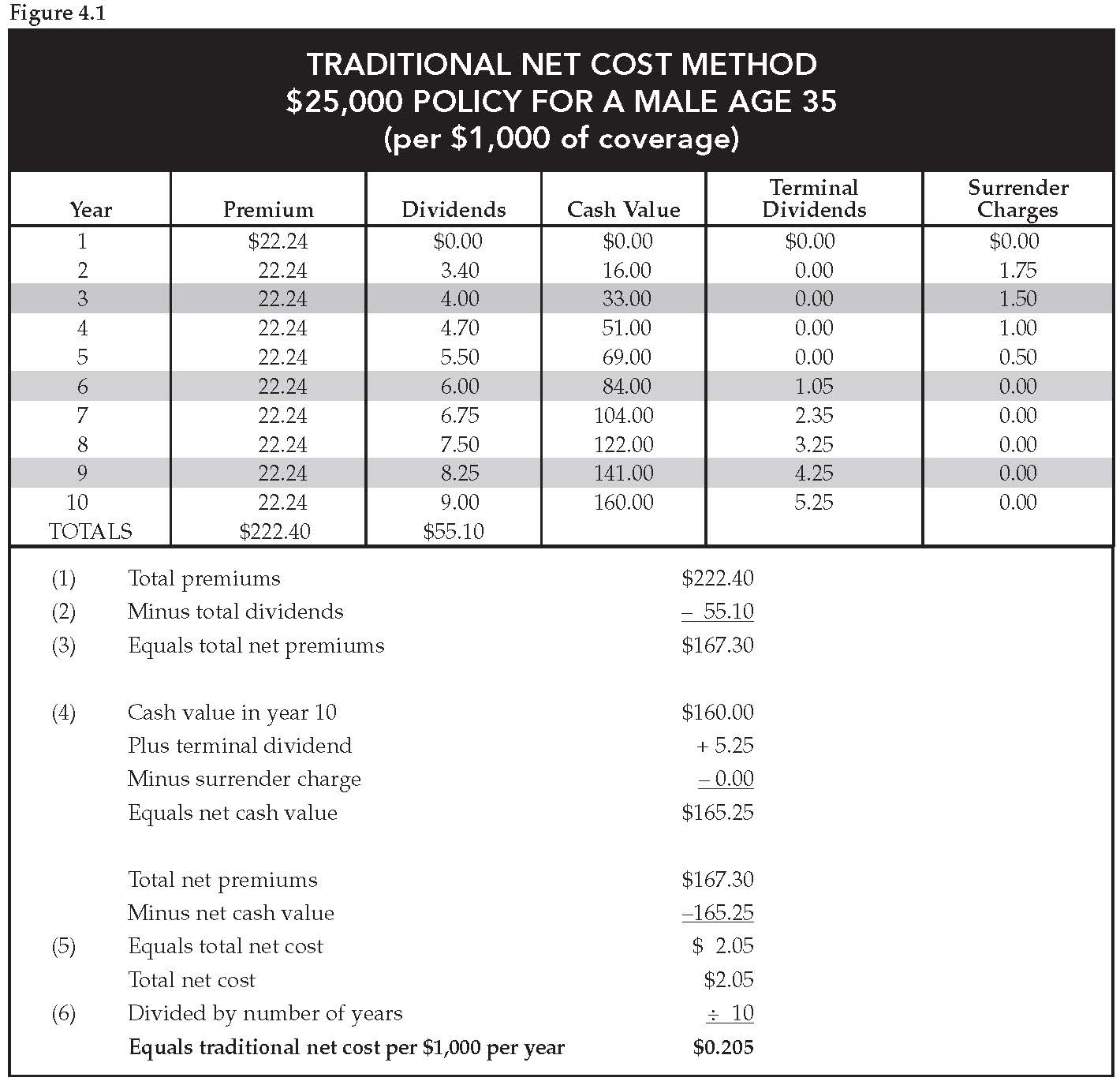

Method 1: Traditional net cost

The traditional net cost method works like this:

Step 1: Add up the premiums on the ledger sheet over a stated period of time such as ten, fifteen or twenty years.

Step 2: Add up the dividends projected on the ledger sheet over the same period of time.

Step 3: Subtract the total dividends from the total premiums to find the total net premiums paid over the period being measured.

Step 4: Add the cash value and any "terminal dividends" shown on the ledger statement as of the end of such period (and minus any surrender charge) to find the net cash value.

Step 5: Subtract the net cash value from the total net premiums to arrive at the total net cost of the policy over the selected period.

Step 6: Divide the total net cost by the face amount of the policy (in thousands) and again by the number of years in the selected period to arrive at the net cost of insurance per thousand dollars of coverage per year. (In Figure 4.1, numbers were calculated per $1,000 of coverage from the start.)

This is the easiest method to understand and use, but its simplicity is its weakness. This measure ignores the time value of money, which makes it possible to manipulate policy illustrations by shifting cash flows. Even without intentional manipulation, the traditional net cost method grossly understates the cost of insurance coverage and, in many cases, implies that the average annual cost of coverage is zero or negative. The result could be misleadingly low measures of policy costs. Few states sanction this method for comparing policy costs, although it can be used by the planner, together with the other methods described below, to make a quick and rough first-level relative comparison of policies.

Interest-adjusted cost methods

The interest-adjusted methods of comparing the cost of life insurance policies consider the fact that policyowners could have invested the money spent on premium dollars elsewhere earning some minimum after-tax return (five percent is usually assumed.) Because a policy may terminate, either when the policyowner surrenders the policy or when the insured dies, there are two different interest-adjusted indexes to measure the cost: (1) the net surrender cost index; and (2) the net payment cost index. The indexes do not necessarily define the true cost of policies, but they are useful in comparing the relative costs of similar policies. All other things being equal, a low index represents a better value than a high index. Note, however, that the interest-adjusted indexes are only indexes and nothing more. The true cost of a life insurance policy, if it can actually be measured prospectively, depends on when and how a policy terminates.

Method 2: Interest-adjusted net surrender cost index

This index is a relative measure of the cost of a policy assuming the policy is surrendered. It works like this:

Step 1: Accumulate each year's premium at some specified rate of interest. (Most policy illustrations use a five percent rate.) Perform the calculation over a selected period of time such as ten, fifteen, or twenty years.

Step 2: Accumulate each year's dividends projected on the ledger sheet at the same assumed rate of interest over the same period of time.

Step 3: Subtract the total dividends (plus interest) from total premiums (plus interest) to find the future value of the total net premiums paid over the period being measured.

Step 4: Add the cash value and any "terminal dividends" shown on the ledger statement as of the end of such period (and minus any surrender charge) to find the net cash value.

Step 5: Subtract the net cash value from the future value of the net premiums to arrive at the future value of the total net cost of the policy over the selected period.

Step 6: Divide the result by the future value of the annuity due factor for the rate assumed and the period selected. The result is the level annual cost for the policy.

Step 7: Divide the level annual cost for the policy by the number of thousands in the face amount of coverage. The result is the interest-adjusted net annual cost per thousand dollars of coverage using the surrender cost index. (In Figure 4.2, numbers were calculated per $1,000 of coverage from the start.)

Method 3: Interest-adjusted net payment cost index

This index is a relative measure of the cost of a policy assuming the insured dies while the policy is in force. It works like this:

Step 1: Accumulate each year's premium at some specified rate of interest. (Most policy illustrations use a five percent rate.) Perform the calculation over a selected period of time such as ten, fifteen, or twenty years.

Step 2: Accumulate each year's dividends projected on the ledger sheet at the same assumed rate of interest over the same period of time.

Step 3: Subtract the total dividends (plus interest) from the total premiums (plus interest) to find the future value of the total net premiums paid over the period you are measuring.

Step 4: Divide the result by the future value of the annuity due factor for the rate assumed and the period selected. (Use the same factors that were used in the Net Surrender Cost Index, above.) The result is the level annual cost for the policy.

Step 5: Divide the level annual cost for the policy by the number of thousands in the face amount of coverage. The result is the interest-adjusted net annual cost per thousand dollars of coverage using the payment cost index. (In Figure 4.2, numbers were calculated per $1,000 of coverage from the start.)

Planners usually will not have to do these computations because most ledger sheets will contain these indexes at the bottom of the front page of the ledger statement. However, the ledger statement usually shows the indexes only for ten and twenty years, and sometimes for the insured's age sixty-five.

Most states require that insurers/agents provide prospective policyowners with a policy's interest-adjusted indexes. Planners should therefore understand how this measure works, understand its limitations, and be able to explain it to sophisticated clients. Among the weaknesses of the interest-adjusted methods are these:

-

If the policies being compared are not quite similar, the index results may be misleading. For instance, if the outlays differ significantly, the planner should establish a hypothetical side fund to accumulate the differences in the annual outlays at the assumed rate of interest to properly adjust for the differences. This will be the case where an existing policy is compared with a potential replacement. There will almost always be a material difference in the projected cash flows. This makes the interest-adjusted methods unsuitable (unless adjusted) for "replacement" comparisons.

-

The interest-adjusted methods are subject to manipulation (although to a lesser extent than the traditional net cost method) and in the commonly used measuring periods, such as ten or twenty years, insurers/agents can design them to provide more favorable estimates of cost than for other selected periods.

-

The interest-adjusted methods are valid only to the extent that the projections of cash flows materialize as assumed. Therefore, the calculations cannot consider the impact of an overly optimistic dividend scale.

-

It is possible in the comparison between two policies for each policy to be superior when ranked on one of the two indexes and inferior when ranked on the other index. However, relative rankings on each index tend to be highly correlated. That is, a policy that is ranked higher than others using one index tends to also rank similarly using the other index.

Method 4: Equal outlay

The equal outlay method works like this: The client is assumed to outlay (pay out) the same premium for each of the policies to be compared. Likewise, the client is assumed to purchase, in each policy under comparison, essentially equal amounts of death benefits year by year.

The equal outlay method is easiest to employ when comparing flexible premium type policies (e.g. universal life) because it is easy for the insurer/agent to generate the illustration with equal annual contributions.

Planners should demand that:

-

the illustration projects cash values using the guaranteed rates for the policy;

-

the insurer/agent run separate illustrations showing a selected intermediate interest rate assumption; and

-

the insurer/agent run separate illustrations showing the current interest rate the company credits to policies.

An inspection of the projected cash values in future years should make it possible to identify the policy with the highest cash values and, therefore, to determine which is the best purchase. The procedure will be more complicated where the equal outlay method is used to compare a fixed premium contract with one or more flexible premium polices. Here, the net premium level (adjusted for any dividends) and the death benefit of the flexible premium policies must be made to match the corresponding values for the fixed premium contract for all years over the period of comparison. This makes it possible to compare future cash values in the same manner as when comparing two flexible premium policies.

As shown in Figure 4.3, planners also can use the equal outlay method to compare two or more fixed-premium policies, or to compare a term policy to a whole life policy, in the following manner: Hypothetically, "invest" the differences in net annual outlay in a side fund at some reasonable after-tax rate of return that essentially keeps the two alternatives equal in annual outlay. Compare cash values and total death benefits (including side fund amounts for both).

Note, quite often the result of this computation will show that term insurance (or a lower-outlay whole life policy) with a side fund will outperform a permanent type whole life plan during a period of perhaps the first seven to ten years but then lose that edge when the projection is carried to a longer duration.

There are a number of disadvantages to the equal outlay method:

-

When comparing a fixed to a flexible premium contract, the underlying assumptions of the contracts are not the same and, therefore, the analysis cannot fairly compare them. For instance, many universal life cash value projections are based on "new money assumptions," while ordinary life policy dividends are usually based on the "current portfolio rate" of the insurer (a rate that often varies significantly from the new money rate). Because the portfolio of the insurance company includes investments made in prior years that will not mature for several years, the portfolio rate tends to lag behind new money rates. If new money rates are relatively high, the portfolio rate will generally be less than new money rates. However if new money rates are trending down, portfolio rates will generally be higher than new money rates.

This difference in the rate used to make illustrations can be misleading. For example, if new money rates are greater than the portfolio rate and the trend of high new money rates continues for some time, cash values in universal life contracts are more likely to materialize as projected. But if these economic conditions hold true, then it is likely that the portfolio rate will also rise. This means dividends paid would increase relative to those projected based on the current portfolio rate. The equal outlay method does not take into consideration either the fluctuations in rates or the differences in how they are computed.

The required adjustments in most comparisons can quickly become burdensome. In many cases, it is quite difficult to equate death benefits under the comparison policies while maintaining equal outlays.

When comparing an existing policy with a potential replacement policy, the analysis must consider any cash value in the existing policy at the time of the comparison. Generally, it is easiest to assume that the cash value will be paid into the new policy. Otherwise, the analysis should probably account for the time value of that cash value and should, as closely as possible, equate total death benefits including any side fund.

The results, even after many adjustments have been made, may be ambiguous. Quite often the results can be interpreted as favoring one policy for certain durations, favoring another policy for certain durations, and favoring even another policy for other durations.

Method 5: Cash accumulation

The cash accumulation method works like this:

Step 1: Equate outlays (much in the same manner as the equal outlay method) for the policies being compared.

Step 2: Change the face amount of the lower premium policy so that the sum of the side fund plus the face amount equals the face amount of the higher premium policy. Note that this would yield the same result as where it is possible to set both death benefits and premium payments exactly equal — in flexible premium policies.

Step 3: Accumulate any differences in premiums at an assumed rate of interest.

Step 4: Compare the cash value/side fund differences over given periods of time to see which policy is preferable to the other.

The cash accumulation method is ideal for comparing term with permanent insurance. But planners must use this analysis with caution; the use of the appropriate interest rate is critical because, as is the case with any time-value measurement, a higher assumed interest rate will generally favor a lower premium policy/side fund combination relative to a higher premium policy.

We suggest a two-part approach:

-

If planners perform this comparison without regard to a specific client and merely to determine the relative ranking of the polices, the planners should assume a relatively conservative risk-free, after-tax rate comparable to the rate that one would expect to earn on the cash values of the higher premium policy. This will more closely equate the combination of the lower premium/side fund with the risk-return characteristics of the higher premium policy.

-

Alternatively, if the comparison is being conducted for a specific client, the planner should use that individual's long-run after-tax opportunity cost rate of return, which may be considerably higher than the rate of return anticipated on the cash value of the higher premium policy.

A full and fair comparison is made more difficult because of the impact of death taxes, probate costs, and creditor laws. This is because the cash accumulation method uses a hypothetical side fund to make the comparison. But money in a side fund — if in fact it were accumulated — would not be eligible for the exemptions or special rate reductions afforded to the death proceeds of life insurance. Therefore, each dollar from that side fund would be subjected to a level of transfer tax that life insurance dollars would not. Likewise, the side fund would be subjected to the normal probate fees and attorney's costs to which cash or other property is subject. Furthermore, this method does not consider the value of state law creditor protection afforded to the death benefits in a life insurance policy, but not to amounts held in most other types of investments.

The bottom line is that the side fund money may appear to have more value than it actually would have in the hands of those for whom it was intended. It is therefore apparent that, while the cash accumulation method has strengths that overcome many of the weaknesses of other comparison methods, it also has weaknesses that prevent it from being the single best answer to the financial planner's policy comparison problem.

Method 6: Linton yield

The Linton yield method works like this: The planner computes the rate of return that the policyowner must earn on a hypothetical (or real) side fund assuming death benefits and outlays are held equal for every year over the period being studied. The policy that should be selected according to this method is the one that has the highest Linton yield, that is, the policy that — given an assumed schedule of costs (term rates) — has the highest rate of return.

In essence, this method is just the reverse of the interest-adjusted surrender cost method, which holds the assumed interest rate level and solves for cost; the Linton method holds cost level and solves for interest. It should therefore be an excellent way to check the interest-adjusted method results because the two methods should rank policies virtually identically.

As demonstrated in Figure 4.5, planners can compare dissimilar policies through the Linton yield method. Note, however, that planners must use the same term rates for each policy that the planners are evaluating or the results will be misleading. The higher the term rate that the planners use, the higher is the Linton yield that the analysis will produce — and, of course, the reverse is also true. This emphasizes the importance of using this method only for a relative comparison of policies and not to measure the "true rate of return" actually credited to the cash value of a give policy.

Computationally, the Linton yield method is a variation on the cash accumulation method. Using the cash accumulation methodology described above, the Linton yield is the rate of return that equates the side fund with the cash surrender value for a specified period of years. For example, in the cash accumulation method example above (see Figure 4.4) the side fund was just about equal to the cash surrender value in year ten when the side fund was invested at 6 percent. Therefore, the Linton yield for the whole life policy (assuming the YRT rates are competitive) is about 6 percent for ten years. The example in Figure 4.5 shows that the twenty-year Linton yield for this policy is 9.696 percent.

Belth methods

Joseph M. Belth, Ph.D., Professor Emeritus of Insurance at Indiana University has been a leading researcher, constructive critic, and writer on life insurance policy comparison methods and other life insurance issues. He devised two comparison methods that give comparable ranking results:

-

the yearly rate of return method

-

the yearly price of protection method

The reason he developed two methods follows from what has already been said (implicitly, if not explicitly) about comparison methods: If you prefer to compare policies based on a measure of the price of protection, you must specify or assume the cost of protection. In contrast with the methods discussed earlier, which essentially reduce comparisons to a relative measure of one rate of one cost index for each policy being compared for a specified term, the Belth methods compute the rates of return or the prices of protection for all years, or any subset of years, that the policies may be in force. One of the more attractive features of Belth's methods is that they are easier to use (with caveats) than the other methods when trying to decide whether to replace an existing policy with a new policy.

Method 7: Belth yearly rate of return

The Belth yearly rate of return method works like this:

Step 1: Compute "benefits" from the policy for the year, which is the sum of:

a. the cash value at the end of the year;

b. the dividends paid during the year; and

c. the net death benefit for the policy year.

Step 2: Compute the "investment" in the policy for the year. The investment is defined as the sum of:

a. the premium paid for the year; plus

b. the cash value at the beginning of the year.

Step 3: Divide the benefits for the year by the investment for the year and subtract one from the result. Stated as a formula, the computation is:

Step 4: Repeat the calculations for each year over the desired duration or planning period.

This yearly rate of return method is especially useful in comparing policies over many different durations. The policy with the highest yearly rates in the greatest number of years is generally the best choice.

As is the case with the comparison methods described above, this system has its weaknesses and potential flaws:

-

The calculated yearly rates of return may be misleading where cash values are small.

-

The results can be manipulated or unintentionally affected by the term rate assumed. The planner must specify an assumed yearly cost for insurance in order to calculate the benefits for the policy year. In other words, planners must use one-year term rates. But if the term rates used are neither competitive nor realistic, the results would not accurately portray how well a "buy term and invest the difference" plan performs in comparison to a "buy whole life and build the cash values" plan.

-

Typically, no one policy will be better than another year after year. This means the "best policy" may not be easy to select. One policy may provide the higher yearly rates of return in early years, but not in later years.

Method 8: Belth yearly price of protection

The Belth yearly price of protection method works like this:

Step 1: Accumulate the "investment" in the policy for one year at an assumed rate of interest. The investment is the sum of:

a. the cash surrender value at the end of the previous year; plus

b. the current premium.

Step 2: Compute the year end policy surrender value. The year-end policy surrender value is the sum of:

a. the year end cash surrender value; plus

b. any dividend.

Step 3: Subtract the year end policy surrender value from the year's accumulated investment.

Step 4: Divide the result of (3) by the year's net amount at risk (face amount minus current year's cash surrender value) in thousands to derive the cost of protection (per thousand dollars of coverage) for the year. Stated as a formula, the computation is:

The result is an estimate of the cost in any given year of the net death benefit (death benefit minus cash value). The policy with the lowest yearly price of protection in the most years is generally the contract that should be selected under this method.

As a complement to the yearly price of protection method, Belth has developed: (1) benchmark costs per thousand dollars of term insurance for various age ranges, see table below; and (2) rules of thumb for using this method in replacement situations. He describes the benchmark rates (see below) as follows:

The benchmarks were derived from certain United States population death rates. The benchmark figure for each five-year age bracket is slightly above the death rate per $1,000 at the highest age in the bracket. What we are saying is that if the price of your life insurance protection per $1,000 is in the vicinity of the 'raw material cost' (that is the amount needed just to pay death claims based on population death rates), your life insurance protection is reasonably priced.Belth suggests the following rules of thumb for applying the benchmarks in replacement situations:

Belth suggests the following rules of thumb for applying the benchmarks in replacement situations:

-

If the policy price per thousand is less than the benchmark for the insured's age, replacement would probably be inadvisable.

-

If the price per thousand is between one and two times the benchmark, probably no change is indicated.

-

If the price is greater than two times the benchmark, consider replacing the policy.

The flaws and potential weaknesses of this method are:

-

The yearly prices of protection may have no relation to the actual mortality costs charged against the policy in any given year. To compare the calculated yearly "prices" (which have been critically affected by the rate of return assumed by the planner) with term insurance rates may be misleading. But, if the same assumed rate of interest is used when computing the yearly prices for all policies under consideration, the yearly rates for each policy should provide a good indication of where various polices stand in relation to others. Planners should use an assumed rate as close as possible to the rate actually used by the insurance company in its cash value and dividend illustrations. This will enable a fair comparison of the yearly prices of protection from the policy to yearly renewable term insurance.

-

Where the net amount at risk for the year is relatively small, the yearly prices of protection will tend to fluctuate widely and have little meaning.

-

As is the case with previous methods, in some years one policy may look better, while in other years another policy will appear more favorable. This method may not always lead to an unambiguous choice.

-

Like other methods, this method does not take policy loans into consideration. Since policy loans do affect the amount of investment in the contract, the rate of return and the price of protection may be miscalculated if loans are ignored. Also, policy loans will generally affect (usually reduce) dividend payments.

Method 9: Baldwin method

The Baldwin method is a somewhat more complete variation of the Belth yearly rate of return method that seeks to cure some of the inadequacies of the previously discussed comparison methods. Perhaps its most notable feature is that it combines both rate of return with the value of the insurance actually received into one measure. It also adjusts for policy loans and for the opportunity cost of funds and incorporates tax considerations. Despite this relative comprehensiveness, it is basically a user friendly system. It works like this:

Step 1: Determine how much life insurance is provided by the policy in any given year. This is computed by subtracting the total current asset value (what you would get if you cashed the policy in today) from the total death benefit to determine the "net amount at risk."

Step 2: Determine what has been paid to maintain the life insurance in force for the year. This is computed by adding the premium, the net after-tax loan interest cost (if any), and the net after-tax (opportunity) cost of cash left in the policy. The opportunity cost of the cash left in the policy is the cost of not borrowing from the policy if you could have invested policy loans at a greater after-tax return than the after-tax cost of borrowing from the policy.

Step 3: Determine the cash benefits received as a result of maintaining the policy in force for the year. This is computed by adding the current year's dividend (if any) to the current year's increase in cash value, account value, or asset value.

Step 4: Determine the investment in the contract. This is computed by subtracting any loans outstanding (plus any unpaid interest) from the total asset or cash value.

Step 5: Determine the dollar amount of return (net gain or loss) earned in the current policy year. To derive this amount, subtract the costs derived in Step 2 from the benefits derived in Step 3.

Step 6: Determine the cash-on-cash return for the year. This is computed by dividing the net gain or loss [from Step 5] by the amount invested [from Step 4].

Step 7: Determine the equivalent taxable return. To derive the before-tax rate of return that is necessary to provide an after-tax return that is equal to the currently tax-free return in the policy, divide the rate of return in Step 6 by (one minus the combined tax rate).

Example. If the combined local, state, and federal tax rate is 40 percent and the rate of return in the policy is 5.4, you would need to earn 9 percent in taxable investments to have 5.4 percent left after tax [5.4% ¸ (1 – 40%) = 9%].

Step 8: Determine the value of the life insurance protection received for the year. This is the truly new element added by Baldwin's method. It recognizes that the value of life insurance protection can vary from person to person and is at least partly subjective. Some people have no need for insurance protection and place no value on the life insurance protection provided by the policy. For these people, the equivalent taxable rate of return in the policy [see Step 7] is the total measure of the value of the policy.

However, most people will place at least some value on the insurance protection. In general, if protection is desired, its value should be equal to at least the absolute minimum term insurance cost for an equivalent amount of protection available to the insured. That is, the most accurate cost per thousand dollars of coverage would be the figure you could obtain as a result of applying to an insurance company for an equivalent amount of term insurance, submitting to medical examination, and receiving an offer for term insurance at a contractually guaranteed rate. Once the equivalent retail value of term insurance is determined, it is multiplied by the amount of life insurance (in thousands) provided by the contract [from Step 1] to determine the value of the insurance in the contract.

Step 9: Determine the total value received (total benefits) as a result of continuing the life insurance contract. The total value is equal to the year's net gain or loss [from Step 5] plus the life insurance value [from Step 8].

Step 10: Determine the percentage return on the total benefits. This is computed by dividing the total benefits [from Step 9] by the amount invested [from Step 4].

Step 11: Determine the equivalent after-tax return that matches the tax-deferred/tax-free return from the life insurance contract. Divide the percentage rate of return [from Step 10] by (one minus the combined tax rate).

The Baldwin method overcomes some of the problems associated with the other comparison methods, but still depends on the values shown on the ledger statement, which must be closely scrutinized for accuracy and the reasonableness of the underlying assumptions. Also, like the Belth methods, it provides a series of annual rate of return figures for as many policy years as you wish to measure. It is quite possible for each of two policies to show superior performance for some years and inferior performance for others relative to each other. Therefore, rankings of policies may be ambiguous.

Policy comparison measures summary

The Summary of Policy Comparison Measures in Figure 4.7 should prove helpful in reviewing these methods and in deciding which should be used or how to properly overcome their flaws. Other considerations in using these techniques are listed below.

-

Remember that a policy comparison based on policy illustrations created by a source other than an insurance company's home office may not be officially sanctioned, accurate, or complete. Demand computer printouts from the insurer's home office for comparative purchasing purposes.

-

Policy dividends are not guarantees — a point the consumer often does not hear or understand (or sometimes does not want to hear or understand). The financial advisor should not only emphasize this in comparing policies but also in making presentations to clients.

-

The longer the period into the future in which values are projected or illustrated, the less likely they are to be accurate.

-

The method used to decide rates credited to cash values and to allocate the amount of dividends to policyowners and then apportion them among policyowners will significantly affect policy comparisons. Check to see if the company is using the "portfolio" method or the "investment year" method (sometimes called the "new money" method). Most companies now use the investment year method. Under the investment year method, the assets acquired with the premiums paid during a particular year are treated as a separate cell of the insurance company's general asset account. The investment returns earned by the assets in each calendar-year cell are credited to the cell. Each year as the composition of the cell changes due to maturities, repayments, sales, and other transactions, the changing investment performance of the cell is allocated to the policies that paid the premiums to acquire the assets in the cell. This method promotes equity, since policyholders receive the investment results that are directly attributable to their premium contributions. If the portfolio method is used, all policies are credited with the rate earned on the company's overall portfolio, despite the fact that earnings on premium dollars received in some years may actually be earning higher or lower returns than the portfolio rate. For instance, in periods of declining interest rates, the premium dollars received on new policies will probably be invested by the company at rates that are lower than the company earns on its existing portfolio. Also, when using the portfolio method, these new policyholders will benefit at the expense of the prior policyholders, because they will be credited with higher returns than their premium dollars are actually earning. Conversely, if interest rates are increasing, use of the portfolio method will be disadvantageous for new policyholders, but beneficial to existing policyholders. Make sure all the illustrations are based on the same method, if possible.

-

Supplementary benefits and riders impact upon policy comparisons. For example, the total premium for a policy with waiver of premium should be adjusted to take into account the extra charge.

-

In deciding whether to purchase whole life insurance or to "buy term and invest the difference," be sure to consider the value of:

a. protection from creditors;

b. probate savings;

c. federal gift/estate tax savings implications;

d. state gift/death tax savings implications;

e. dividend options (such as one-year term);

f. loan/collateral uses; and

g. settlement (annuity) options.

Editor's Note: This article is excerpted from Tools & Techniques of Life Insurance Planning, 6th edition, which delivers detailed information about the entire range of life insurance products that can be used by estate and financial planners in a wide variety of circumstances. It includes planning techniques for retirement income needs, estate and gift tax avoidance, estate liquidity needs, and long-term care planning.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.