AARP's recent "Insight on the Issues" survey showed that more than half (52.6 percent) of Americans age 50 and over were not confident that they'll have enough money to live comfortably in retirement.

More than two in five (45.9 percent) of those surveyed anticipated a “less economically secure” retirement than their parents possibly due to lack of savings and increasing debt. The top two financial concerns respondents expressed about retirement were: retirement income may not keep up with inflation (44.8 percent very concerned), and not having enough money to pay for long-term care (44.3 percent very concerned).

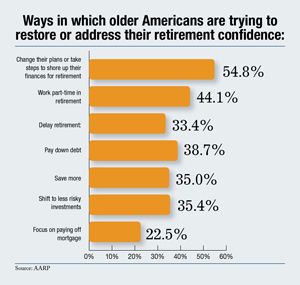

Here are seven ways in which older Americans are trying to restore or address their retirement confidence:

Change their plans or take steps to shore up their finances for retirement: 54.8%

Work part-time in retirement: 44.1 %

Delay retirement: 33.4%

Pay down debt: 38.7%

Shift to less risky investments: 35.4%

Focus on paying off mortgage: 22.5%

Save more: 35%

Continue Reading for Free

Register and gain access to:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.