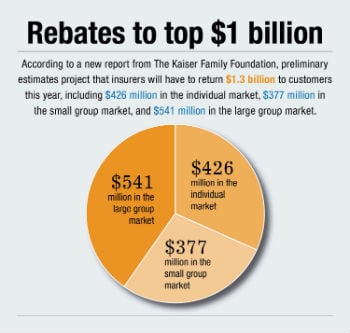

Experts are gathering more evidence that health insurer rebates this year will top $1 billion. Consumers and businesses can expect to receive notices of their rebates by August.

Experts are gathering more evidence that health insurer rebates this year will top $1 billion. Consumers and businesses can expect to receive notices of their rebates by August.

Rebates are required by new rules governing the medical loss ratio (MLR) for health insurers. Under this health reform policy, health insurers offering coverage to individuals and small businesses must spend at least 80 percent of their premium income on claims and quality improvement activities, and 20 percent or less must be reserved for administrative expenses. The MLR threshold is higher for large group plans, which have to spend at least 85 percent of premium income on claims and quality improvement.

Insurers that don't meet these standards are required to issue rebates to their customers.

Continue Reading for Free

Register and gain access to:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.