while insurer financial performance declined slightly from the first quarter of 2018 to 2019, margins were still higher than all other previous years through 2017. (Photo: Shutterstock)

while insurer financial performance declined slightly from the first quarter of 2018 to 2019, margins were still higher than all other previous years through 2017. (Photo: Shutterstock)

Despite dire predictions that the Trump Administration's policy changes would collapse the Affordable Care Act exchanges, the ACA-compliant individual insurance market continues to be stable – and insurers are generally profitable, according to an analysis by the Kaiser Family Foundation.

“One concern about the effective repeal of the individual mandate that took effect for 2019, along with the expansion of short-term plans, was whether healthy enrollees would drop out of the market in large numbers,” the authors write. “The still-modest growth in claims costs during the first three months of 2019 suggests that these policy changes did not cause as many healthy enrollees to leave the individual market as was feared.”

Moreover, many insurers on average continue to make a profit in the individual insurance market, according the KFF's analysis of financial data reported by insurance companies through the first quarter of this year.

Related: Key factors driving 2020 ACA premium increases

In anticipation of Trump's policy changes, including the cessation of cost-sharing subsidy payments, insurers in 2018 raised benchmark premiums by an average of 34 percent.

“These premium hikes, along with slow claims growth, made 2018 the most profitable year for individual market insurers since the ACA went into effect,” the authors write. “Premiums fell slightly on average for 2019, as it became clear that some insurers had raised 2018 rates more than was necessary.”

Insurers on average continue to be profitable, as measured by average medical loss ratios and gross margins, according to KFF.

Considering that insurers rose 2018 premiums to cover anticipated policy changes—and some even over-corrected—ratios continued to fall in 2018.

“With such low loss ratios, insurers generally could not justify premium hikes for 2019, and loss ratios for the first quarter of 2019 rose to 73 percent,” the authors write. “Though 2019 annual loss ratios are likely to end up higher than 73 percent, this is nevertheless a sign that individual market insurers on average are on a continuing path towards sustained profitability.”

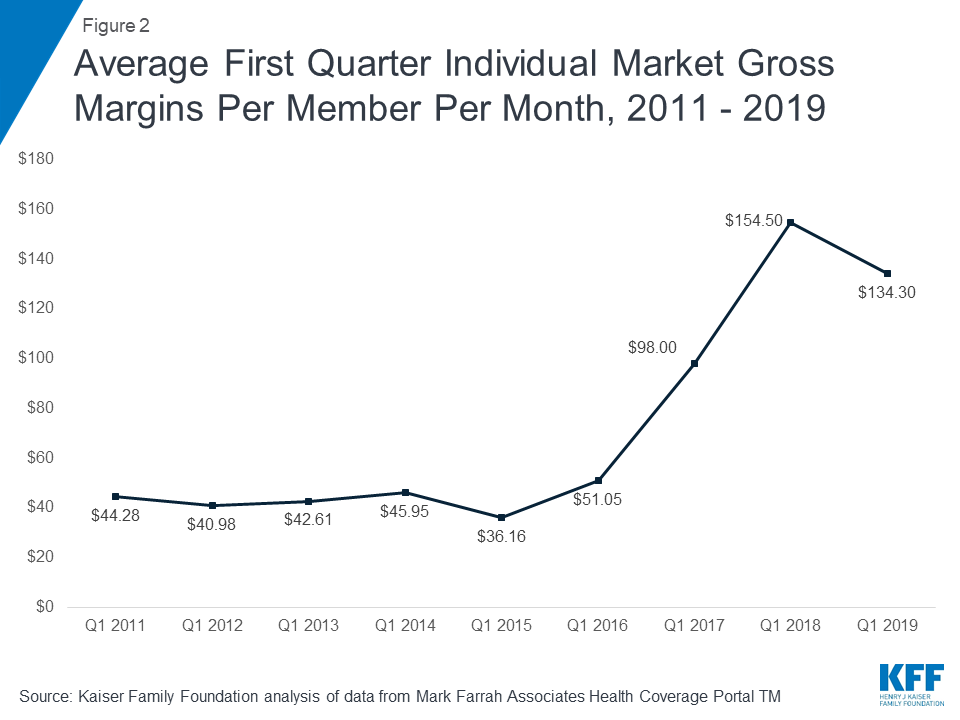

Moreover, while insurer financial performance declined slightly from the first quarter of 2018 to 2019, margins were still higher than all other previous years through 2017. Following record insurer margins in 2018, premiums per enrollee fell slightly on average for 2019 while claims costs continued to grow at a similar pace to previous years. On average, premiums per enrollee fell 0.4 percent from early 2018 to 2019, while per person claims grew 5 percent.

“Continued modest growth in claims costs in early 2019 indicates that the repeal of the individual mandate penalty and expansion of short-term insurance plans did not leave the individual market significantly less healthy,” the authors write.

For 2020, insurers so far are requesting modest premium increases, ranging from an average 3 percent decrease in Maryland to a 13 percent increase in Vermont.

“With a continuing legal battle threatening the very existence of the ACA, significant uncertainties remain,” the authors write. “However, earlier concerns that the market would collapse or insurer exits would lead to counties with no coverage available at all have proven unfounded.”

Read more:

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.