Relatively few TDF managers invest big money alongside the savings of the 401(k) participants they compete for. (Photo: Shutterstock)

Relatively few TDF managers invest big money alongside the savings of the 401(k) participants they compete for. (Photo: Shutterstock)

The millions of Americans who are placing their retirement prospects in target-date funds can “rightfully expect” the managers of their assets to invest their own money in the savings strategies as well, says Jeff Holt, director at Morningstar and lead author of the 2019 Target-Date Fund Landscape Report.

But the fact is that relatively few TDF managers invest big money alongside the savings of the 401(k) participants they compete for.

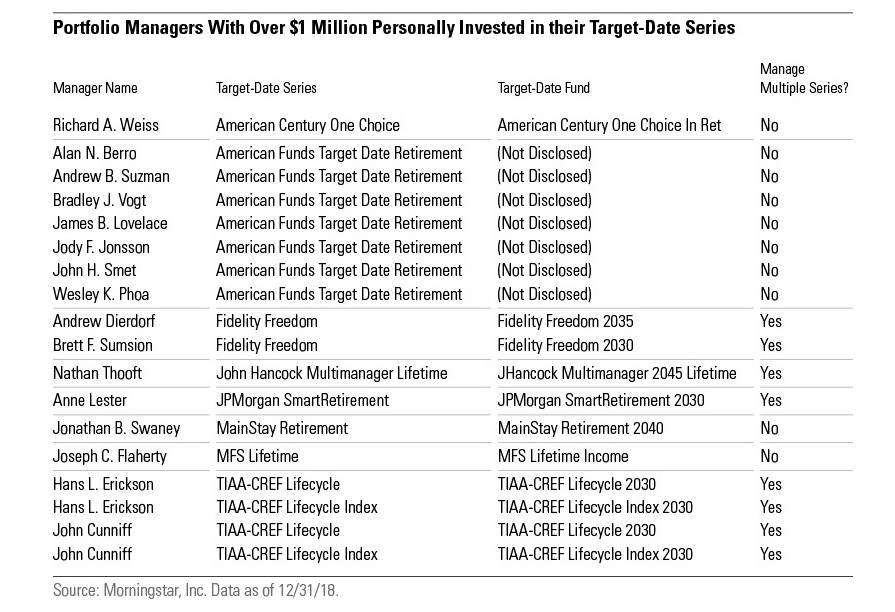

Of the roughly 140 fund managers who run 63 different target-date series, only 16 — or 11 percent — invest $1 million or more of their own cash in the glide paths they manage. (See Morningstar's chart near the end of this article for names and funds.)

To be fair, $1 million – -the highest threshold of managers' personal investment the Securities and Exchange Commission reports in mutual fund disclosures — isn't exactly chump change, even for productive TDF managers.

The exact salaries and earnings of mutual fund managers are not a required disclosure to the SEC. That opaqueness has spurred criticism in media reports, and from some corners of the fund industry, that money managers' compensation is exorbitant.

Research from Institutional Investor shows the average mutual fund portfolio manager earned $1.37 million in 2018, and $938,955 in 2017

The best-paying firms managed mutual funds — not necessarily target-date funds — overseeing between $10 billion and $30 billion in assets. Fund managers at those firms earned an average of $1.59 million in total compensation last year, including $1.36 million in bonuses, options, and commissions, reports Institutional Investor.

The fund companies tracked by Morningstar manage between $396.2 billion (Vanguard) in TDF series on the highest end, and $16.9 million (Columbia) on the lowest end.

A separate survey, conducted by Russell Reynolds Associates, showed fund managers at mutual fund companies made an average of $436,500.

Still, the fact that so few managers of mutual fund TDFs report investing more than $1 million in their own strategies is “telling,” Morningstar's Holt recently told BenefitsPRO.

“Coinvestment signals the managers' conviction in their approach,” writes Holt in the 2019 TDF report. Target-date collective investment trusts, which are gaining considerable momentum in the 401(k) space and now account for $660 billion in retirement savings, do not disclose whether managers invest in their own strategies.

The 16 managers investing more than $1 million come from eight firms. Morningstar tracks the TDF offerings from 29 firms.

Portfolio managers with funds over $1 million personally invested in their TDF series. Chart: Morningstar

Portfolio managers with funds over $1 million personally invested in their TDF series. Chart: MorningstarNo TDF offers a purely passive strategy, but funds comprised of at least 80 percent of passively managed underlying funds comprise $480 billion, or 43 percent of the mutual fund TDF space. Those managers presumably make less than managers of actively managed TDFs, which held $570 billion, or 52 percent of the market in 2018.

Six of the 16 TDF managers who are investing $1 million or more in their own funds oversee multiple target-date series. Four of them invest more in their active strategies than their passive strategies, demonstrating their belief that active stock and bond picking will outperform indexed strategies even as nearly all of the $55 billion in new TDF flows went to passive strategies in 2018.

READ MORE:

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.